Do Title Companies Get A 1099

What is an IRS. Title abstractor paid by law firm 200 for Sally Jones search and 400 for John Does search and later reimbursed by client at closing.

Fake Health Insurance Card Inspirational How To Make Proof Document Of Petermcfarland Us Car Insurance Insurance Health Insurance

Fake Health Insurance Card Inspirational How To Make Proof Document Of Petermcfarland Us Car Insurance Insurance Health Insurance

Where do I get the 1099-S.

Do title companies get a 1099. For submitting the sellers gross proceeds information required by law. A copy of the 1099 certification form is presented to the sellers at closing. The Form 1099S is the reporting form adopted by the IRS.

At closing time its up to the title company to bring the required documentation explain it to everyone involved in the sale collect the money for closing costs and distribute the money. If the seller certifies that the sale price is for 250K or less and the sale is for their principal residence the transaction is not reportable. The first criteria is that the sales price for an individual seller must be 250000 or less in order to qualify.

If there was a property sale this year contact the title company that you closed with to see if the filed a Form 1099-S. Having the title company pay those funds directly does not release you of the requirement to file a 1099-MISC when the amounts paid total more than 600 within a tax year. You never had their part of the commission.

Do I Send a 1099 to a Real Estate Agent. Law firm issues 1099 because law firm was responsible for engagement and payment of fees. If there are joint sellers you must obtain a certification from each seller whether married or not or file Form 1099-S for any seller who does not make the certification.

You DO NOT have to issue a 1099 MISC to a LLC that has elected to be taxed as a corporation C or S corp. You dont have to issue a 1099 to all corporations but you can issue one just to be safe. The settlement agent generally will be the escrow agent or title company.

The title company apparently sent the 1099-S because the house sold for over 250000. This form will assist the Title Company in determining whether the sale or exchange of the property should be reported to the IRS on Form 1099-S. If you received the total commission and then paid the agent their percentage out of your own account you would issue the 1099-MISC to the agent.

The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600. This would be provided by the closing title company who is in charge of selling your home. You DO need to issue a 1099 MISC if the LLC was setup as a single member or partnership that did not elect to.

Form 1099-S is generally provided by a title company after the sale of real estate. However it may be an attorney real estate broker or other person providing settlement services. If you close a transaction with a title company or attorney as most people do they will collect the necessary information and file Form 1099-S for you.

In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person For contractors that operate and file taxes as corporations such as a C-corp. However it may be an attorney real estate broker or other person providing settlement services. What does the title company do at closing.

I paid 415000 for the house in. Reply by MWVAon 11209 744am Msg 274211. Please note that you do not need to enter.

You wont get penalized for issuing a 1099 to a corporation when you didnât have to. When a settlement agent is used the IRS. You dont have to usually issue a 1099 to an incorporated entity.

Who provides the 1099S for sale of a home. Industry standards dictate that the closing agent generally a title company or a real estate attorney should distribute the commission among the. The title company for the sale of my house sent a 1099-S to the government when they should not have I should be eligible to exclude the gain.

You must issue a 1099 to any attorney you hired even if that attorney operates a corporation. Makes this agent responsible for the delivery of the information on the Form 1099S. In addition they were required to furnish a.

You can check with the IRS much later in the year near the October extended deadline after the 2017 wage and income transcripts are available. For tax purposes theyre treated as. And what will be reported.

Home Products Title and Settlement Services 1099 Reporting Return to Mobile First American Title Insurance Company makes no express or implied warranty respecting the information presented and assumes no responsibility for errors or omissions. It depends on how the LLC is taxed. The title company will get all of the signatures needed for the home purchase contract and the mortgage loan.

A CDA is merely an instruction to the title company to directly pay to someone else money that would have first come to you and is yours to disburse. Because the agent was paid their percentage directly by the title company you would not issue a 1099-MISC. However these are not usually provided for the sale of a primary residence.

The Tax Reform Act of 1986 required anyone responsible for closing a real estate transaction which may include the escrow agent title company or attorney to report a real estate sale or exchange to the IRS on Form 1099-S. NOT tax advice or an accountant just example of why you may see this.

Informational Escrow Flyer Trust Agreements Www Westcoastescrow Com Escrow101 Realestate Realtors Homebuying Homeselling Escrow Informative Home Buying

Informational Escrow Flyer Trust Agreements Www Westcoastescrow Com Escrow101 Realestate Realtors Homebuying Homeselling Escrow Informative Home Buying

Tax Receipt Templates 10 Free Printable Excel Word Pdf Samples Receipt Template Templates Tax

Tax Receipt Templates 10 Free Printable Excel Word Pdf Samples Receipt Template Templates Tax

Blank Da Form 4856 Da 2404 Fillable Pdf Business Letter Template Rental Agreement Templates Dr Note For Work

Blank Da Form 4856 Da 2404 Fillable Pdf Business Letter Template Rental Agreement Templates Dr Note For Work

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Figuring Out Your Form W 4 How Many Allowances Should You Claim Allowance Form Finance

Figuring Out Your Form W 4 How Many Allowances Should You Claim Allowance Form Finance

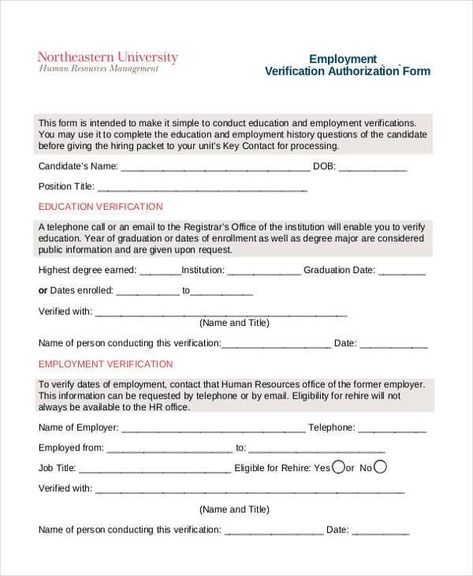

Sample Employment Verification Form 8 Employment Verification Sample Forms Free Example Job Letter Employment Form Employment

Sample Employment Verification Form 8 Employment Verification Sample Forms Free Example Job Letter Employment Form Employment

How To Get A Title In Michigan Dr Note For Work Birth Certificate Template Michigan

How To Get A Title In Michigan Dr Note For Work Birth Certificate Template Michigan

Free Employment Contract Agreement Pdf Word Eforms Free Fillable Forms Contract Agreement Contract Template Separation Agreement

Free Employment Contract Agreement Pdf Word Eforms Free Fillable Forms Contract Agreement Contract Template Separation Agreement

Things To Pay Special Mind To When Purchasing Insurance Blasting Feeds Insurance Lifeins Life Insurance Quotes Life Insurance Broker Life Insurance Premium

Things To Pay Special Mind To When Purchasing Insurance Blasting Feeds Insurance Lifeins Life Insurance Quotes Life Insurance Broker Life Insurance Premium

Certificate Of Origin For A Vehicle Template 4 Best Templates Ideas For You Best Tem In 2021 Birth Certificate Template Certificate Templates Certificate Of Origin

Certificate Of Origin For A Vehicle Template 4 Best Templates Ideas For You Best Tem In 2021 Birth Certificate Template Certificate Templates Certificate Of Origin

Subcontractor Invoice Templates Construction Invoice Templates Construction Invoice Templates Model Invoice Template Invoice Template Word Invoice Layout

Subcontractor Invoice Templates Construction Invoice Templates Construction Invoice Templates Model Invoice Template Invoice Template Word Invoice Layout

Tax Deductions And Advice For 1099 Misc Independent Contractors Tax Questions Tax Deductions Deduction

Tax Deductions And Advice For 1099 Misc Independent Contractors Tax Questions Tax Deductions Deduction

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Cash For Your Car In Hawaii Free Same Day Pickup Car Title Certificates Online Bank Statement

Cash For Your Car In Hawaii Free Same Day Pickup Car Title Certificates Online Bank Statement

How To Sell A Home Social Media Goo Gl 7lwbu Things To Sell Real Estate Infographic Selling House

How To Sell A Home Social Media Goo Gl 7lwbu Things To Sell Real Estate Infographic Selling House

Employment Verification Form Samples Awesome 15 Letter Of Employment Templates Doc Pdf Job Letter Letter Of Employment Template Letter Template Word

Employment Verification Form Samples Awesome 15 Letter Of Employment Templates Doc Pdf Job Letter Letter Of Employment Template Letter Template Word

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Capital Gains Tax Real Estate Investor

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Capital Gains Tax Real Estate Investor

I Chose This Image Because It Represents A Title To An Automobile In The State Of California It Is Car Title Birth Certificate Template Credit Card Statement

I Chose This Image Because It Represents A Title To An Automobile In The State Of California It Is Car Title Birth Certificate Template Credit Card Statement

How To Get A Title In Ohio Letter Of Employment Free Printable Certificate Templates Car Title

How To Get A Title In Ohio Letter Of Employment Free Printable Certificate Templates Car Title