1099-r Blank Form

Form 1099 is a multipurpose form which is used for reporting different types of income. Governmental section 457b plans.

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

If no amount is listed you will need to determine the amount yourself.

1099-r blank form. 6050Y must be reported on Form 1099-R. You dont have to determine on your own the taxable amount TurboTax will help you with this. Federal income tax purposes.

Form 1099 is a form used for reporting different types of income including interest dividends pensions royalties and certain payments by a business to its employees. Youll generally receive one for distributions of 10 or more. 1099-r the taxable amount is blank and the taxable amount not determined is checked what is my taxable amount It is actually very common for a brokeradministrator to check the box taxable amount not determined and not have taxable amount filled out.

These payments are treated as private pensions for US. Form RRB-1099-R is used for both US. W-2 and 1099-R Forms Blank Paper 4-Up VersionNO Instructions on Back for Laser and Ink Jet Printer 1 Pack - 100 Sheets 50 out of 5 stars 5 1219 12.

Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans permanent and total disability. Form SSA-1099RRB-1099 Tier 1 Distributions TaxSlayer Navigation. If this is a Roth Distribution that has been held for 5 or more years and you are withdrawing the contributions only enter 0 for Box 2a.

Report on Form 1099-R not Form W-2 income tax withholding and distributions from a section 457b plan maintained by a state or local government employer. Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. Report such payments on Form W-2 Wage and Tax Statement.

Distributions from a governmental section 457b plan to a participant or beneficiary include all amounts that are paid from the plan. Citizen and nonresident alien beneficiaries. Or Keyword SSA If an amount is present in the description of Box 3 on Form SSA-1099 or Boxes 7 8 and 9 on Form RRB-1099 the taxpayer received benefits attributable to a prior.

You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. IRS Form 1099-R is related to tax filing. Please note that Copy B and other copies of this form which appear in black may be downloaded and printed and used to satisfy the.

Reportable disability payments made from a retirement plan must be reported on Form 1099-R. Distributions from a governmental section 457b plan to a participant or. One for the IRS.

However the 10 penalty on early distributions. Do not combine with any other codes. It needs to be used anytime you receive over 10 from these accounts in a tax year.

Report on Form 1099-R not Form W-2 income tax withholding and distributions from a section 457b plan maintained by a state or local government employer. There is no special reporting for qualified. The federal tax filing deadline for individuals has been extended to.

Get And Sign 1099 R Blank 2018-2021 Form Returns available at wwwirsgovform1099 for more information about penalties. Enhanced Form IT-1099-R Summary of Federal Form 1099-R Statements Enhanced paper filing with a fill-in form Electronic filing is the fastest safest way to filebut if you must file a paper Summary of Federal Form 1099-R Statements use our enhanced fill-in. These show payment due to death of the account owner.

The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

Federal SectionIncome1099-R RRB-1099 RRB-1099-R SSA-1099Social Security BenefitsRRB-1099. Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4 are still taxable based on the amounts in Box 2a. The report will include the financial information so you can include it.

It is used to show any distributions from pensions IRAs profit-sharing plans and annuities. Tax form 1099 is issued by the IRS to the lender at the end of the year. Generally the issuer of the 1099-R will have an amount listed in Box 2a for the taxable amount.

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

1099 R Form Copy C Recipient Discount Tax Forms

1099 R Form Copy C Recipient Discount Tax Forms

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 R Forms 4 Part Carbonless Discount Tax Forms

1099 R Forms 4 Part Carbonless Discount Tax Forms

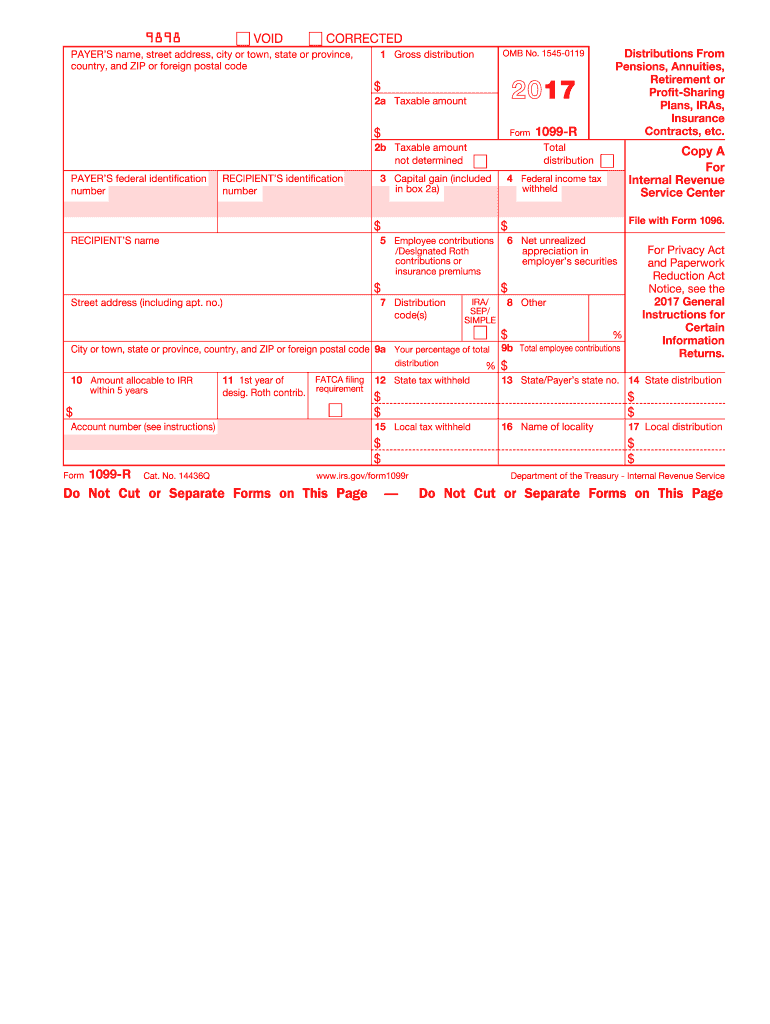

2017 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

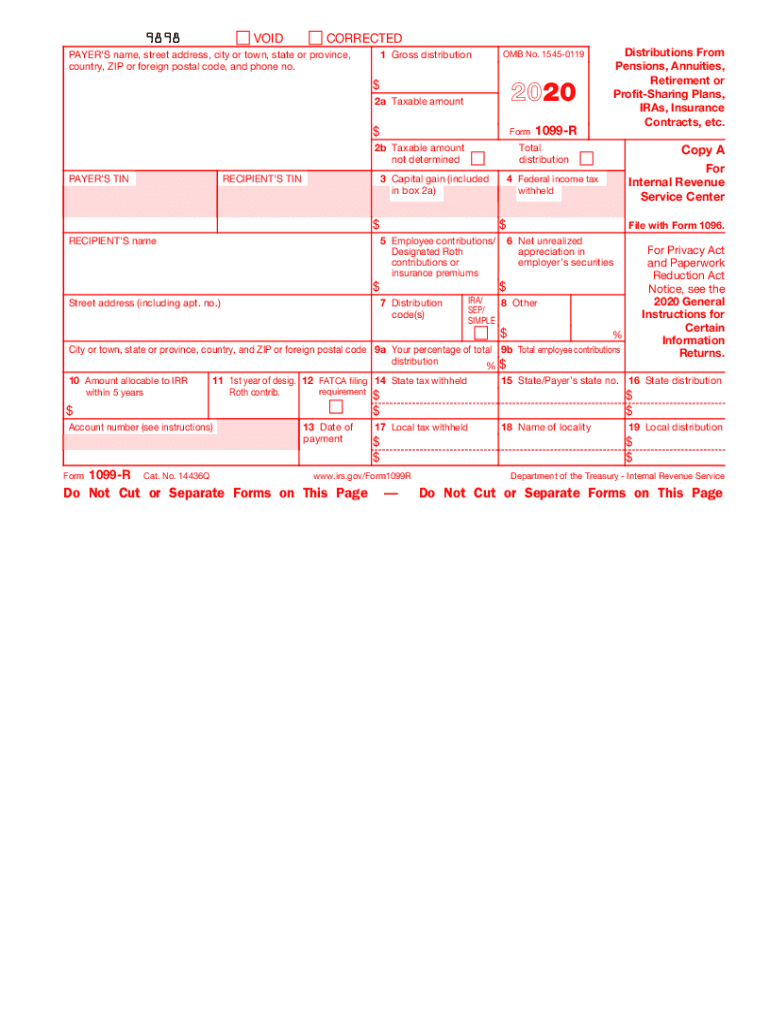

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

1099 R Form Copy B Recipient Zbp Forms

1099 R Form Copy B Recipient Zbp Forms

1099 R Tax Form 4up Copy B C 2 2 Laser W 2taxforms Com

1099 R Tax Form 4up Copy B C 2 2 Laser W 2taxforms Com

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

1099 R Software To Create Print E File Irs Form 1099 R

1099 R Software To Create Print E File Irs Form 1099 R

1099 R Fill Online Printable Fillable Blank Pdffiller

1099 R Fill Online Printable Fillable Blank Pdffiller

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller