How To Lodge My Business Activity Statement

Tips to help you prepare and lodge your business activity statement BAS and get your goods and services tax GST information right. You can lodge online through the ATO business portal or through your myGov account if you are a sole trader.

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

This will make it easier to lodge your activity statemen.

How to lodge my business activity statement. The easiest and fastest way to lodge is online. See the page for completing the new Activity Statement if you use the new report. You can lodge your activity statement in a matter of minutes.

To keep on top of cash-flow. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. Select No thanks I prefer to lodge manually.

When you register for an Australian business number ABN and GST we will automatically send you a BAS when it is time to lodge. You wont need to submit tax invoices when you lodge your GST return but you will need to have them on hand. Run the older BAS in Xero review it publish it and then lodge it with the ATO.

How to lodge your BAS. Log in to the Business Portal. Online through your myGov account linked to the ATO only if youre a sole trader by phone for nil statements only by mail.

Online through the Business Portal or Standard Business Reporting SBR software. 01 Feb 2021 QC 26962. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST to us.

Use it to lodge activity statements request refunds and more. Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid. Under Activity Statement Reporting Method select Simpler BAS or Full BAS and click Save continue.

To lodge a new activity statement select Lodge activity statement. If the ATO issues a document such as a business activity statement BAS then they expect it to be lodged on time and any payment made in full. Check out the ATO website to.

This depends on the business. You cannot just ignore BAS statements because your business. Due dates for lodging and paying your BAS.

When you click Lodge to ATO the status of the Activity Statement will update to Sent to ATO. Once its past the due date activity statements will display as overdue. Under Tax click Activity Statement.

Goods and services tax GST pay as you go PAYG instalments. Once accepted by the ATO the status will update to. Most businesses that lodge their own BAS choose an online option.

To complete your current activity statement click on it under Description. Has ceased to operate no longer has turnover over the GST threshold currently 75000 It is up to. You need the Submit BAS user permission to lodge an Activity Statement.

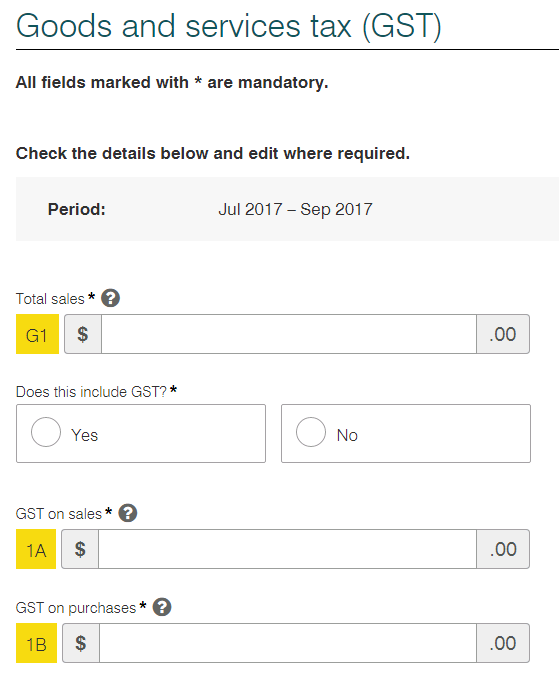

Your BAS will help you report and pay your. GST Calculation Period this determines the frequency that. How often are Business Activity Statements BASs required to be lodged.

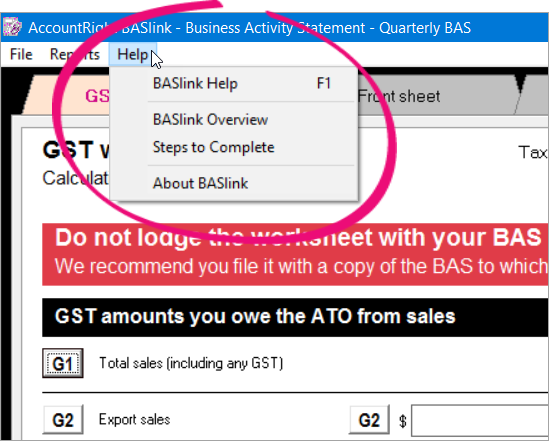

However businesses may elect to lodge monthly should they wish ie. From 1 July 2017 well be introducing changes which will transform the look of a number of screens. Typically small to medium business are only required to lodge BASs once every quarter 4 times a year.

Through a registered tax or BAS agent. Even if you cant pay lodge on time to avoid this extra cost. 10 Jul 2020 QC 33690 Footer.

Select the Prepare as NIL option on your activity statement form and you wont need to fill in each label as a zero. To view or revise an already lodged activity statement select View or revise activity statements. If you have an accountant or bookkeeper this is a task that they can take care of for you.

Information you will need Youll need a record of how much GST you collected on sales and how much was paid on purchases. You do this by completing a business activity statement BAS. This page explains how to complete your Activity Statement using Xeros older BAS report.

Select Tax and then Activity statements from the menu. To send your Activity Statement to the ATO click Lodge to ATO within the form. The Business Portal is a free secure website for managing your business tax affairs with us.

You can lodge your BAS online through MyGov or through a registered tax agent. A penalty may apply if you dont lodge on time. You can lodge a nil business activity statement BAS from the Prepare activity statement screen.

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Lodging An Activity Statement Through The Business Portal Youtube

Lodging An Activity Statement Through The Business Portal Youtube

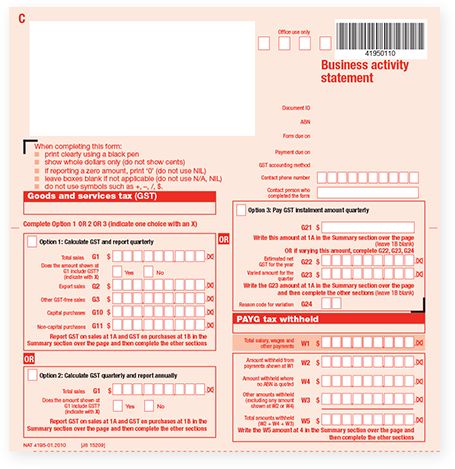

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

How To Complete The Business Section In Mytax Youtube

How To Complete The Business Section In Mytax Youtube

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

What Is A Bas Statement Small Business Guides Reckon Au

What Is A Bas Statement Small Business Guides Reckon Au

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre