How To File 1099-hc Form

If you would like to download this form electronically please follow the steps below. To request a PDF of your 1099-HC form via secure email login to your Member Central account and click on Contact Us.

Form Ma 1099 Hc Reporting Requirements 2020 1099 Hc Ma Filing

Form Ma 1099 Hc Reporting Requirements 2020 1099 Hc Ma Filing

The 1099-HC form is a Massachusetts tax document which provides proof of health insurance coverage for Massachusetts residents.

How to file 1099-hc form. To start the form use the Fill Sign Online button or tick the preview image of the document. You should contact your insurance provider to get a copy of the 1099 HC form before you file your return. Form 4852 will require much of the same information as your original 1099 but it will allow you to file with the corrected information.

To file MA 1099-HC forms with the State of Massachusetts MA and distribute copies to the residents of Massachusetts the employer must needthe following. From there you can use our secure inquiry form to request your 1099-HC form in an email reply. This form is known as the Individual Mandate for Massachusetts Health Care Coverage.

This information should be on your insurance card. The name and FID Federal Tax ID of the responsible insurance company or administrator. If you would like to download this form electronically please follow the steps below.

If you currently reside in Massachusetts or work for a Massachusetts based employer Form MA 1099-HC will be mailed to your home address. The information provided on Form MA 1099-HC is being reported directly to the Massachusetts Department of Revenue. The 1099-HC file consists of a single XML Document.

This form is provided by your health insurance carrier and not the GIC. This adds up to extra stress and administrative work for any employers who operate in or employee workers who reside in these states. If you did not receive Form s MA 1099- HC fill in the oval s in lines 4f for you andor 4g your spouse and enter the name of your insurance carrier or administrator and your subscriber number in line 4f andor 4g and go to line 5.

Every Commonwealth of Massachusetts resident who has health insurance will receive a 1099-HC form. Enter your official identification and contact details. Select ViewUpdate your Tax information under the What would you like to do section.

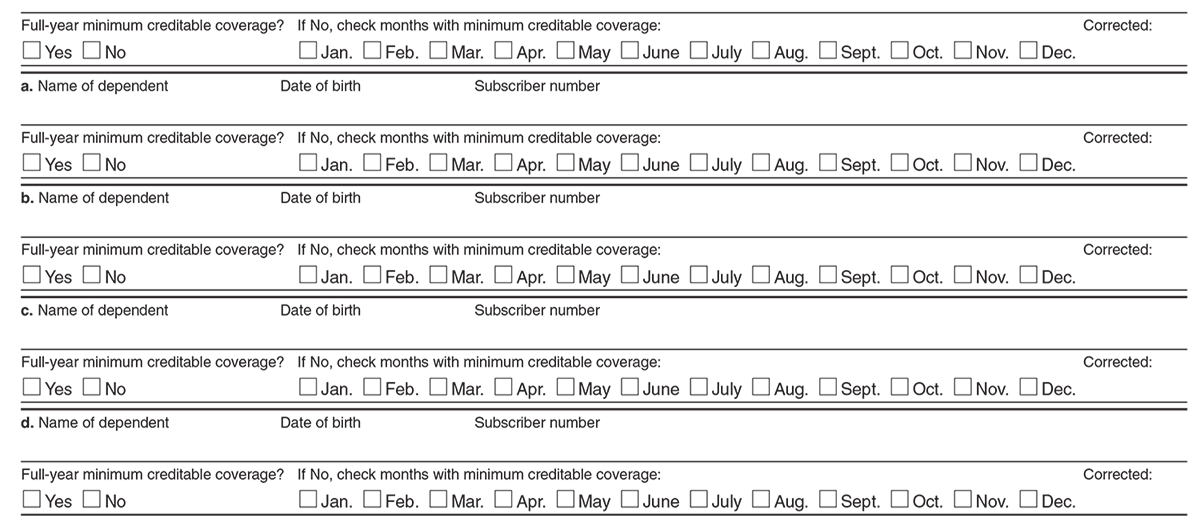

Information on the primary subscriber including Name. Submit Form 1099-HC information to the Department of Revenue DOR through their MassTaxConnect MTC account. The coverage period during which the.

Name FID Federal Tax ID of the responsible insurance company or administrator. Many states require ACA reporting on the state level even after eliminating federal individual mandates under the Affordable Care Act ACA by Congress. You can complete your Massachusetts tax return without one but you will not be able to e-file that return.

TurboTax may not allow you to e-file in which case youll need to print and mail your MA tax return. Select ViewUpdate your Tax information under the What would you like to do section. The advanced tools of the editor will lead you through the editable PDF template.

You will need this information to complete Schedule HC of your 2020 Massachusetts state tax return. MA Form 1099-HC Filing Instructions. The form ensures that all residents of Massachusetts meet the requirements for minimum health care.

Form 1099 HC is needed to complete your Massachusetts state tax return. To e-file MA Form 1099-HC you must need the following information. A Form MA 1099-HC will be used by the state of Massachusetts for health care and coverage purposes.

The way to complete the Ma 1099 hc 2017-2019 form on the internet. If you make this election you may fill out the form found online at IRSgovForm1099H and send Copy B to the recipient. File your taxes on April 15 or the applicable tax deadline for that year using Form 4852 if you have not received a 1099-R corrected 1099 by that date.

A copy of the form can be found at your local library or post office or you can download a copy of the Schedule HC Health Care Information Form PDF. The name subscriber number Date of Birth DOB and address of the primary subscriber. At this time we only provide the 1099-HC form by mail or through Contact Us.

For employers with fully insured plans most carriers will distribute Forms 1099-HC on behalf of employers and submit reporting to the state. Information about Form 1099-H Health Coverage Tax Credit HCTC Advance Payments Info Copy Only including recent updates related forms and instructions on how to file. The XML must be well formed and will be validated against the published MA DOR XML Schema for the Form.

Although you wont receive a Form MA 1099-HC if you are filing your taxes through the mail you will need to fill out a Schedule HC form to verify you had minimum coverage in the past year. It is used for tax filing purposes and must be filed by all full-time residents and some part-time residents of the state. The latest XML Schema a sample XML Document and Release Notes can be downloaded from our Record Layouts and Specifications page.

Enter the insurance company name and your subscriber number but leave the FID blank. You may see an error during the state review which you can ignore. File this form if you received any advance payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance TAA Reemployment TAA or Pension Benefit.

When asked if you received a 1099-HC answer No. The HCTC Program will furnish a copy of Form 1099-H or an acceptable substitute statement to each recipient on your behalf unless you elect to file Form 1099-H and furnish the copy or substitute statement yourself.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

How To Request Deadline Extensions For Form 1099 Misc Asap Help Center

How To Request Deadline Extensions For Form 1099 Misc Asap Help Center

/ScreenShot2021-02-12at11.48.59AM-e4b3de27a8544337b02af39530d548d6.png) Form 1099 H Health Coverage Tax Credit Advance Payments Definition

Form 1099 H Health Coverage Tax Credit Advance Payments Definition

File Form 1099 Misc Online Free Vincegray2014

File Form 1099 Misc Online Free Vincegray2014

Rhode Island Aca Reporting Deadline Rhode Island Island Employment

Rhode Island Aca Reporting Deadline Rhode Island Island Employment

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1094 B 1095 B Software 599 1095 B Software

1094 B 1095 B Software 599 1095 B Software

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

California Aca Reporting Requirements Health Care Coverage Rhode Island Health Insurance Coverage

California Aca Reporting Requirements Health Care Coverage Rhode Island Health Insurance Coverage