What Is Payroll Register File

Prepared payroll register sheet 2. In instances where payroll and accounting are outsourced this is an even more recommended practice for the employees payroll records.

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Every time payday comes this is the document you will refer to so you know how much salary you owe to your employee.

What is payroll register file. A payroll register is a report that summarizes the payments made to employees as part of a payroll. Payroll records are documents related to paying your employees. You receive acknowledgement within 24 hours.

Employees earnings records contain YTD gross pay which reflects when employees reach tax bases. What is a payroll register. The register also lists the totals for all employees combined during the period.

Depending on how you are keeping your records you may want to add information to the payroll register or remove it. Below were going to lay out the exact information contained in a payroll register. Prepared necessary journal entry for preparation of payroll and payments of deductions to concerned party ANSWER Saba Stones PLC Payroll Register Sheet For The Month of Ginbot 30 2007 SN o.

The following are payroll records that you must maintain in your files. A payroll register is a record of all pay details for employees during a specific pay period. In other words a payroll register is the document that records all of the details about employees payroll during a period.

A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. It saves you time. ABATrans Code A nine-digit numeric code created by the American Bankers Association that identifies an employers bank and routing for electronic transactions.

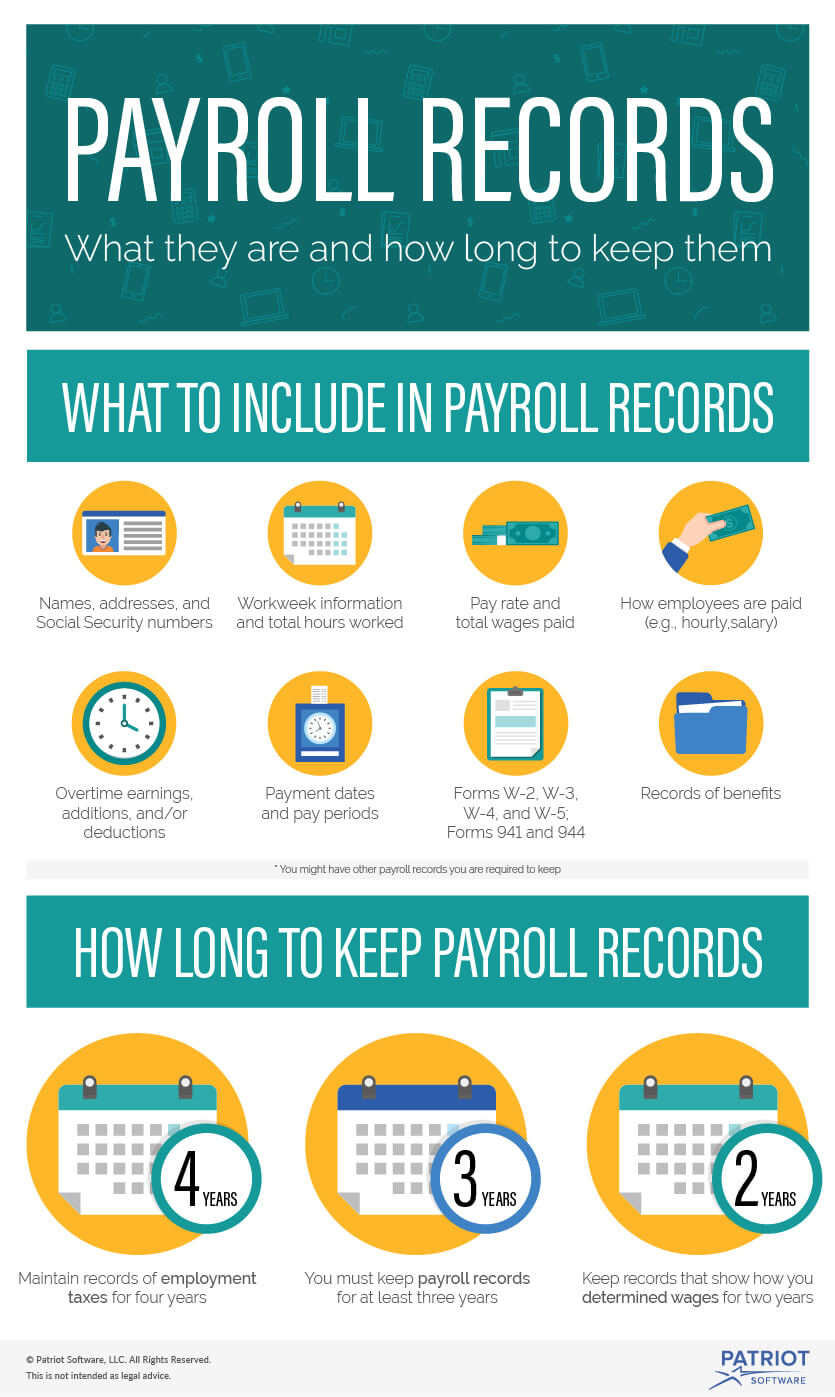

The payroll register report is created at the end of the payroll process. Names addresses and Social Security numbers of all employees Workweek information eg start and end dates. Thats where your payroll register comes in.

Per federal law you should retain payroll records for three years and payroll tax records such as unemployment taxes need to be kept for four years. This sample payroll register will help you follow along with the examples in the article Instant payroll totals for quarterly tax reporting The article explains how to use the Excel 2003 List feature and AutoFilter feature to get customized totals from a payroll register. You can choose to pay your workers on an hourly daily weekly bi-monthly or monthly basis.

The information must be dated and kept on file for. The payroll register is a spreadsheet that lists all of this payroll information for each employee across a given time period. Form 940 reports your total unemployment tax liability and payments throughout the year and must be filed with the IRS annually.

Sokolow said the payroll records must identify the employee as a tipped employee and employers must keep. File Form 941. A debit increases which of the following types of accounts.

Employees earnings records contain details of payroll tax reporting and may be considered as source documents. A payroll is a document where you can find a list of the names of your employees with their corresponding total amount of wages. 940 941 943 944 and 945.

The payroll file enables accounting staff to pay the employee without accessing employee confidential information. A payroll register is usually part of an online accounting software package or online payroll applicationThe information in the payroll register is used to help you with several important payroll tax tasks. States such as New York and agencies such as ERISA governing private retirement and.

The difference between payroll register and paycheck history reports. The Payroll Register worksheet is where you can keep track of the summary of hours worked payment dates federal and state tax withholdings FICA taxes and other deductions. Form 941 reports your total payroll tax liability and payments from the previous quarter and must be filed with the IRS quarterly.

Accounting staff can keep payroll records where it makes sense for paying the employee. Its secure and accurate. Payroll records are documents with any information about a companys payroll including data about employees paychecks and taxes.

Review options from small businesses to e-file Forms 940 941 944 and 945. You can think of it as a summary of all the payroll activity during a period. Making payroll tax deposits Submitting quarterly payroll tax reports to.

You can use the payroll register to run payroll each pay period file your payroll taxes throughout the year and reconcile payroll as needed. Absent Parent The parent who does not live with or have custody of a child but does have responsibility for financial support. The totals on this register can be used as the basis for a payroll journal entry.

It shows the gross and net pay for each employee and each of the payroll. You can e-file any of the following employment tax forms. The information stated in a payroll register can include the following.

The payroll register lists information about each employee for things such as gross pay net pay and deductions.

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Nonprofit Accounting Basics

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template Cnbam

What Should I Include In My Employee Payroll Records

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Employee Payroll Register Template Pdf Format E Database Org

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Free 7 Sample Payroll Register Templates In Ms Word Pdf

How Long To Keep Payroll Records Retention Requirements

15 Free Payroll Templates Smartsheet

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates