Do Llc Corporations Get 1099s

From IRSs 1099-Misc instructions. The following payments made to corporations generally must be reported on Form 1099-MISC.

This exception also applies to limited liability companies that elect to be treated as corporations.

Do llc corporations get 1099s. Even though an LLC will not receive the IRS 1099-MISC limited liability companies must send them out to any contractors they have hired. There is no need to send 1099-MISCs to corporations. Payments for which a Form 1099-MISC is not required include all of the following.

If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership. Do partnerships get 1099 forms. Exception to the general rule.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. The simple rule of thumb is.

There are exceptions to the rules for not having a 1099-MISC for an LLC and corporation when documenting costs calculated for any work done. A Limited Liability Company LLC is an entity created by state statute. Exceptions to the 1099 Rules.

If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient.

The business that made the payment to the independent contractor is the one who must report the payments to the IRS and then send a copy to the provider. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC.

This is only required if you performed over 600 worth of. If you see its taxed as an S Corp or C Corp it does not need to receive a 1099-MISC or 1099-NEC. If youre wondering Do LLCs get 1099s the answer depends on the type of business structure.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title. An LLC will not receive a 1099 if taxed as an s-corporation.

Private contractor or LLPpartnership 1099-MISC LLC with S or C corporation status No 1099-MISC. There are some exceptions to the general rules. In addition LLPs that provide.

Most payments to incorporated businesses do not require that you issue a 1099 form. You do need to issue the LLC a 1099 MISC. Most corporations dont get 1099-MISCs Another important point to note.

Basically you do not have to issue a 1099 MISC to a LLC that has elected to be taxed as a corporation. For LLCs taxed as either sole proprietors or partnerships youll need to receive a 1099-MISC from your clients. If the LLC is taxed as a partnership or is a single-member LLC disregarded entity the contractor needs to receive a 1099 form.

However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. As a general rule a business is not required to issue a 1099 to a corporation or other entity taxed as a corporation.

If the LLC files as a corporation then no 1099 is required. Even though an LLC can file an election with the IRS to be taxed like a corporation your business may not be aware of the LLCs current tax status so its usually safer to issue a 1099 to any LLC that you pay more than 600 on an annual basis. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

The Internal Revenue Service requires all corporations LLCs and LLPs to issue 1099s to any of these individuals or entities classified as independent contractors. In general sole proprietorships may need to file these but corporations do not. Generally payments to a corporation including a limited liability company LLC.

The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600. However there are exceptions so understanding the laws pertaining to taxes can help make sure you follow some very important rules.

Llc Taxes In 2021 Llc Taxes Business Tax Llc Business

Llc Taxes In 2021 Llc Taxes Business Tax Llc Business

Better Choice Entity Selection Llc Or S Corporation S Corporation The Selection Small Business Administration

Better Choice Entity Selection Llc Or S Corporation S Corporation The Selection Small Business Administration

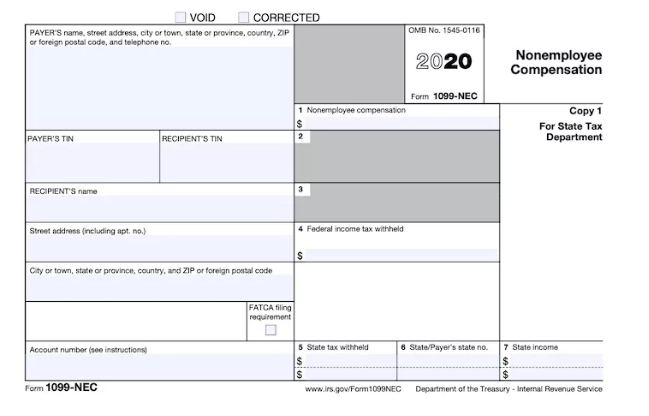

Importance For Recipients Tax Return In 2020 Tax Return Irs Forms 1099 Tax Form

Importance For Recipients Tax Return In 2020 Tax Return Irs Forms 1099 Tax Form

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

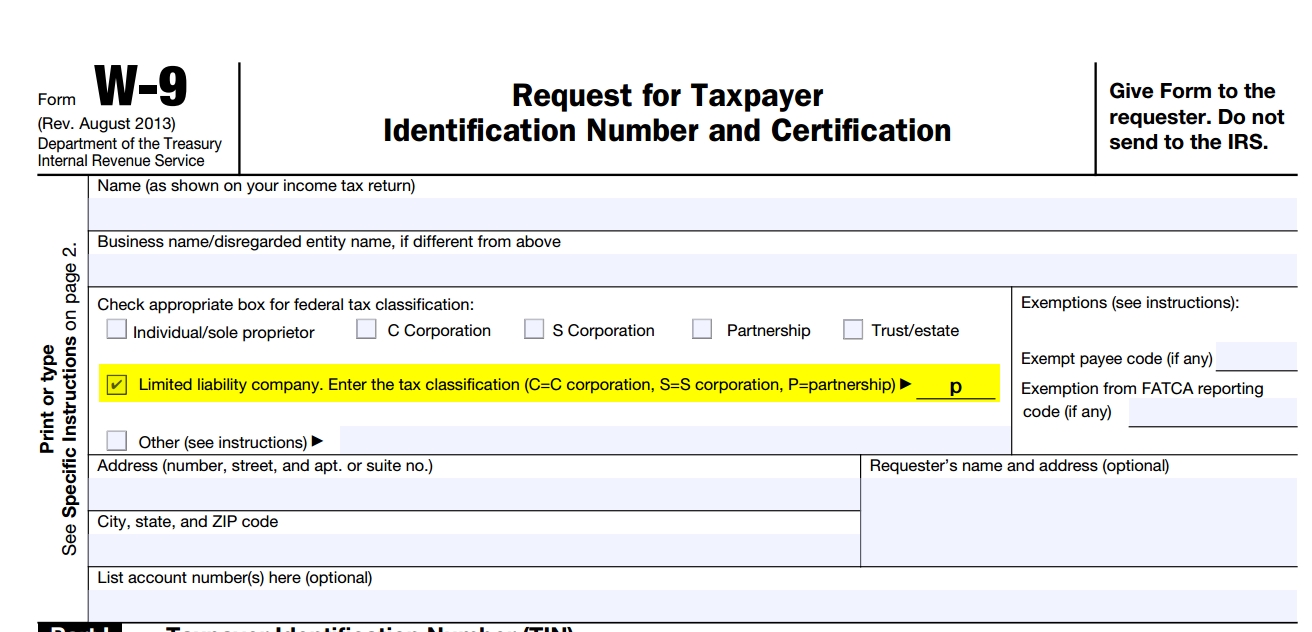

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

Do I Need To Send 1099s Lauren Gann Cpa Pllc

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Math Cheat Sheet

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Math Cheat Sheet

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose