Nonbusiness Energy Credit Form

The residential energy credits are. Enter the smaller of line 28 or line 29.

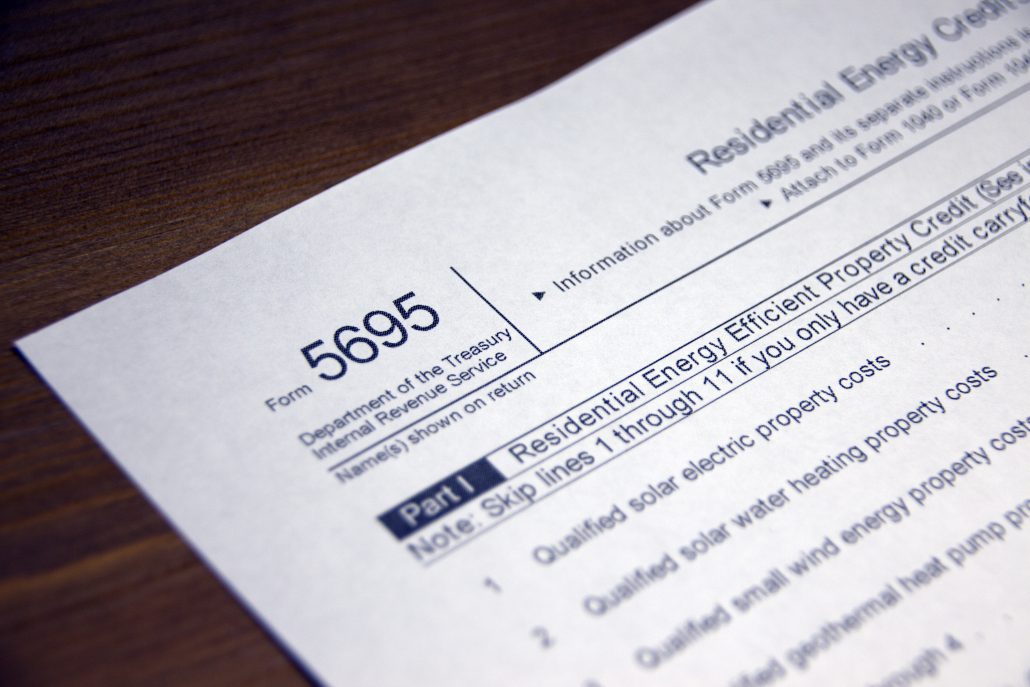

Form 5695 Residential Energy Credits

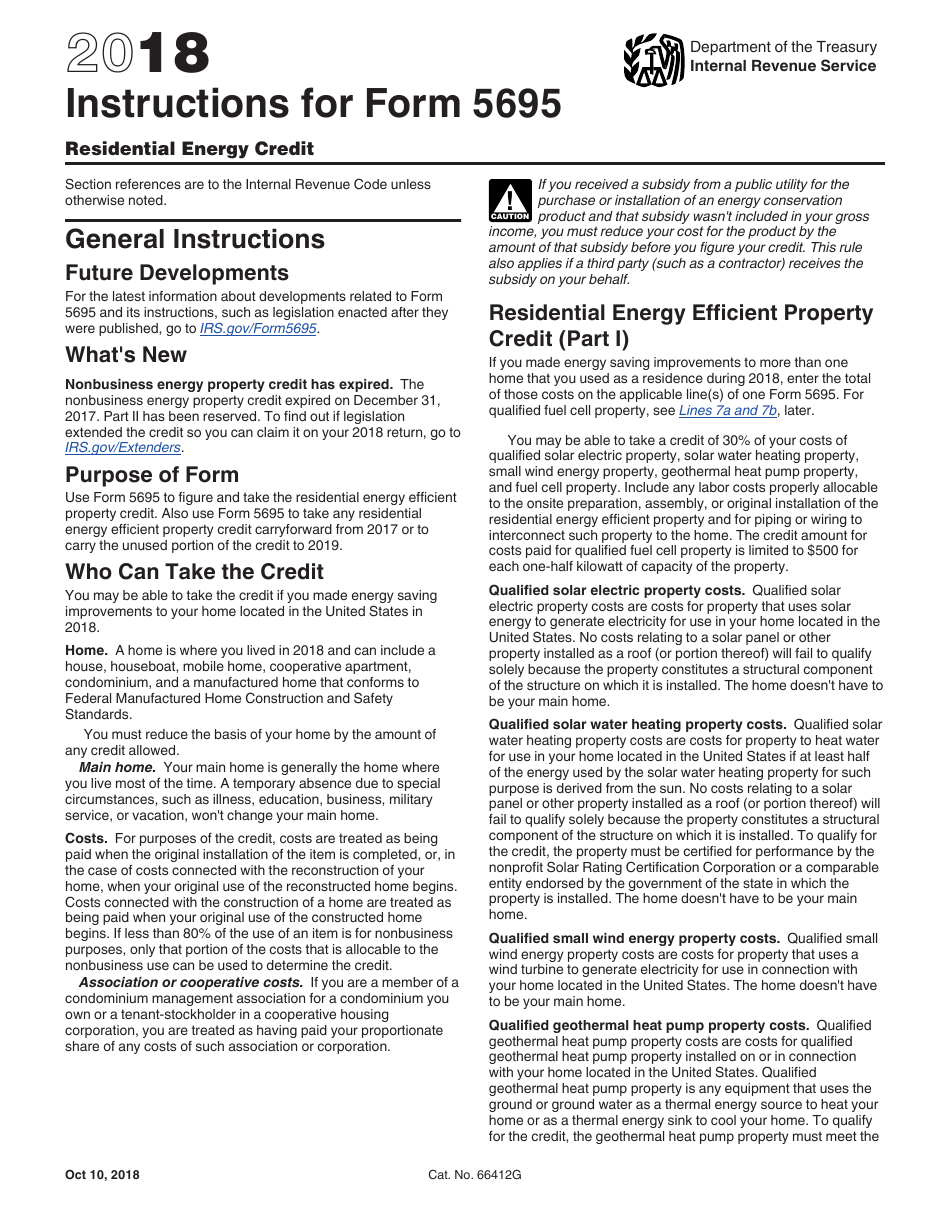

10 of cost up to 500 or a specific amount from 50-300.

Nonbusiness energy credit form. Also use Form 5695 to take any residential energy efficient property credit carryforward from 2019 or to carry the unused portion of the credit to 2021. NONBUSINESS ENERGY PROPERTY CREDIT. Qualifying improvements include adding insulation energy-efficient exterior windows and doors and certain roofs.

Form 5695 2020 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. Dec 31 2020 You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit. The nonbusiness energy property credit has been extended through 2020.

The maximum lifetime credit for all types of property combined is 500. To learn more about the nonbusiness energy credit visit wwwenergystargov. Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Attach to Form 1040 1040-SR or 1040-NR. Before starting your energy-efficiency project did you know you may qualify for no-cost home improvements through the Energy Savings Assistance Program or get a 20 percent discount on your monthly energy bills through the CARE program. After 2019 the value of the credit will be steadily reduced so its worth installing these energy-efficient.

Details of the Nonbusiness Energy Property Credit Extended through December 31 2021 You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs. The residential energy-efficient property credit best known as the residential energy credit and most commonly claimed by homeowners is claimed in Part I of Form 5695. Dec 06 2019 On the left-side menu select Credits.

Or Form 1040-NR line 50. The residential energy-efficient property credit can be used for upgrades made to both primary and secondary residences. Of that combined 500 limit.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration. Click on EIC Residential Energy Oth Credits. California does not offer state solar tax credits.

Nonbusiness energy property credit. The credit is worth 30 for upgrades made before December 31 st 2019. Also include this amount on Schedule 3 Form 1040 or 1040-SR line 5.

Also use Form 5695 to take any residential energy efficient property credit carryforward from 2017 or to carry the unused portion of the credit to 2020. Names shown on return. Click the Next button.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. The nonbusiness energy property credit is claimed in Part II. Jun 14 2017 In claiming the credit you were allowed to rely on the Manufacturers certification statements as to whether the purchase qualified as a nonbusiness energy credit.

Also use Form 5695 to take any residential energy efficient property credit carryforward from 2019 or to carry the unused portion of the credit to 2021. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021 Tax Credit. The cost of the installation should be included when you file Form 5695.

Of this total not more. Energy Savings Assistance Program and California Alternate Rates for Energy CARE Program information. All tax credits on these products are eligible until December 31 st 2021.

Must be an existing home. The 2011 credit is 10 percent of the cost of qualified energy-efficient improvements up to 500. The Non-business Energy Property Credit is generally intended for homeowners who install energy-efficient improvements.

The residential energy efficient property credit and The nonbusiness energy property credit. Maximum Lifetime Credit Limit. Mar 23 2021 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file.

Who Can Take the Credits You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2020. The nonbusiness energy property credit. On the left-side menu select Nonbusiness Energy Property Credit 5695.

Your social security number. Use Form 5695 Residential Energy Credits to figure and take the residential energy efficient property credit. The maximum amount an eligible homeowner may receive in federal tax credits for purchasing and installing qualifying products whether those purchases are in the form of upgraded windows installation HVAC equipment or other eligible improvements is 10 of the installed cost up to 500.

Scroll down to the bottom of the screen. Remove any entry in Nonbusiness energy credit Form 5695 Override. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction.

California State Energy Tax Credits. Who Can Take the Credits You may be able to take the credits if you made energy saving. Non-business energy property credit The non-business energy property credit can reduce your tax bill for some of the costs you incur to make energy-efficient improvements to your home.

December 31 2021 Details.

2007 Form 5695 Fill Online Printable Fillable Blank Pdffiller

2007 Form 5695 Fill Online Printable Fillable Blank Pdffiller

Free Online Tax Filing With Turbotax 2016 Filing Taxes Turbotax Free Tax Filing

Free Online Tax Filing With Turbotax 2016 Filing Taxes Turbotax Free Tax Filing

Http Www Irs Gov Pub Irs Pdf P4845 Pdf

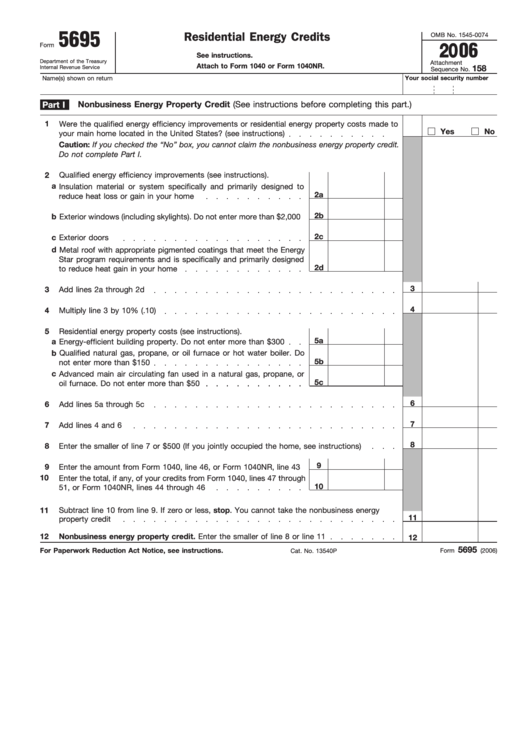

Form 5695 Instructions Information On Irs Form 5695

Form 5695 Instructions Information On Irs Form 5695

Steps To Complete Irs Form 5695 Lovetoknow

Steps To Complete Irs Form 5695 Lovetoknow

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

Form 5695 Claiming Residential Energy Credits

Form 5695 Claiming Residential Energy Credits

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

W 2 Forms How To Calculate Healthcare Costs To Report Hr Blr Com Workforce Management Start Up W2 Forms

W 2 Forms How To Calculate Healthcare Costs To Report Hr Blr Com Workforce Management Start Up W2 Forms

How To Claim The Federal Solar Investment Tax Credit Solar Sam

How To Claim The Federal Solar Investment Tax Credit Solar Sam

Form 5695 For 2020 2021 Energy Tax Credits

Form 5695 For 2020 2021 Energy Tax Credits

5695 Ef Messages 5530 And 5313 I Am Receiving Ef Message 5530 Or 5313 About My Form 5695 What Is Causing These Messages Ef Message 5530 States Form 5695 Credit Not Calculated An Entry Was Made In One Of The Non Business

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

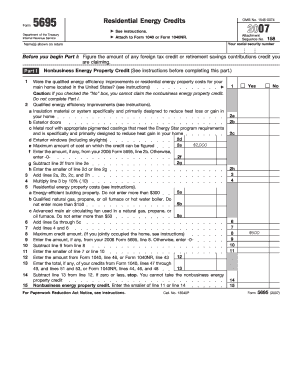

Https Www Irs Gov Pub Irs Prior I5695 2018 Pdf

Download Instructions For Irs Form 5695 Residential Energy Credit Pdf 2018 Templateroller

Download Instructions For Irs Form 5695 Residential Energy Credit Pdf 2018 Templateroller

How To Import Your 2015 W2 Form Using Turbotax Online Tax Refund Filing Taxes Turbotax

How To Import Your 2015 W2 Form Using Turbotax Online Tax Refund Filing Taxes Turbotax

Https Www Irs Gov Pub Irs News Ir 10 110 Pdf

Fillable Form 5695 Residential Energy Credits Internal Revenue Service 2006 Printable Pdf Download

Fillable Form 5695 Residential Energy Credits Internal Revenue Service 2006 Printable Pdf Download

Filing For Residential Energy Tax Credits What You Need To Know

Filing For Residential Energy Tax Credits What You Need To Know