Schedule K-1 Form 1065 Box 16 Codes

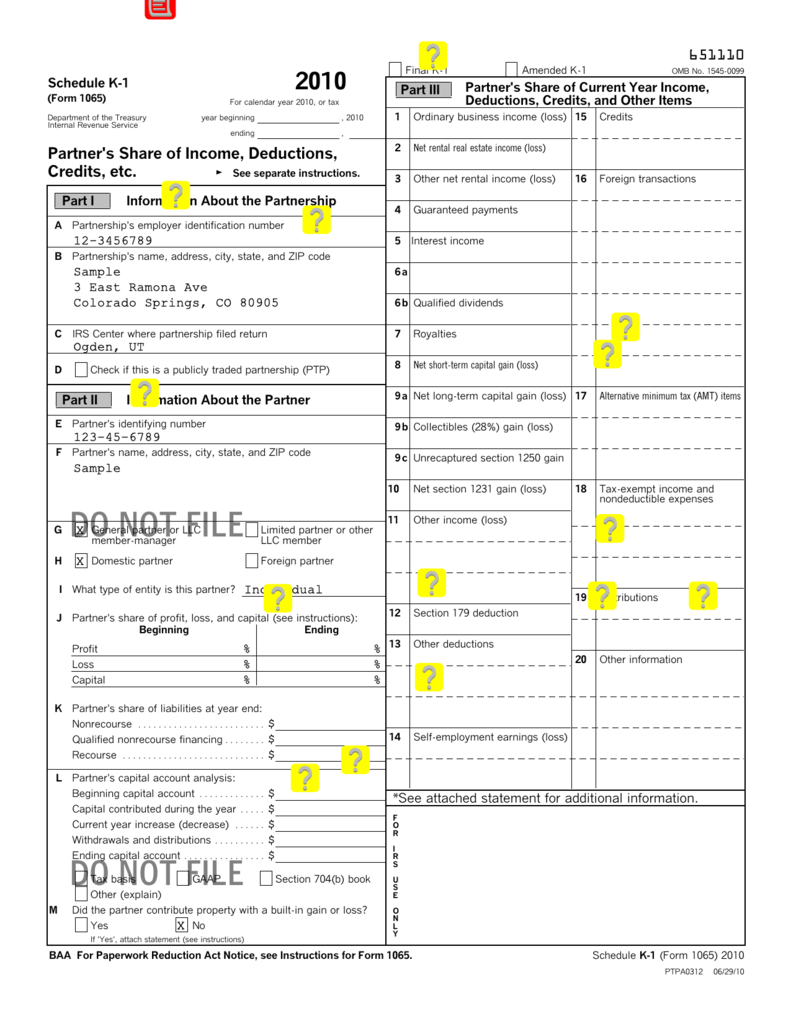

The K-1 1065 Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 Form 1065 that the taxpayer received. They can be specially allocated to the partners.

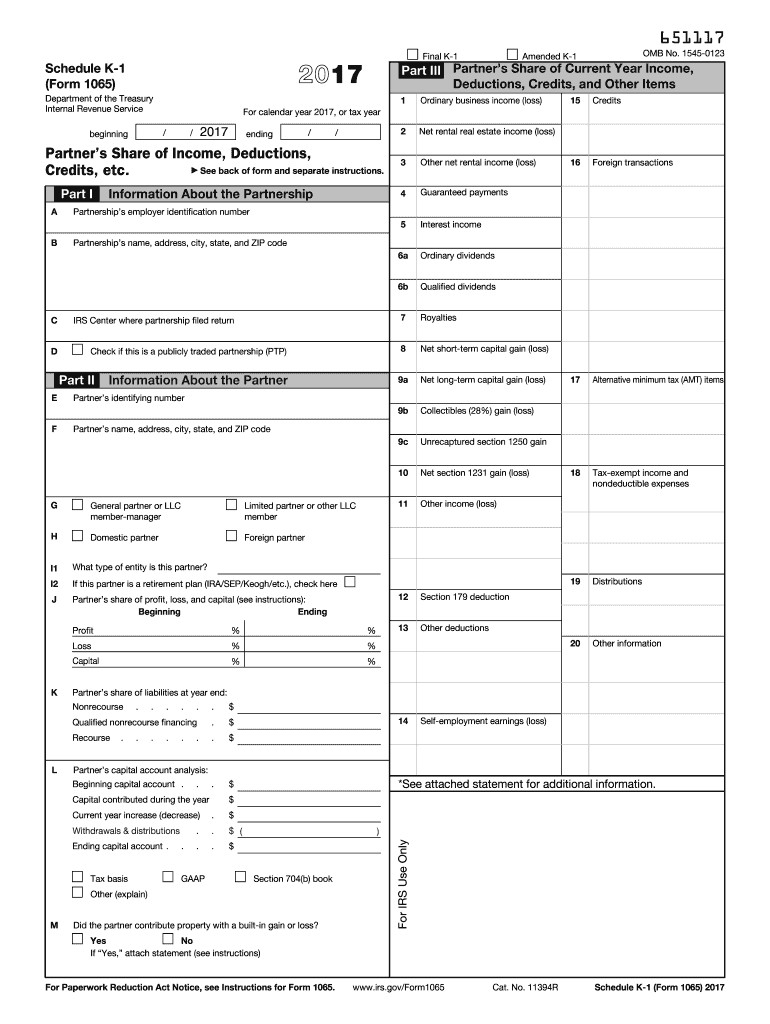

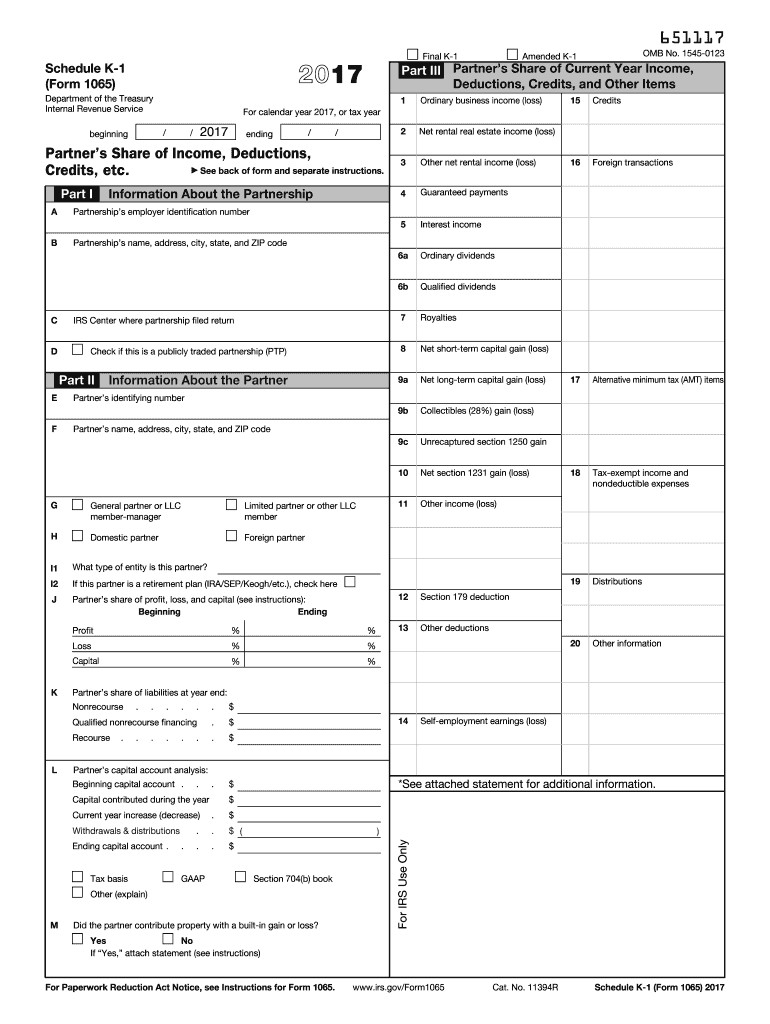

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

A description of the Tax Exempt Income and Non-Deductible Expenses contained in Box 18 the Distribution items contained in Box 19 and the Other Information contained in Box 20 can be found below.

Schedule k-1 form 1065 box 16 codes. Items affecting shareholder basis A Tax-exempt interest income B Other tax-exempt income C Nondeductible expenses D Distributions E Repayment of loans from shareholders Box 17. On Schedule K-1 if there is more than one country enter code A followed by an asterisk A enter STMT and attach a statement to Schedule K-1 for each country for the information and amounts coded A through R and code X. Scroll down to the Foreign Transactions section.

Foreign tax credit to go to this entry in TurboTax. Page numbers refer to Instructions for Schedule K-1 Form 1065. Schedule K-1 Form 1065 - Section 754 in Box 13 Code W.

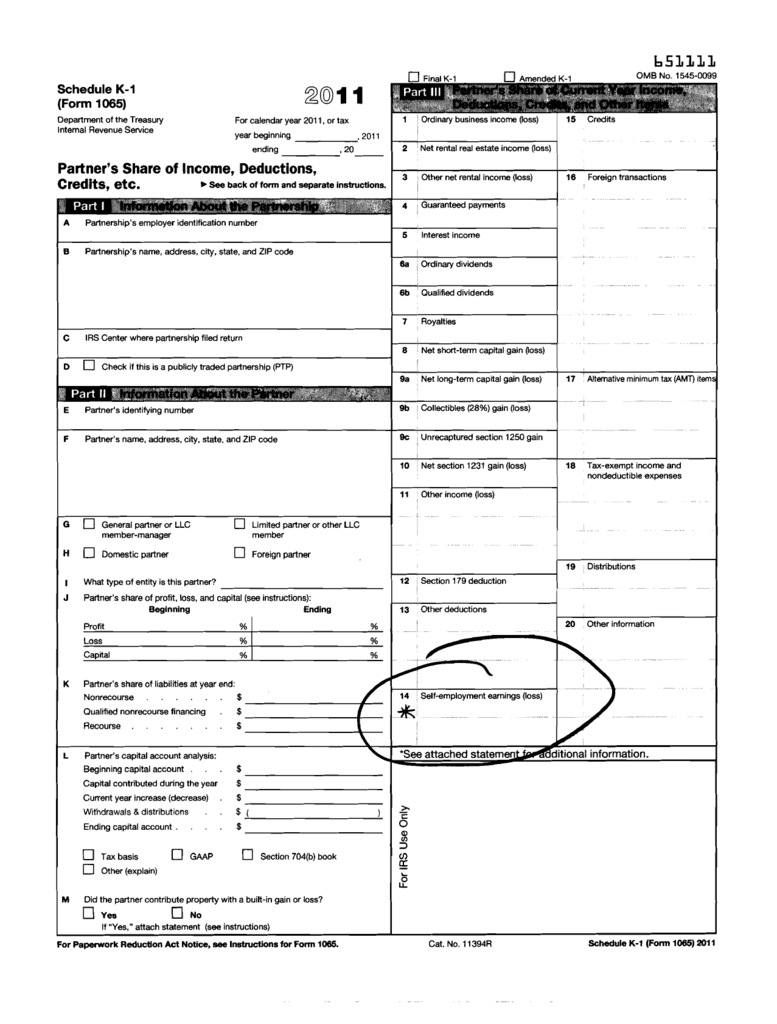

Schedule K-1 Form 1065 2011. Other informa-tion A Investment income B Investment expenses C Qualified rehabilitation expenditures other than rental real estate D Basis of energy property E Recapture of. Below is a list of changes made to the Partnership Schedule K-1 that accompanies Form 1065 US.

Investment income Form 4952 line 4a Code B. Choose the codes s on the K-1 from the drop-down under Enter Other Codes and enter the amount for each code in the box. Beyond ordinary business income or losses Schedule K-1 also captures things like real estate income bond interest royalties and dividends capital gains foreign transactions and any other payments that you might have received as.

Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 On a K1P K1F or K1S screen c lick the Screen Help button at the top right of the screen or right-click on. Use the information reported as codes A through N code Q and attached schedules to figure your foreign tax credit. Form 1065 Schedule K-1 Box 16 codes B through R involve Form 1116 for reporting foreign tax paid so it likely has to do with Form 1116.

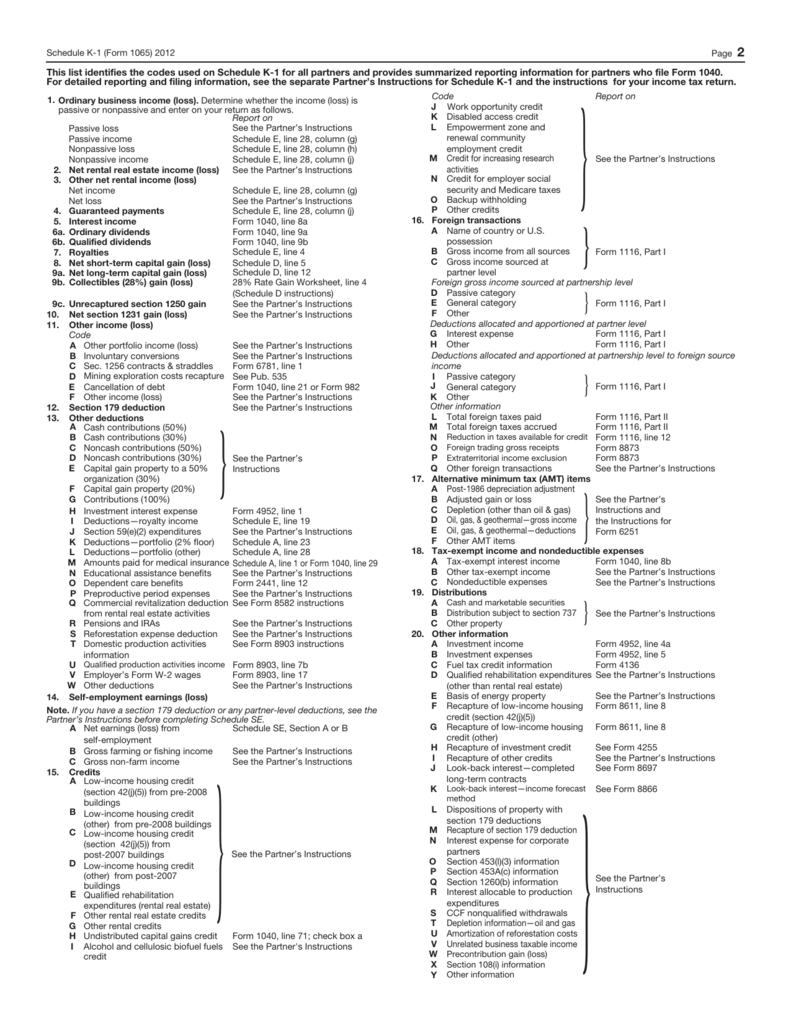

Partners Instructions for Schedule K-1 1041 fiduciary K-1. Possession enter See attached and attach a statement for each country for lines 16a through 16r codes A through R and code X of Schedule K-1. This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040.

However there are a few new items that practitioners must be aware of. In box 11 and boxes 13 through 20 the partnership will identify each item by entering a code in the column to the left of the dollar amount entry space. Please use the jump to wording.

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040 or 1040-SR. To override code AA current year gross receipts. Go to Screen 22 Other Schedule K Items.

A description of the credit items contained in Box 15 including each of the codes that can be entered in Box 15 are found below. These amounts will be populated automatically based on the Form 1065 Schedule K-1 instructions. Most of the information youll need to complete your Schedule K-1 will come from the Income and Expenses section of Form 1065.

At first glance it may not appear as though there are many major differences from 2017. 25 rows Form 1065 Schedule K-1 Box Entries Some items reported on your Schedule K-1 Form. How to read a K-1 Form 1065.

Enter any amounts reported in Box 16 of Schedule K-1 in the applicable fields below. Other information Code A. Form 1065 Box 18 Information Some items reported on your Schedule K-1 Form 1065 may need to be entered directly into a specific form instead of the K-1 entry screen.

The K-1 1065 Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 Form 1065 that the taxpayer received. For detailed reporting and filing information see the separate Partners Instructions for Schedule K-1 and the instructions for your income tax return. The amounts reported on these lines include only the gross income code D from and deductions code E allocable to oil gas and geothermal properties included in box 1 of Schedule K-1.

Try filling in foreign tax income on Form 1116 as -0-. If the partnership had income from or paid or accrued taxes to more than one foreign country or US. Choose the country in the drop-down for Box 16a.

Below is a list of items that are not entered directly into Form 1065 Schedule K-1 within the program. If you have more than one country for Box 16 you will need to add another K-1 to report each country. For more information see Form 1116 Foreign Tax.

To suppress or override the amounts in Lacerte. The corporation should have attached a statement that shows any income from or deductions allocable to such properties that are included in boxes 2 through 12 16 and 17 of Schedule K-1. If you have amounts other than those shown on Schedule K-1 to report on Schedule E Form 1040 enter each item separately on line 28 of Schedule E Form 1040.

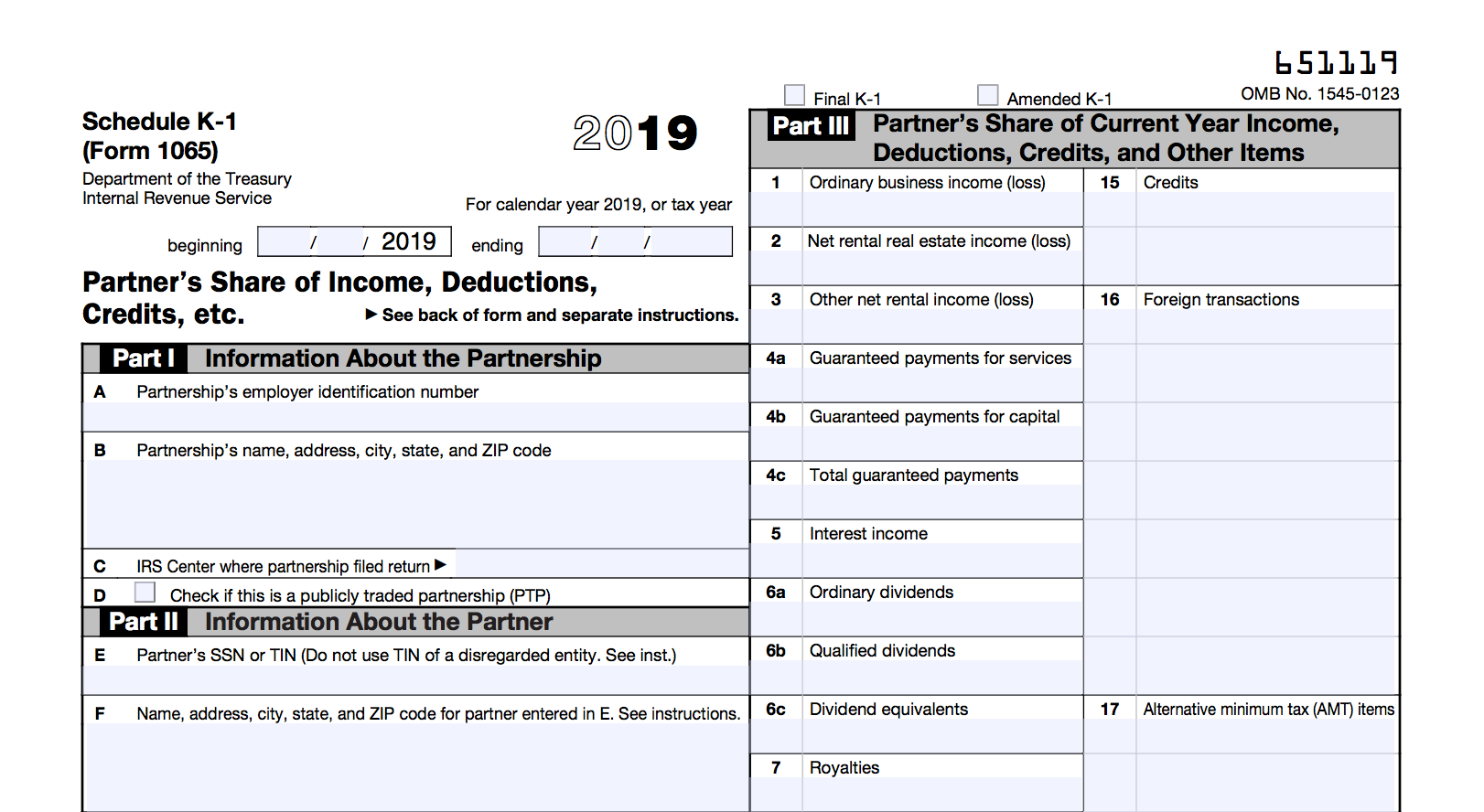

Box 13 code W may represent a variety of deductions and the partnership should provide details regarding the reported amounts. Schedule K-1 Form 1065 2019. Investment expenses Form 4952 line 5.

For detailed reporting and filing information see the separate Partners Instructions for Schedule K-1 and the instructions for your income. Distribution subject to section 737 See page 16 Code C. Return of Partnership Income for 2018.

Other property See page 16 Box Number Item Where to report or where to find further reporting information. Continue to save your entries. If the amount is a Section 754 adjustment verify that the amount in Box 13 code W has not already been included in your K-1 income box 1 or 2.

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Entire Lesson Pub 4491 Part 3 Nttc Training Ppt Download

Schedule K 1 Entire Lesson Pub 4491 Part 3 Nttc Training Ppt Download

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Choose One Of The Partners Murray Or Parker And Chegg Com

Choose One Of The Partners Murray Or Parker And Chegg Com

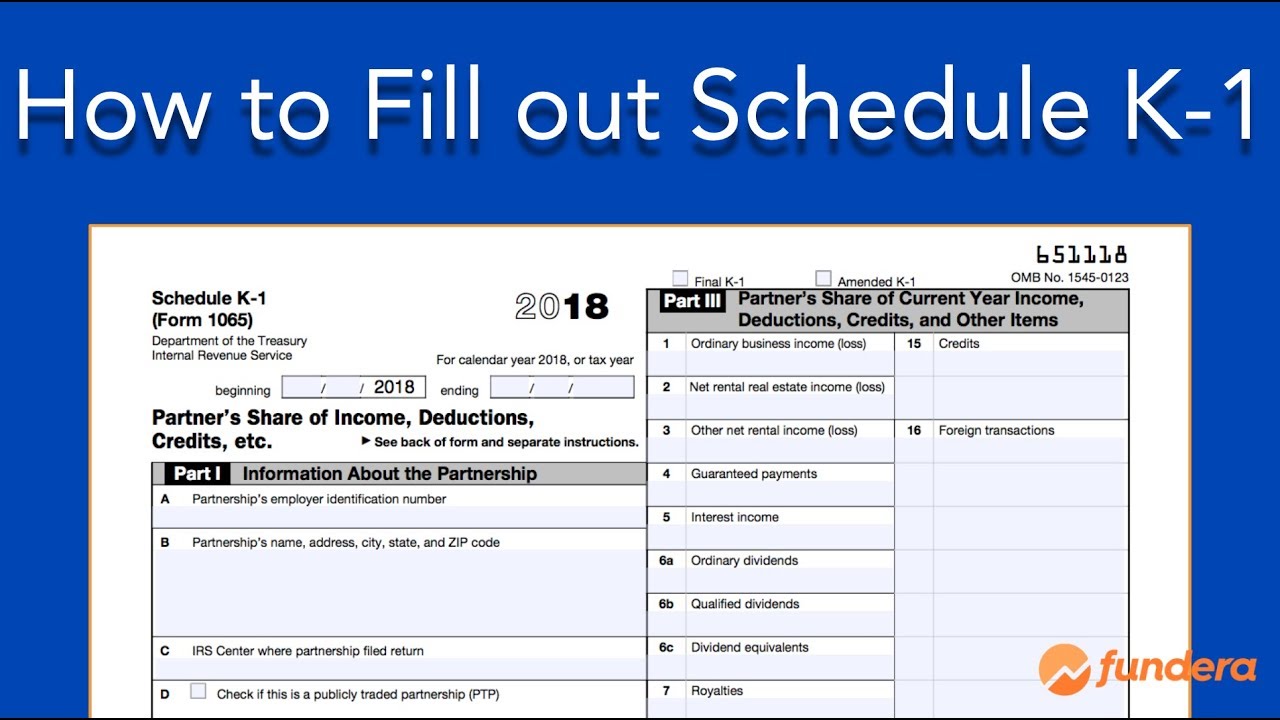

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Please Refer To Line By Line Instructions Here To Assist In Completing

Please Refer To Line By Line Instructions Here To Assist In Completing

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Mexpafryequlfqjeop Form Schedule K 1 Form 1065