How To Send W8ben Form

Stake automatically completes your W-8BEN form for you. Ask for any taxpayer identification numbers on Form W-8BEN.

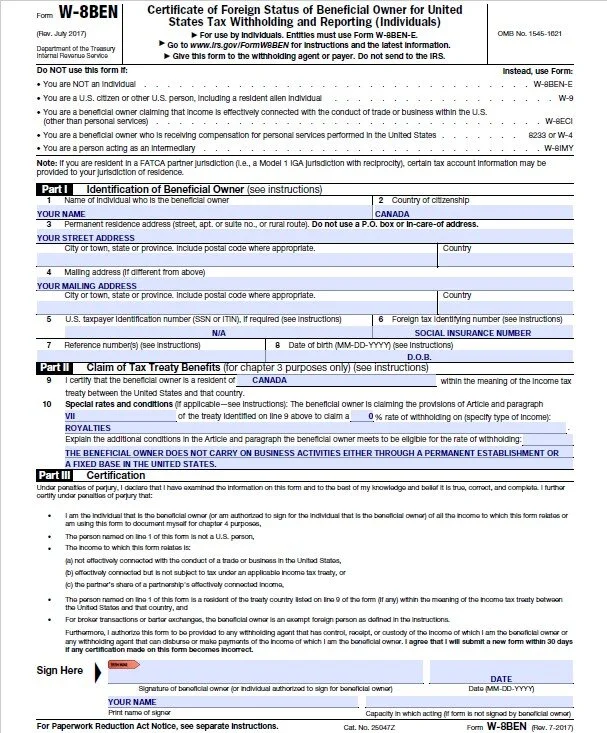

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Use the Form W-8BEN to report your income to anyone.

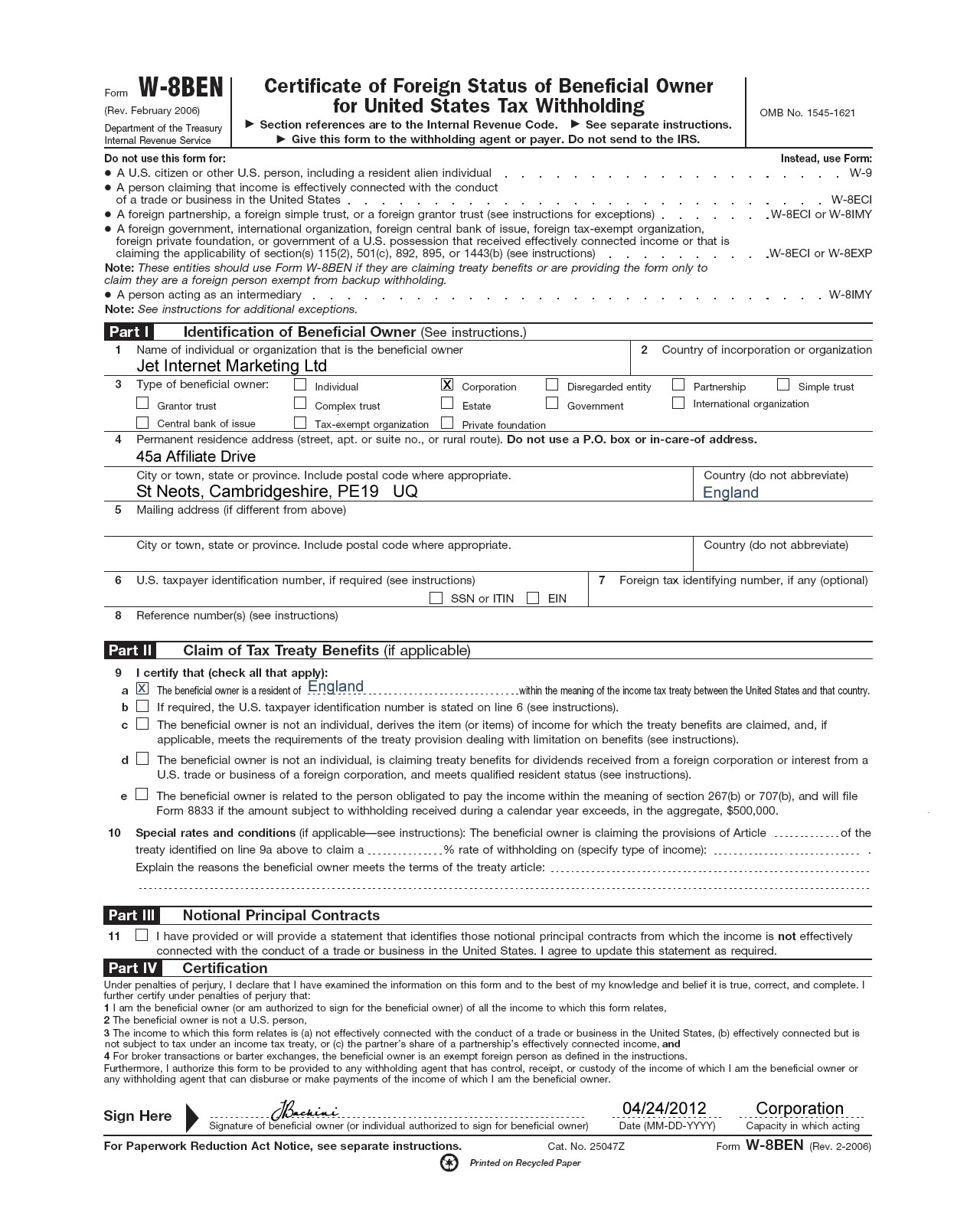

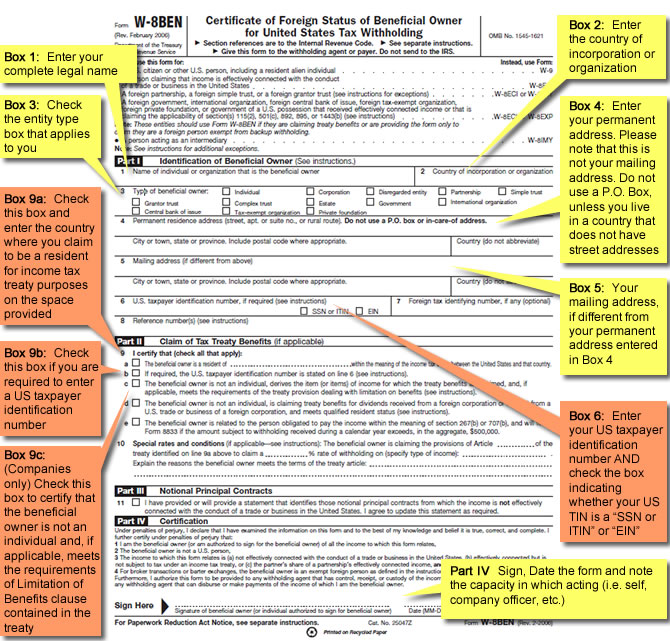

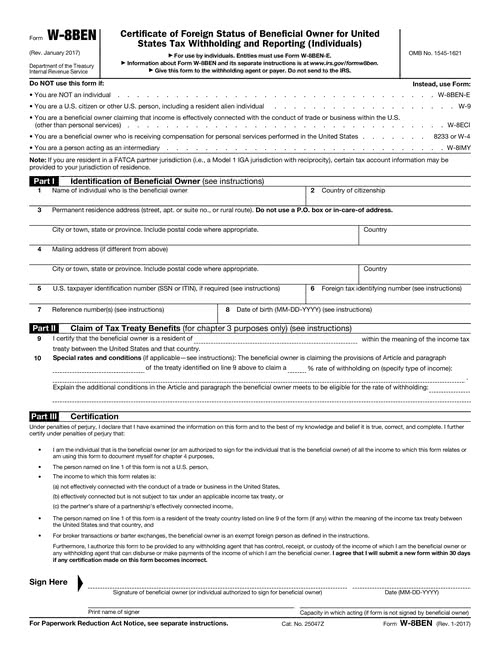

How to send w8ben form. Requesting a W-8BEN Form W-8BEN forms are used to certify that foreign individuals not businesses have been paid with the appropriate withholding rate. And i also want to know that either i. Name of individual who is the beneficial owner.

How to complete your W-8BEN form. And Form W-8BEN is no longer valid with respect to such income. How long is the Form W-8BEN Valid.

A Give this form to the withholding agent or payer. A Go to wwwirsgovFormW8BEN for instructions and the latest information. You can send a copy of the form to your non-resident alien employees but theyll need to fill it out themselves.

2 return your w-8ben form to. Filling out Form W-8BEN is fairly straightforward. Where to Send the Form W8-BEN.

Giving Form W-8BEN to the withholding agent. You must file Form W-8ECI. Need to submit Hard Copy or Soft Copy by Scanning that W-8BEN form.

It should not be sent directly to the IRS. Fill in the details as required. It is a United States legal tax form from the IRS Internal Revenue Service which is also.

Part 1 Identification of Beneficial Owner. Complete and sign the w-8ben form. Generally this will be the person from whom you receive the payment who.

Enter your address in the Address field. Filling in a W-8BEN form is required in order to buy US stocks through our app. Do not send Form W-8BEN to the IRS.

All you need to do is type your name exactly as displayed as per Part I of the W-8BEN form eg. Please fax all requested paperwork to 866-468-6268 or attach to an email through the Secure Message Center. Enter your full legal name in the Legal Name field.

Giving Form W-8BEN to the withholding agent. Generally this will be the person from whom you receive the payment who credits your account or a partnership that allocates income to you. If you complete the W-8BEN certification Upwork does not.

To provide Upwork with your Form W-8BEN information. Follow instructions on page 2. Super Funds Trusts Companies.

For example a Form W-8BEN signed on September 30 2015 remains valid. If mailing is preferred send original W-8BEN to the address in the upper right hand corner. In this tutorial you will learn How to Complete the W-8BEN Form.

Instead give it to the person who is requesting it from you. Entities must use Form W-8BEN-E. Log into your Upwork account.

Locked bag 22 australia square nsw 1215. The form can be completed electronically but must be signed by hand. Entities must use Form W-8BEN-E.

Heres what to expect. Weve taken a look at some of brokers that offer US stocks below. Some brokers will assist in completion of your W-8BEN form while others expect you to fill it out and send it to them.

See Change in circumstances later. As I am Indian Resident I choose for Paper form and download it after filled necesary info. Please tell the complete procedure to do the same.

As a non-US investor you will be required to fill in a W-8BEN form through the app to declare you are not a US tax resident which most likely reduces the amount of US tax you have to pay on US-sourced income from 30 to the most favourable rate allowed by your countrys tax treaty with the USA. At the end you will be given your EIN number over the phone. Go to wwwirsgovFormW8BEN for instructions and the latest information.

MR JOHN MICHAEL SMITH and click Sign and Finish. Go Settings Tax Information. My problem is I dont know How to SubmitMail W-8BEN form.

Instead give it to the person who is requesting it from you. The Form W8BEN must be presented to the withholding agent or payor in order to claim a reduced rate of withholding tax. It is important that the Form W-8BENBEN be kept up to date in order to avoid having tax wrongfully withheld from your income.

Lets look at each part in turn. How Do I Fill Out Form W-8BEN in Canada. Provide us with your legal name and address.

Form W-8BEN will remain in effect for purposes of establishing foreign status for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year unless a change in circumstances makes any information on the form incorrect. Give this form to the withholding agent or payer. Where to send or submit W-8BEN from.

Go to Settings Tax Information page. Paperwork will follow in a few weeks but it is the magic EIN number that you will need now to complete the W-8BEN form. The W-8BEN form is in four parts.

Do not send Form W-8BEN to the IRS. If you are adding US Trading to an Individual Joint or Sole Trader account your W-8BEN form will be pre-populated for digital submission. Withhold any taxes from your earnings.

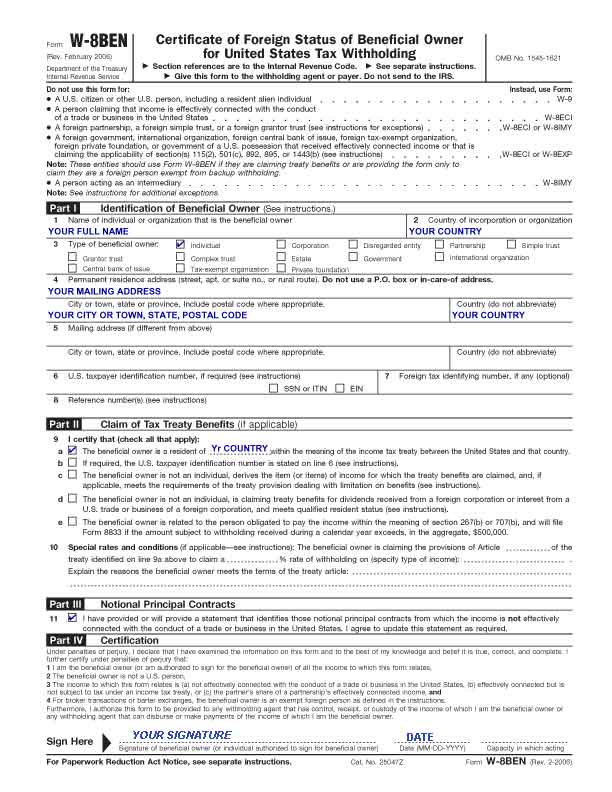

W8ben Fill Out And Sign Printable Pdf Template Signnow

W8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

W 8ben Fill Out And Sign Printable Pdf Template Signnow

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

Tutorial How To Fill Up Irs Form W 8ben Winning Theme

For Foreign Authors Wishing To Publish On Amazon Read This Self Publishing Review

For Foreign Authors Wishing To Publish On Amazon Read This Self Publishing Review

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

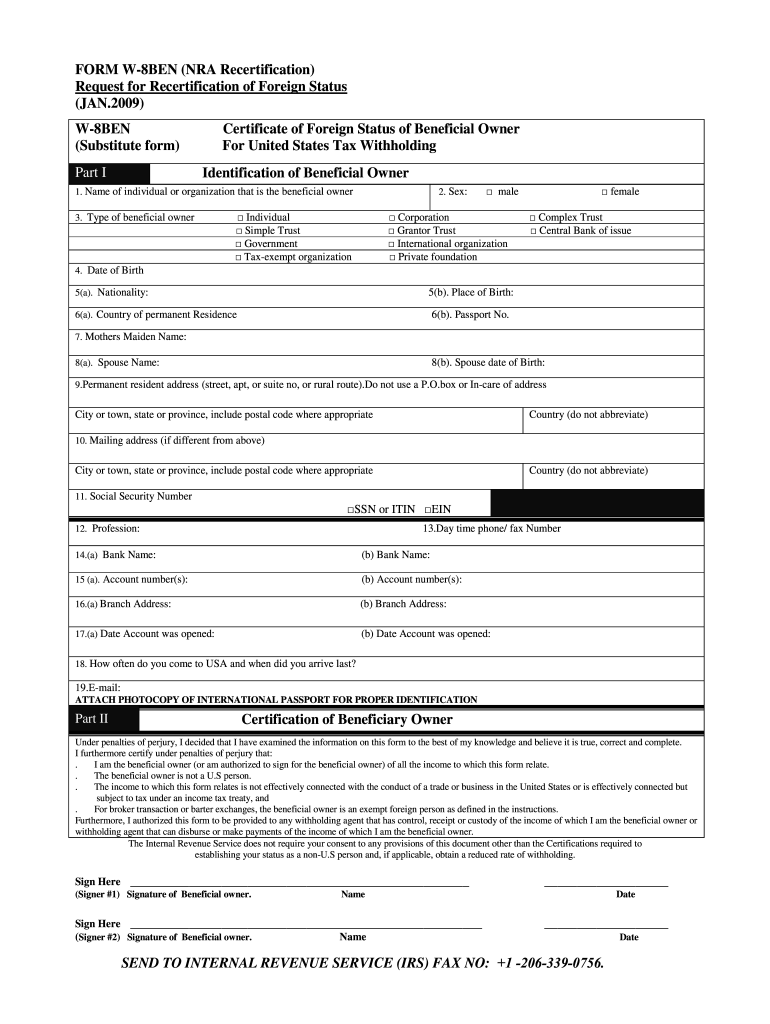

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

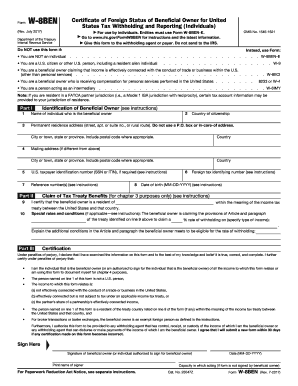

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

5 Us Tax Documents Every International Student Should Know

Fake Form W 8ben Used In Irs Tax Scams Don T Get Hooked

W 8ben Form Instructions For Canadians Cansumer

W 8ben Form Instructions For Canadians Cansumer

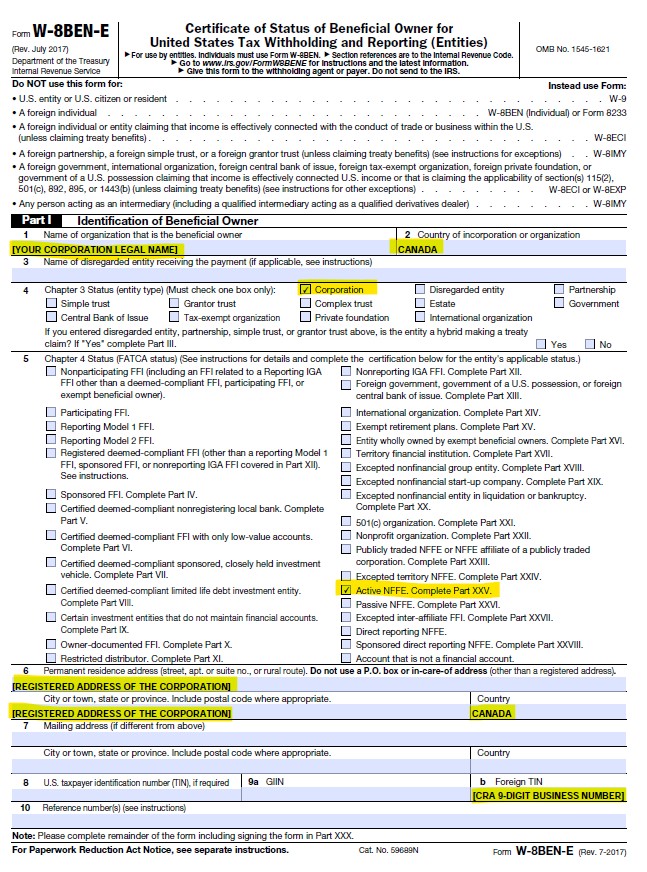

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa