How Do I Give A 1099 Form

You can get 1099-NEC forms from office supply stores directly from the IRS from your accountant or using business tax software programs. This may delay processing of your return.

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

You must use the official form.

How do i give a 1099 form. Do not also send in federal Form 1099-R. As a private person you are not required to issue a form 1099-MISC. Theres a menu on the left pull it out and tap on My Account at the bottom.

File Form 1099-MISC for each person to whom you have paid during the year. At least 600 in. Like Form 1099-MISC also submit a Form 1096 summary along with Form 1099-NEC.

How to Get Your 1099-G online. Remember some businesses dont issue these forms until the January 31st deadline. The form shows how much they earned from you.

However the IRS takes the position that you may issue the form if you want to on the grounds that it helps to increase tax compliance. Youll also need to provide a 1099-Misc to anyone you pay 10 or more in royalties. Due Dates for 1099-NEC Forms.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Amounts less than 600 are still considered as taxable income. You must send this form in along with copies of all of the 1099-MISCs.

Scroll down to find the Verification Tax Info section. To access this form please follow these instructions. You cant use a form that you download from the internet for Form 1099-NEC because the red ink on Copy A is special and cant be copied.

This is the form that summarizes the total of monies spent on all of your outsourcingindependent contractors. This form is issued if you made 200 or more transactions and you received payments of 20000 or more for goods or services via third-party services such as credit card processors or merchant card services. Fill out Form 1099-NEC if you have any workers you paid 600 or more to in nonemployee compensation.

The easiest way to do this is to call your paying company and request the Form 1099. Fill out two 1099-NEC forms. This is how you can do it via your Payable account.

This child tax credit will give families a big boost in 2021. Get your tax forms in order Step 1. Tap on Tax Form.

Before you can fill out Form 1099-NEC andor Form 1099-MISC you need to gather some information. You can also access your account by. After youve completed and mailed all of the 1099-MISC forms the next step is to mail a 1096 to the IRS.

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Launch the Payable app and log in to your account. You have until the last day of February to get this done.

Use it to report to your contractors and to the IRS how much they were paid over the course of. When you hire independent contractors for your small business you need to give them a 1099-Misc if you paid them 600 or more in the previous tax year. Filling out Forms 1099.

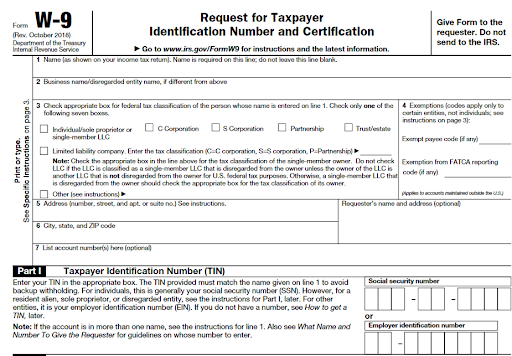

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. Use a W-9 form. Ride-sharing drivers will also receive a Form 1099.

To issue the form you must send a copy to the payee and a copy to the IRS before January 31 2018. Your earnings exceed 600 in a year According to Instacart if you dont meet this requirement you wont receive a 1099-NEC. If you do not have an online account with NYSDOL you may call.

The 1099-NEC form is the independent contractor tax form. While Stride operates separately from Instacart I can tell you that Instacart will only prepare a 1099-NEC for you if. Ask your independent contractor to fill out Form W-9 When tax time rolls around Form W-9 will be your best.

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. You may choose one of the two methods below to get your 1099-G tax form. A very active Airbnb listing for which hosts have more than 200 guest bookings per year would be an example of side income that would lead to issuance of a 1099-K.

If the IRS comes calling have a record of this request at hand. Keep it for your records.

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager