Franchise Tax Board Business Installment Agreement

This includes both domestic corporations and. DISCLOSURE OFFICE FRANCHISE TAX BOARD PO BOX 1468 SACRAMENTO CA 95812-1468.

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Cas Pdf

File a return make a payment or check your refund.

Franchise tax board business installment agreement. For more information you may write the FTB at. Agreements also allow the federal government as well as other. Mail your payment to.

CDTFA would be allowed to enter into an installment payment agreement in lieu of the complete payment required but only if final payment under the terms of that installment payment agreement is due and is paid no later than June 30 2022. RTC Section 195047 RTC Section 195047 Interception - If you do not pay your entire income tax liability by the time it becomes due and payable the unpaid amount could be satisfied by interception of funds due to you from the. Apply for a payment plan - individuals.

This optimized payment contract is subject to a 34 tax and this tax is added to its balance. As of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web. Apply online for a payment plan Installment agreement - individuals.

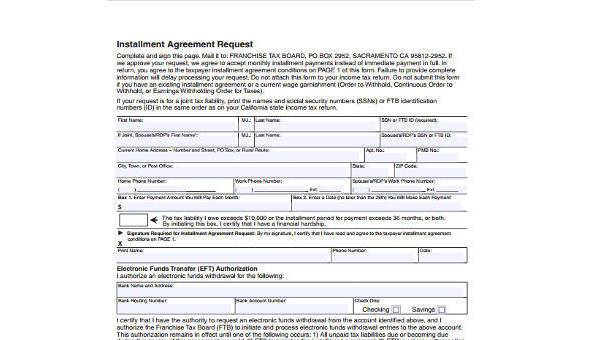

By Mail Complete the enclosed FTB 3567 Installment Agreement Request on PAGE 2 and mail it to us at. CA FTB Installment Agreement Conditions. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement.

STATE OF CALIFORNIA FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0011. We encourage you to borrow from private sources to immediately pay your tax liability in full. State of California Franchise Tax Board Corporate Logo.

You may be eligible if the amount due is less than 25000 the installment payment period is no longer than. If We Accept Your Installment Agreement Request we will send you a notice confirming the payment amount and the due date for each monthly payment. All information will be.

Online Log in to check your status Phone 800 689-4776 Weekdays 8 AM to 5 PM When to check your status. Businesses owing the FTB may also establish an installment payment agreement over the phone but it is more complicated and more documents are required. Franchise Tax Board PO.

Only newly assessed liabilities may qualify for an online installment agreement. The combination must match our records in order to access this application. Check after 30 days.

Terms and Conditions. If you are unable to pay your taxes you may qualify for an FTB Payment Plan. An application fee of 34 will be added to your tax balance when you request an installment agreement.

Check after 90 days. Change or cancel a payment plan. Box 942867 Sacramento CA 94267-0011.

If your request is accepted you will receive a notice with your monthly payment due date and amount. How to Request an Installment Agreement Online Go to ftbcagov and search for installment agreement and then select apply online. FRANCHISE TAX BOARD PO BOX 2952.

At FinishLine Tax Solutions we dont believe in stopping until we get the best outcome for you. PDF Franchise Tax Board State of California Installment Agreement Request Greg Wise - Academiaedu We will always ask you to immediately pay your tax liability including interest and penalties in full. Make monthly payments until the taxpayer pays the entire tax bill in full.

It may take up to 60 days to process your request. Box 2952 Sacramento CA 95812-2952. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

Typically you will have up to 12 months to pay off your balance. If you run out of space please attach additional pages write your name and social security number on all additional pages. Therefore its beneficial to work with a tax professional when negotiating with the IRS.

Enter your Social Security Number and Last Name. Like other agreements you will have to negotiate with the state on a franchise tax board installment agreement. Installment equal to 40 of the preceding years tax.

All general business corporations must file franchise tax returns under Tax Law Article 9-A. A successful mitigation agreement with the Tax Board franchise requires good information and careful preparation. The FTB also has a unique feature that is not available with IRS temperature chords.

State of California Franchise Tax Board Installment Agreement Financial Statement Please furnish the information requested on this form. State of California Franchise Tax Board Installment Agreement Financial Statement Please furnish the information requsted on this form. All information will be.

You must apply for an Installment Agreement to see if youre eligible. If you run out of space please attach additional pages write your name and social security number on all additional pages. Check the status of your installment agreement request.

It is important that all questions are answered. For more information go to the FTB website at wwwftbcagovonlineinstallments_busshtml. Payment payable to FRANCHISE TAX BOARD and write your account number on your payment.

Pay a 34 set-up fee that the FTB adds to the balance due. It is important that all questions are answered. Automated voice response system.

California Franchise Tax Board. The function is called jumping the month. If you are financially unable to pay the tax.

Log in to your MyFTB account. For more information write to. Individual Electronic Installment Agreement.

Follow the links to popular topics online services. Check after 2 days. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

If approved it costs you 50 to set-up an installment agreement added to your balance.

California Ftb 1521 Pass Sample 1

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Https Www Ftb Ca Gov Tax Pros Law Ftb Notices 2005 5 Pdf

Free 8 Installment Agreement Form Samples In Pdf Ms Word

Free 8 Installment Agreement Form Samples In Pdf Ms Word

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Inspirational Ftb Ca Gov Installment Agreement Models Form Ideas

Inspirational Ftb Ca Gov Installment Agreement Models Form Ideas

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Form 3561 Installment Agreement Financial Statement

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Cas Pdf

Form 3561 Installment Agreement Financial Statement

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Cas Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Non Tax Debt Collections Pdf

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

California Ftb 1521 Pass Sample 1