W8 Form For Limited Company

Utilize a check mark to point the answer wherever expected. It is most likely because you are invoicing as an individual rather than company.

How To Form A Nonprofit Corporation National Edition Ebook Non Profit How To Raise Money Free Pdf Books

How To Form A Nonprofit Corporation National Edition Ebook Non Profit How To Raise Money Free Pdf Books

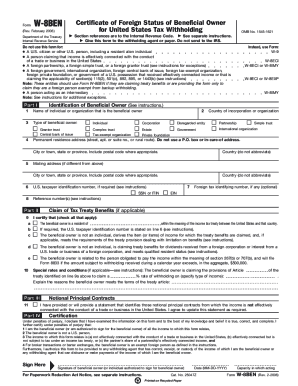

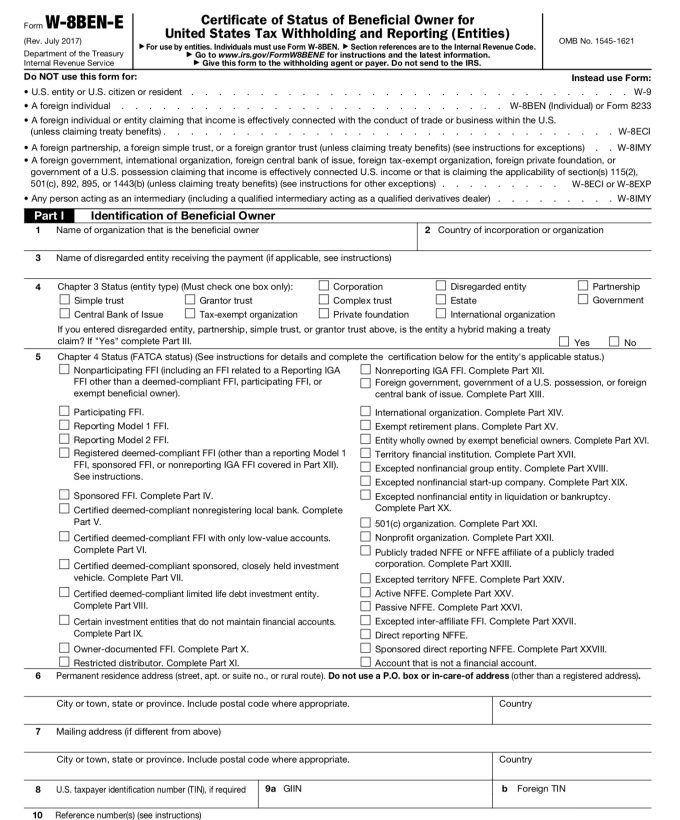

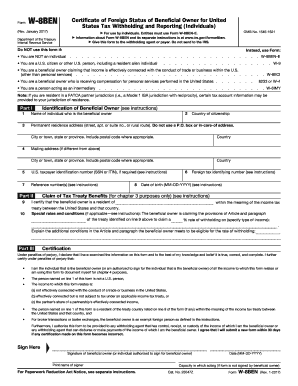

Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting is a form that foreign individuals non-US citizens or business entities need to verify their country of residence for tax purposes.

W8 form for limited company. Form W8 W 8BEN or W8 form is used by non-resident aliens who do work andor make income in the US. However in many cases a TIN is actually not required as we explain in. The W-8BEN is a form required by the Internal Revenue Service IRS the United States tax agency.

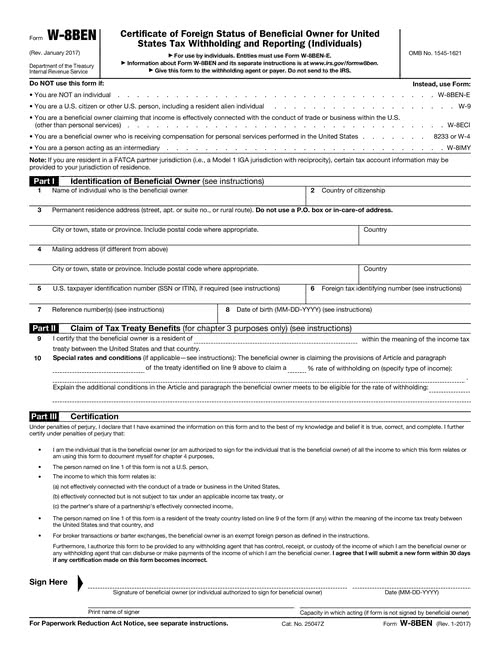

All US payers are required to determine whether the recipient is a US entity or a foreign entity. Simplified Instructions for Completing a Form W-8BEN-E 3 Step 1. A W-8 BEN is issued to an individual usually contractors consultants or investors in US companies.

The W-8BEN-E form is used by payers of US income. Press Done after you fill out the blank. The form is on the IRS website.

Some of our clients have recently been informed by their US bank or withholding agent that a new IRS W8 requires them to provide a Tax Identification Number TIN for their Bermuda BVI or Cayman Company. If youre a legal citizen of the United States at no point will you have to worry about filling out the form. Client in order to avoid paying tax to the IRS.

They just keep it on record in case the IRS inspect them. Section references are to the Internal Revenue Code. Fill in the details as required.

A W-8 form is a grouping of tax forms specifically for non-resident aliens and foreign businesses who have either worked in or earned income in the US. If you are a company in the UK getting paid by a company in the US you need to fill in this form to avoid the US government withholding 30 of your income. You just need to enter the name of the company.

Form W-8 or substitute form must be given to the payers of certain income. It declares the applicants status as a non-resident alien or foreign national and informs financial companies that they will be taxed differently than a resident. Lets look at each part in turn.

A W-8 BEN-E is issued to an entity a limited company who has delivered services to a US company. Use the Sign Tool to add and create your electronic signature to signNow the W8 form. Corporations and partnerships cannot use this form if they are incorporated formed or otherwise organized in the US.

Estates cannot use this form if the decedent was a US. Part 1 Identification of Beneficial Owner Field 1. These individuals must provide a completed W-8BEN form to their US.

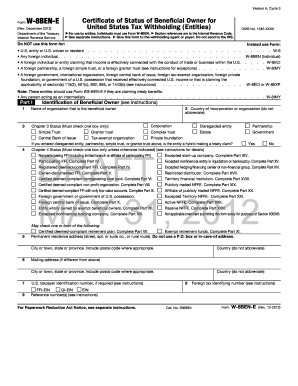

Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities For use by entities. Part 1 Identification of Beneficial Owner. July 2017 Department of the Treasury Internal Revenue Service.

Review the situations listed at the top of the Form under the header Do NOT use this form if If any of these situations apply to you please use the form indicated instead of Form W-8BEN-E. You print it off fill it in and send it to them. Form W-8BEN-E is used to inform the US company that you are a company located in and performing the services in a foreign country so no US taxes are withheld.

These tax forms are only used by foreign persons or entities certifying their foreign status. If a taxpayer identification number or Form W-8 or substitute form is not provided or the wrong taxpayer identification number is provided these payers may have to withhold 20 of each payment or transaction. Double check all the fillable fields to ensure full accuracy.

Individuals must use Form W-8BEN. If you are an individual in the UK getting paid by a company in the US you need to fill in the simpler W-8BEN form which is a lot less scary. If you are a limited company tick corporation in section 3 all the other options for entity are self-explanatory.

The W-8BEN form is applicable to foreign individuals and sole proprietors who earn money or income from US. For general information and the purpose of each of the forms described in these instructions see those forms and their accompanying instructions About Form W-8 BEN Certificate of Foreign. The form is a record in case they are audited by the IRS and ensures the correct amount of US tax withholding is made.

Enter the name of the country. W8-BEN form is so they do not have to withhold tax from you in the US. The Form W-8BEN-E should only be completed by a non-US.

The W-8BEN form is in four parts. Anything that are not filled we will ignore that fields. W-8 forms are generally filed by persons or business entities who receive income in the US though one form in the series Form W-8IMY is used by intermediaries that receive withholdable.

Or by foreign business entities who make income in the US. This is called backup withholding. We will only talk about fields in the form that need to be filled.

Now you are able to print download or share the form. Confirm that you are not precluded from using Form W-8BEN-E. Select Corporation if it is a private limited company.

These instructions supplement the instructions for Forms W-8 BEN W-8 BEN-E W-8 ECI W-8 EXP and W-8 IMY. Ask Your Own Tax Question Customer reply replied 1 year ago. Since the majority of our clients have to complete the W-8 BEN-E so this is the form we will look at in detail today.

This form is issued. If you fall into other categories please select the same.

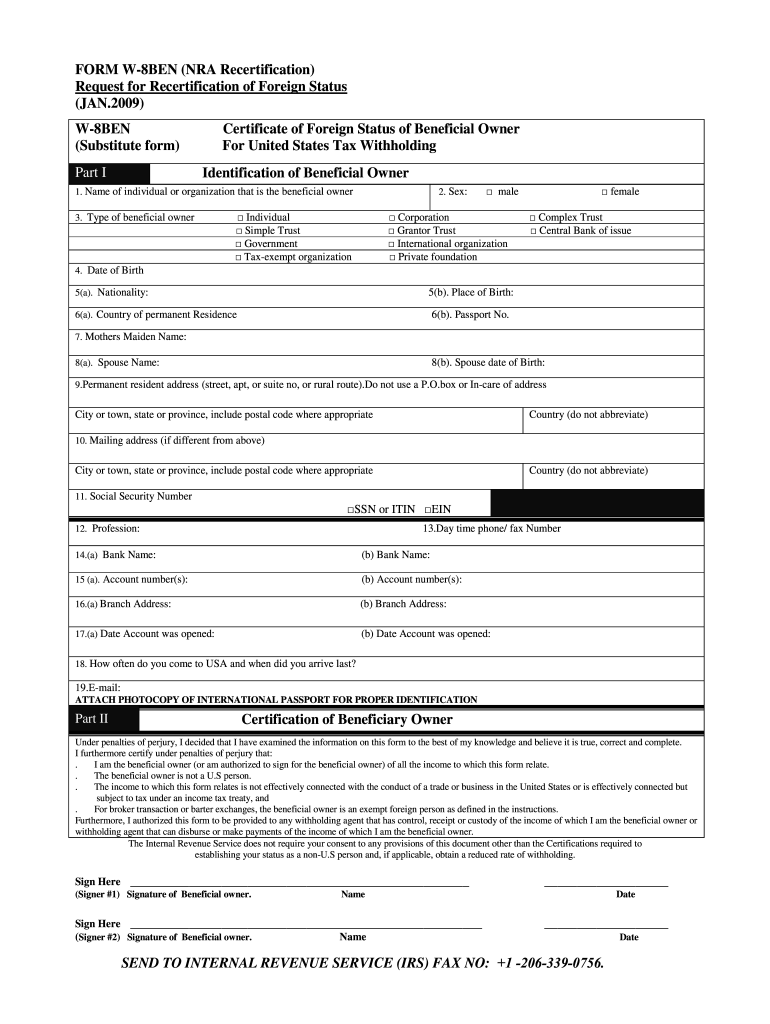

W 8ben Form Pdf Fill Out And Sign Printable Pdf Template Signnow

W 8ben Form Pdf Fill Out And Sign Printable Pdf Template Signnow

W 8ben India Fill Online Printable Fillable Blank Pdffiller

W 8ben India Fill Online Printable Fillable Blank Pdffiller

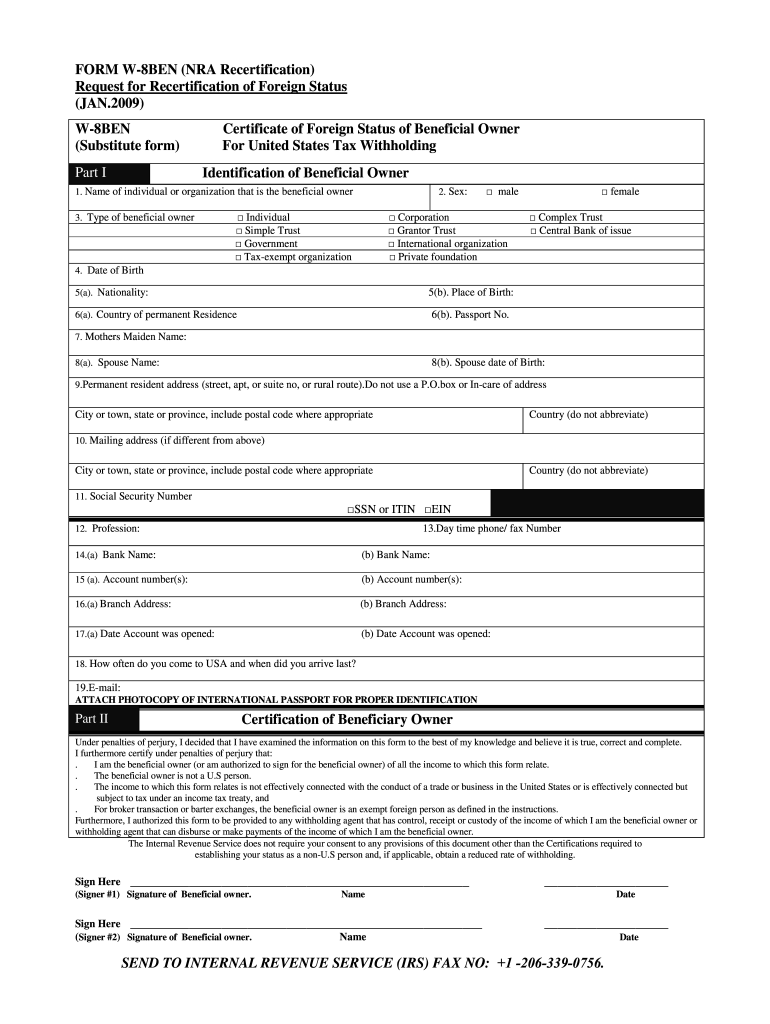

W 8 Form Printable Fill Out And Sign Printable Pdf Template Signnow

W 8 Form Printable Fill Out And Sign Printable Pdf Template Signnow

W8 Form California 8 Five Signs You Re In Love With W8 Form California 8 In 2021 W2 Forms Power Of Attorney Form Business Strategy

W8 Form California 8 Five Signs You Re In Love With W8 Form California 8 In 2021 W2 Forms Power Of Attorney Form Business Strategy

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

What W8 Form For A Uk Charity Fill Online Printable Fillable Blank Pdffiller

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

Irs W 8ben Form Template Fill Download Online Free Pdf

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

How To Fill In A W8ben Form If You Re In The Uk And Trading In The Usa

Primer Zapolneniya Nalogovoj Formy W 8ben Dlya Shuterstok Shutterstock Irs Gov State Tax Business Administration

Primer Zapolneniya Nalogovoj Formy W 8ben Dlya Shuterstok Shutterstock Irs Gov State Tax Business Administration

Fill W8 Ben And W8 Ben E Forms For You By Kmindaugas Fiverr

Fill W8 Ben And W8 Ben E Forms For You By Kmindaugas Fiverr

Https Axaxl Com Media Axaxl Files Pdfs Fatca W8 Xl Finance Ireland Limited W8bene Pdf Sc Lang En Hash 2bf6586b93e5c4a904786a6146fd10cc

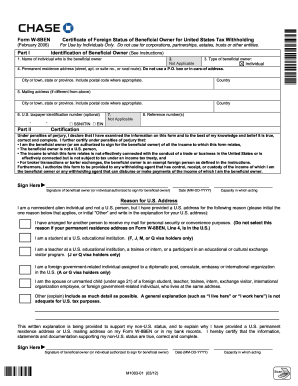

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

W8 Form Fill Out And Sign Printable Pdf Template Signnow

W8 Form Fill Out And Sign Printable Pdf Template Signnow

Http Www Scotiabank Com Fatca Giin W8bene 6xg0ci 00137 Me 092 Pdf

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

W8 Tax Form 8 Quick Tips Regarding W8 Tax Form Irs Forms Fillable Forms Tax Forms

W8 Tax Form 8 Quick Tips Regarding W8 Tax Form Irs Forms Fillable Forms Tax Forms

How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube

W 8 Forms Collected By Stripe Stripe Help Support

W 8 Forms Collected By Stripe Stripe Help Support