In Islamic Finance What Are The 3 Types Of Ownership

This means your ownership share of the property remains consistent throughout the length of the term. This type of business is a business run by an individual.

Https Www Un Org Esa Ffd High Level Conference On Ffd And 2030 Agenda Wp Content Uploads Sites 4 2017 11 Background Paper Islamic Finance Pdf

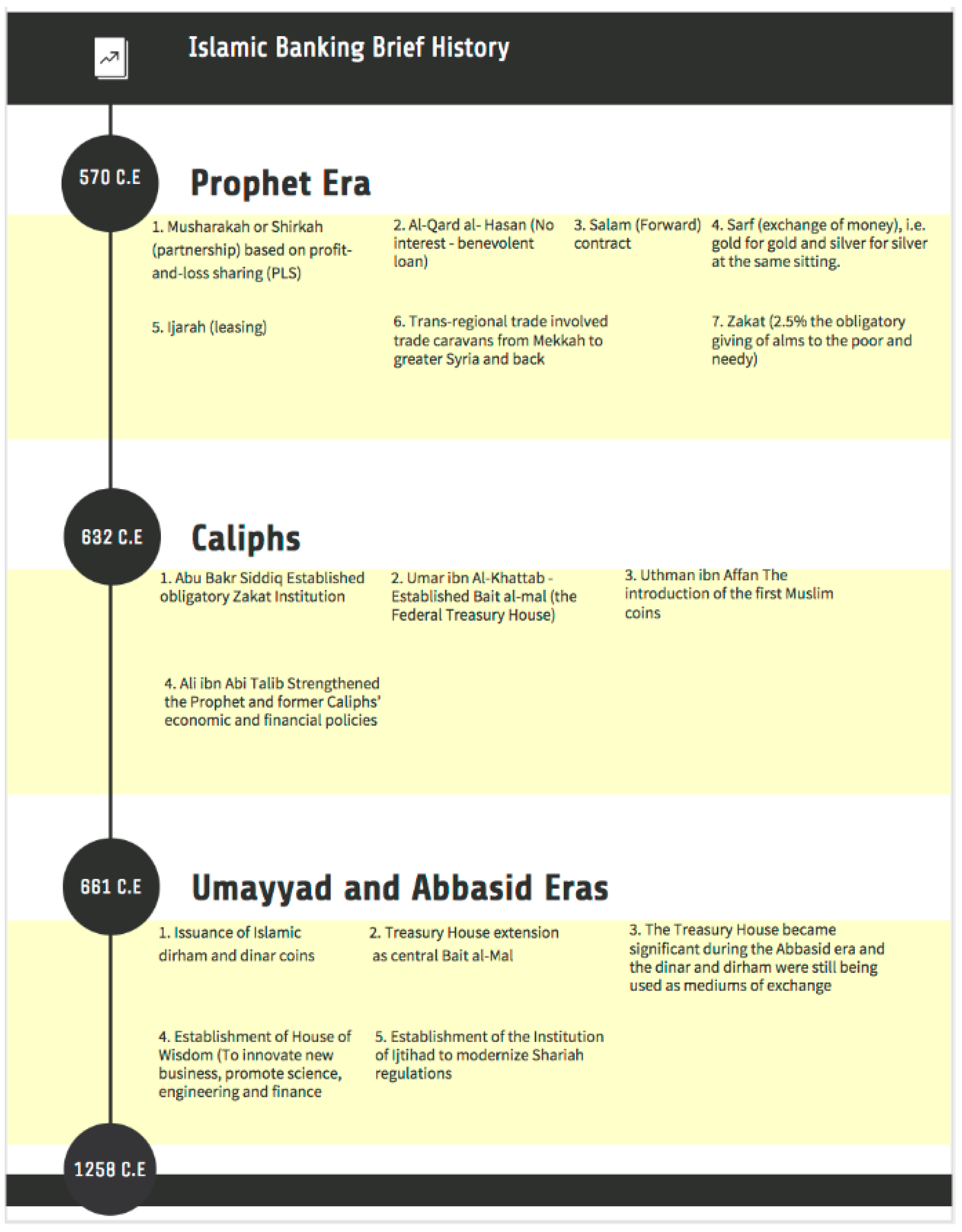

Basic instruments include.

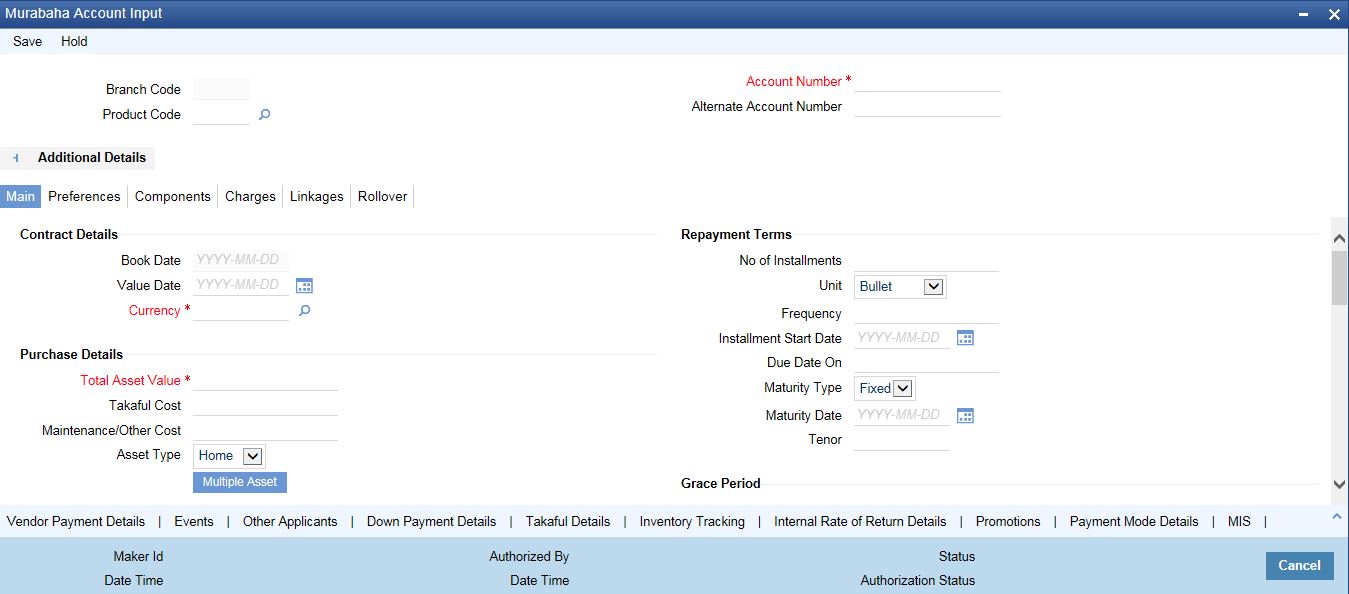

In islamic finance what are the 3 types of ownership. Leasing or Renting Ijara in Islamic Finance. Cost-plus financing murabaha profit-sharing mudaraba leasing ijara partnership musharaka and forward sale baysalam. Such as Mudarabah Musawamah Salam and Istisna.

It simply means equity finance. This means that one is can own certain property and its usufruct. He also has complete authority to.

He own capital and can makes loan on behalf of himself if he thinks that it is needed. The three types of halal mortgage alternatives are. However the establishment of formal Islamic finance occurred.

In an Ijara home purchase plan you make monthly payments that are part rent and part capital to finance your final purchase. Monopoly in all forms. Use exploit or appropriate his property Give it as.

May 19 2004 0000 By Sohail Zubairi Special to Gulf News In an earlier article I briefly touched upon the subject of a lessee sub. The concept can also refer to the investments that are permissible under Sharia. Islamic finance quiz consists of truefalse questions.

Direct Investment and Islamic Syndication. The Arabic term ijara means providing services and goods temporarily for a wage. You will not be able to go back or skip questions.

The concept can also refer to the investments that are permissible under Sharia. Such as Musharakah and Mudarabah. Cheating in quality quantity weight or any specifications of the goods and services traded or acquired or disposed of.

All the criteria in Islamic economic are similar with the other types of individual business outside the Islamic. In the ijara contract a person or party is given the right to use the object the usufruct for a period. Civil Partnership in Islamic Finance.

Salam Rent based modes. TYPES OF OWNERSHIP IN ISLAMIC PERSPECTIVE BASED ON CAPACITY OF OWNERSHIP i Complete Ownership This type of ownership combines both legal and beneficial ownership in one person and entitles him to all rights over that property. These constitute the basic building blocks for developing a wide array of more complex financial instruments.

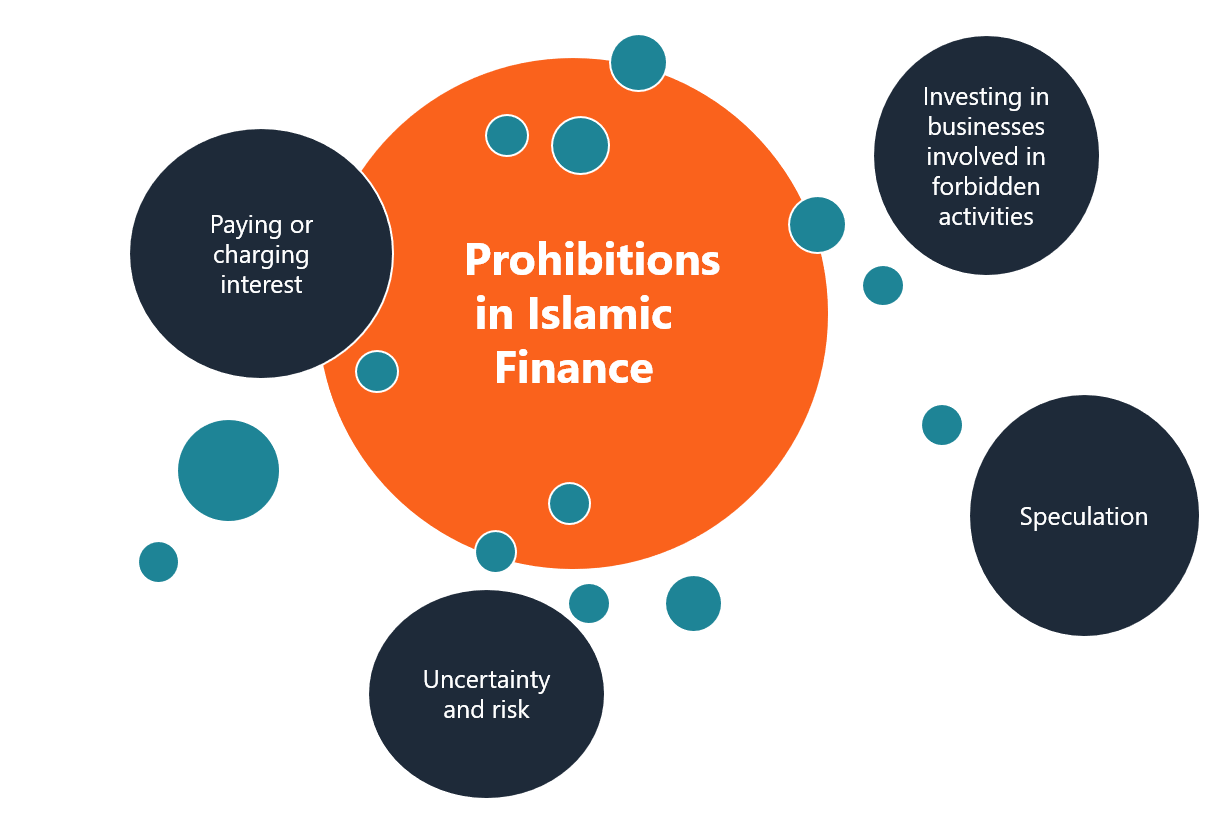

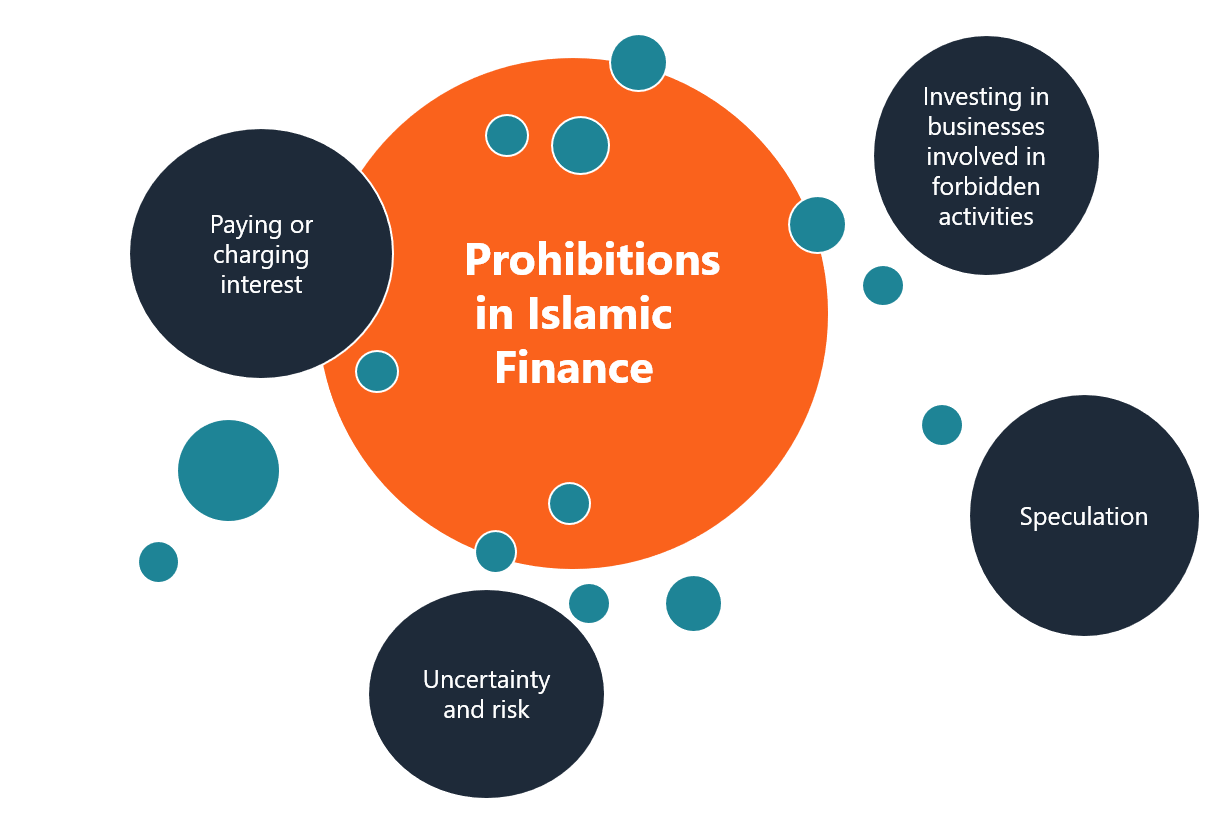

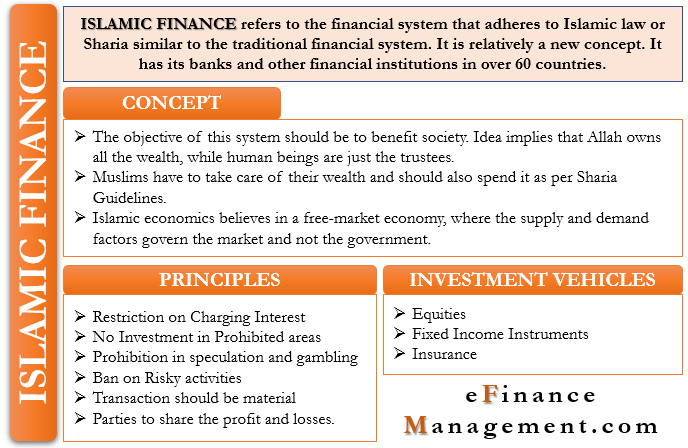

Hoarding especially with food stuffs which are not allowed to stay in traders hands for more than 40 days. Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia or Islamic lawIt also refers to the types of investments that are permissible under this form of. Islamic investing is investing with a commitment to the Shariah the divine guiding principles revealed by God to humankind in the Quran and demonstrated by the Prophet Muhammad peace be upon him.

The Joaalah Contract in Islamic Finance. Salam Contract in Islamic Finance. Islamic finance is a type of financing activities that must comply with Sharia Islamic Law.

There are three main categories of Islamic financial instruments or Islamic modes of finance. The common practices. Hammoudi puts the problem this way.

Islamic finance is a type of financing activities that must comply with Sharia Islamic Law. Different types of asset ownership Published. Islamic modes of financing 1.

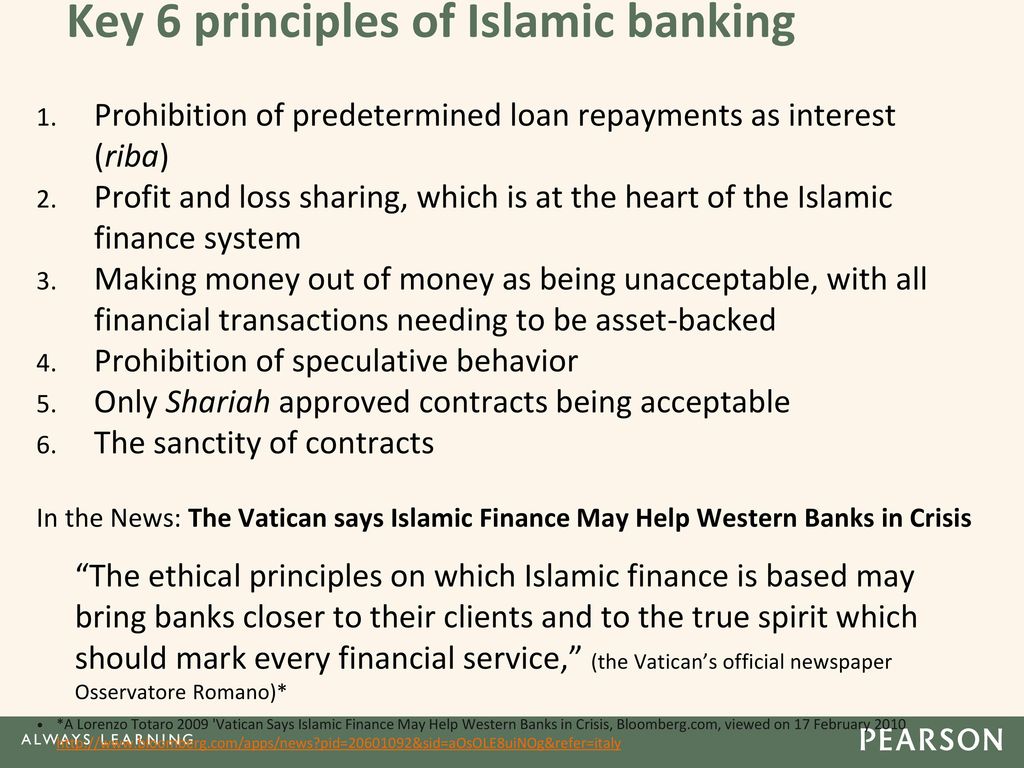

Some of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture Murabahah cost-plus and Ijara leasing. Types of sharia mortgage. Murabaha Trade with markup or cost-plus sale.

The Quran prohibits riba which literally means increase. All answers are final. Hire-Purchase Leasing in Islamic Finance.

The common practices of Islamic finance and banking came into existence along with the foundation of Islam. Most of these principles are common to most religions and morality systems including the three Abrahamic religions Islam Christianity. Gambling and betting in all forms.

Sukuk and Tawarruq Contracts in Islamic Finance. Diminishing partnership Sale modes. There are basically three modes of Islamic financing are.

Islamic modes of financing 2. Debt Based or Trade Based products. The ijara contract as you may guess involves providing products or services on a lease or rental basis.

You must answer each question before you go to the next one.

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

Https Www Un Org Esa Ffd High Level Conference On Ffd And 2030 Agenda Wp Content Uploads Sites 4 2017 11 Background Paper Islamic Finance Pdf

Topic 3 Islamic Financial System Flashcards Quizlet

Topic 3 Islamic Financial System Flashcards Quizlet

Pin On Islamic Finance Lectures

Pin On Islamic Finance Lectures

What Is Islamic Finance And What Can It Do Decision Sciences Institute

What Is Islamic Finance And What Can It Do Decision Sciences Institute

Free Lecture On Salam An Islamic Mode Of Finance For More Free Lectures Study Notes Visit Www Aims Education Islamic Banking Study Notes Finance Lecture

Free Lecture On Salam An Islamic Mode Of Finance For More Free Lectures Study Notes Visit Www Aims Education Islamic Banking Study Notes Finance Lecture

Islamic Finance Principles And Types Of Islamic Finance

Islamic Finance Principles And Types Of Islamic Finance

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

How Different Is Islamic Banking From The Traditional Banking S Silverman Books Blog Writer

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance Meaning Principles Concept And More

Islamic Finance Meaning Principles Concept And More

Islamic Finance An Overview Sciencedirect Topics

Islamic Finance An Overview Sciencedirect Topics

Chapter 1 Introduction To Islamic Banking And Finance Ppt Download

Chapter 1 Introduction To Islamic Banking And Finance Ppt Download

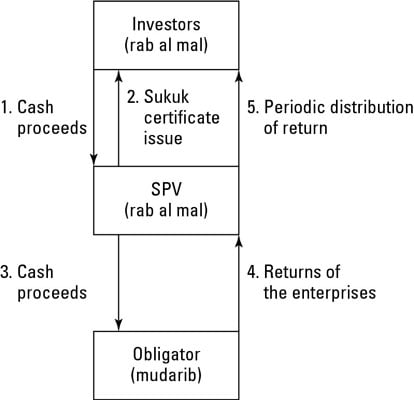

Types Of Sukuk In Islamic Finance Dummies

Types Of Sukuk In Islamic Finance Dummies

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Islamic Finance In Africa Opportunities And Challenges White Case Llp

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)