How To File Income Tax Return For Single Proprietorship

If you operate as an individual just bill your customers or clients in your own name. As a business a sole proprietorship does not pay taxes on the income it generates.

Filling Of Income Tax Return For Sole Proprietorship

Filling Of Income Tax Return For Sole Proprietorship

Since LLCs taxed as sole proprietorships dont file a separate business tax return.

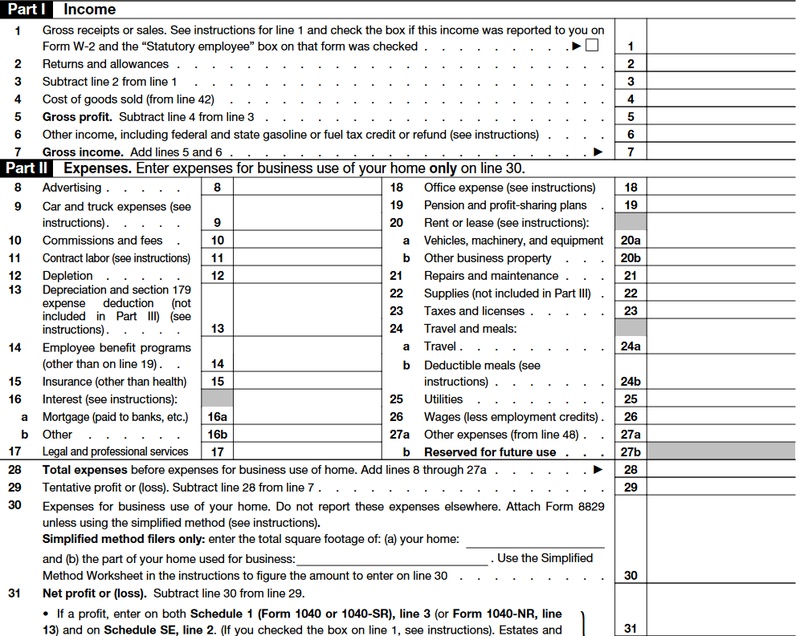

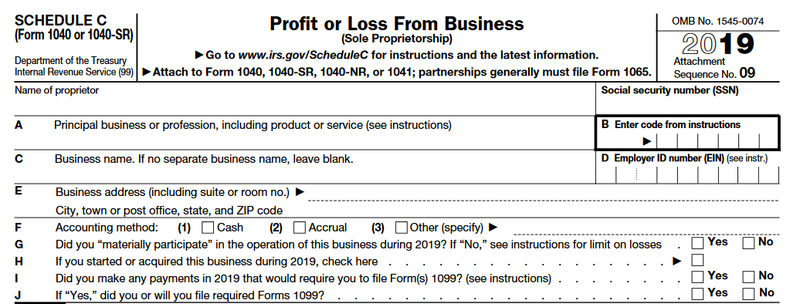

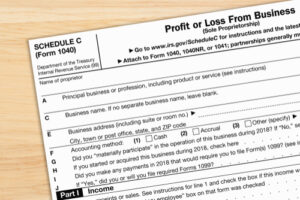

How to file income tax return for single proprietorship. You may choose to register a business name or operate under your own name or both. Firstly theres Form 1040 which is the individual tax return. In addition to filing a personal tax return Form 1040 youll have to file Schedule C Profit or Loss from Business Sole Proprietorship which is a two-page schedule of Form 1040 that looks like this.

Filing taxes as a sole proprietor is a fairly straightforward affair. If your LLC has just one member you can file as a sole proprietor or elect to file as a corporation. HOW TO FILE AN INCOME TAX RETURN AS A PROPRIETOR.

A sole proprietorship is taxed through the personal tax return of the owner on Form 1040. If the documents and bookkeeping have consistently complied filing should be as easy as these three steps. Filing your Income Tax Return ITR Filing for a tax return for the year is a straightforward process.

Sole proprietors file need to file two forms to pay federal income tax for the year. If you have received full-time or part-time income from trade business vocation or profession you are considered a self-employed person. To file taxes as a sole proprietor you need to complete Profit or Loss From Business Form 1040 Schedule C as part of your individual personal taxes.

Form 1040 reports your personal income while Schedule C is where youll record business income. Annual Income Tax Return for Corporation Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate. As part of a single members tax reporting a Schedule C Profit or Loss from Business form must be completed and attached with the federal tax return.

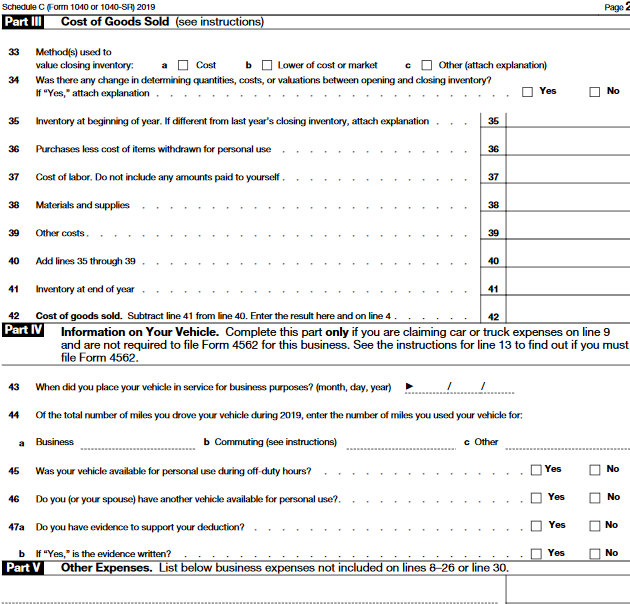

To complete Schedule C the income of the business is calculated including all income and expenses along with cost of goods sold for products sold and costs for a home-based business. The form contains the SMLLCs profit or loss annual income and business expenses. This return shall be filed by Corporation Partnership and other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate of 30.

Instead profits and losses pass through to the owner and the owner pays taxes on that income with their individual tax return. You have to report this income in your tax return. If you are a sole proprietor you pay personal income tax on the net income generated by your business.

So if you have several different businesses or employment income as well as business income or investment or pension income for that matter it all gets reported on the same tax return. The business profit is calculated and presented on Schedule C Profit or Loss from Small Business. You report your worldwide total income on the T1 general income tax return.

The single memberowner is not an employee and his or her wages would not be taxable wages in Florida. If there is no income to report you do not need to file this form. 1040-ES Estimated Tax for Individuals.

A sole proprietorship is an unincorporated business that has a single owner. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a sole proprietorship. Sole proprietors report their business income or losses on their personal tax return by using Form 1040.

The income tax return of a proprietorship firm in specified Form ITR 3 or ITR 4 Sugam can easily be filed online on the e-filing portal of the government by using the digital signature of the proprietor or by generating a CV or generating an Aadhar OTP or by sending a signed copy of the ITR-V to Post Bag No. If the LLC filing its federal income tax return as a sole proprietor has other employees the LLC itself must register and pay tax on the wages paid to the other employees unless the wages are exempt for another reason. Tax Return for Seniors.

Sole proprietors use Schedule C to tell the IRS about. This page shows the relevant information to help you prepare and file your tax return. Business income is reported on Form T2125 which is part of the T1 return.

They must also file Schedule C Form 1040 to report the profit and loss from their business. Download and accomplish the ITR form from BIRs website. The IRS requires individuals with this kind of business to file a Schedule C with any income tax return.

Your single-member LLC files Form 1040 Schedule C to detail business revenue deductions and credits to the IRS. If the single-member LLC is owned by a corporation or partnership the LLC should be reflected on its owners federal tax return as a division of the corporation or. Secondly theres Schedule C which reports business profit and loss.

Schedule SE Form 1040 or 1040-SR Self-Employment Tax. 9 rows THEN use Form. Individual Income Tax Return.

And Schedule C Form 1040 or 1040-SR Profit or Loss from Business.

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

The Federal Tax Forms For A Sole Proprietorship Dummies

The Federal Tax Forms For A Sole Proprietorship Dummies

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Schedule C Profit Or Loss For Form 1040

Schedule C Profit Or Loss For Form 1040

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

How And Where To File Taxes For Llc In 2021 Benzinga

How And Where To File Taxes For Llc In 2021 Benzinga

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

How To Deduct Stock Losses From Your Taxes Bankrate

How To Deduct Stock Losses From Your Taxes Bankrate

What Is Form 941 And How Do I File It Ask Gusto

What Is Form 941 And How Do I File It Ask Gusto

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Schedule C Ez Decoding A Complicated Tax Form Rethority Real Estate Guides News And More

Schedule C Ez Decoding A Complicated Tax Form Rethority Real Estate Guides News And More

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To File Income Tax Return Itr For Small Businessman Income Tax E Filing Itr 4 Live Demo Youtube

How To File Income Tax Return Itr For Small Businessman Income Tax E Filing Itr 4 Live Demo Youtube