Do You Get A 1099 R For A Rollover

Make sure you see the letter G on your 1099-R form in Box 7 which indicates that you did a rollover. Notice 2020-62 contains the two model notices that may be provided to recipients of eligible rollover distributions.

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

For the direct rollover explained later of funds that include DVECs a separate Form 1099-R is not required to report the direct rollover of the DVECs.

Do you get a 1099 r for a rollover. All rollovers whether they are direct or indirect should show up on your 1099-R. Look for Form 1099-R in the mail from your plan administrator at the end of the year. Direct rollovers occur when the plan administrator of the retirement plan makes the payment or distribution directly on the taxpayers behalf to another IRA.

Ideally you will see the letter G in the box. How do plans and IRAs report coronavirus-related distributions. Certain retirement payments or distributions a taxpayer receives from a retirement plan or IRA can be rolled over by depositing the payment into another retirement plan or IRA within 60 days of the date of distribution.

Direct rollovers are identified on Form 1099-R by using either the G or H distribution codes in box 7. If so they have correctly reported the transaction as a rollover. Rollovers between the same type of IRAs are tax-free but rollovers between traditional IRAs to Roth IRAs are taxable.

The tool is designed for taxpayers who were US. No taxes withheld from direct rollovers. I recently did the same thing with a client.

If you are unsure of the liquidation or withdrawal status of your contract for the prior taxable year. Rollover With the Same Trustee If you are rolling over an IRA to a different account with the same trustee the distribution should be reported correctly on the Form 1099-R. What Should I Expect to See on the Form.

Citizens or resident aliens for the entire tax year for which theyre inquiring. If you did a rollover look in box number seven of your 1099-R. Whats New Form 1099-R Safe harbor explanations for eligible rollover distribu-tions.

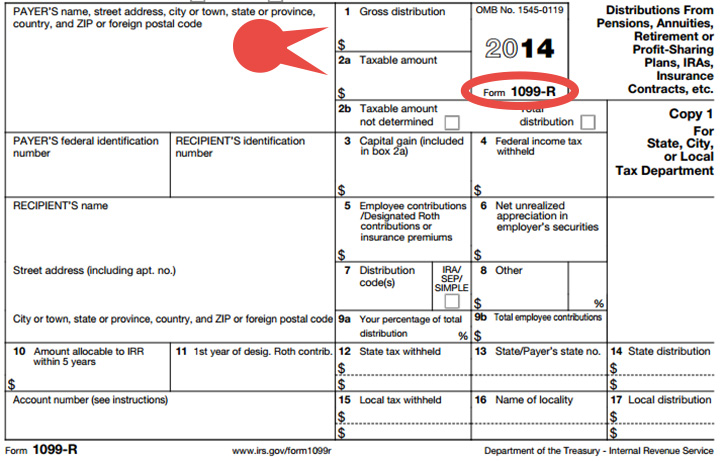

Direct Rollovers You must report a direct rollover of an eligible rollover distribution. Youll get a 1099-R for any IRA rollovers such as from a simplified employee pension or SEP-IRA unless they are trustee-to-trustee transfers. Therefore if your contract did not have a reportable event in the prior taxable year you would not receive a Form 1099-R.

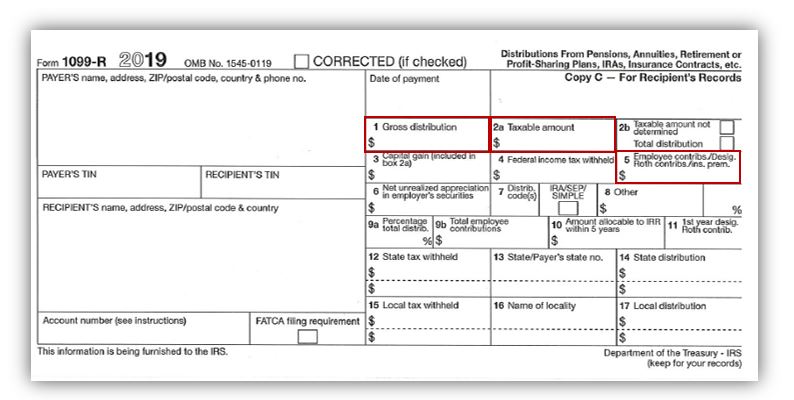

Federal 1099 R Form direct rollover. The taxable amount reported on Form 1099 R box 2a should be zero. Ive done this 50 times with clients and the original IRA institution always sends a 1099-r for the transfer.

You do not need to submit a separate filing to pay taxes on distributions. Whether a previous tax-free rollover occurred with 12 months of the distribution. Form 1099-R - Rollovers of Retirement Plans and IRA Distributions.

Whether federal income tax was withheld from the distribution Form 1099-R. Those shifts do not require a 1099-R if they involve. A Form 1099-R reports distributions and other taxable events.

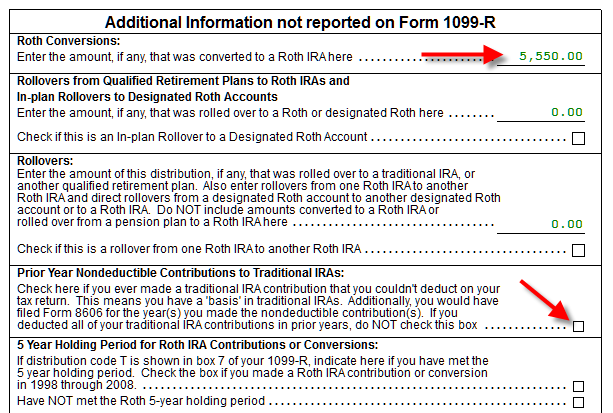

You must pay taxes on a conversion to a Roth retirement plan if the funds you converted were originally set in a pre-tax retirement plan and you must report the conversion on your tax return. Forms 1099-R and 5498 and their instructions such as legislation enacted after they were published go to IRSgov Form1099R or IRSgovForm5498. Yes you do need to report the form 1099-R with the rollover.

This 1099 will come from. If you rolled funds from an employer plan into a self-directed IRA with NDTCO you will receive a Form 1099-R for the rollover distribution. If your form has code G in box 7 the rollover is automatically applied.

Reporting your rollover is relatively quick and easy all you need is your 1099-R and 1040 forms. The payment of a coronavirus-related distribution to a qualified individual must be reported by the eligible retirement plan on Form 1099-R Distributions from Pensions Annuities Retirement or. Fill out Form 1040 or 1040A for your income tax return not form 1040EZ.

This is true even though you didnt retain the funds outside of a qualified plan. In an indirect rollover a retiree or investor withdraws money from an IRA transfers it to another retirement account and gets a 20 federal income tax withholding. Box 1 will show the.

When you complete a rollover you will receive Form 1099-R that shows the taxable portion as well as the amount withheld. Even though the rollover is not taxable it should be reported as such on your income tax return. It can be unnerving for a taxpayer who timely rolled over his or her 2020 RMD to receive Form 1099-R reporting a taxable distribution after doing a.

Indirect rollovers occur when the owner of the account takes possession of the retirement funds and re-deposits them into another qualified retirement account. However if there is any other code you must show the rollover by answering some of the TurboTax follow up questions. By rolling over the retirement plan distribution the taxpayer generally does not pay tax on any portion of the rollover.

Reporting A Retirement Rollover Phoenician Financial Planning Llc

Reporting A Retirement Rollover Phoenician Financial Planning Llc

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

1099 R Says You Owe Tax What Happened To Your 2020 Ira Rmd Rollover

1099 R Says You Owe Tax What Happened To Your 2020 Ira Rmd Rollover

How To Report Your 2020 Rmd Rollover On Your Tax Return Merriman

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Https Apps Irs Gov App Vita Content Globalmedia Teacher 1099r Exclusion Worksheet 4012 Pdf

How To Report Backdoor Roth In Taxact

How To Report Backdoor Roth In Taxact

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

How To Report A 1099 R Rollover To Your Self Directed 401k Youtube

How To Report A 1099 R Rollover To Your Self Directed 401k Youtube

Irs Form 1099 R Box 7 Distribution Codes Ascensus

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape

What S The Difference Between A Transfer And A Rollover Solo 401k

What S The Difference Between A Transfer And A Rollover Solo 401k

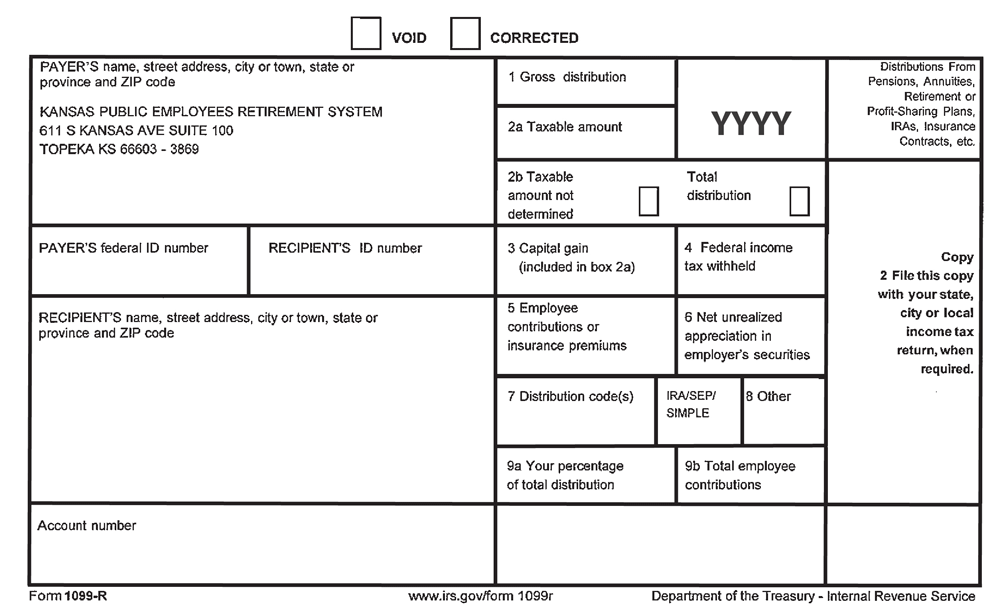

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

How To Report Backdoor Roth In Taxact

How To Report Backdoor Roth In Taxact

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape