Do Food Vendors Get A 1099

Businesses file a 1099-MISC when purchasing services not. Beginning with tax year 2011 the IRS requires you to exclude certain payment types you made to a 1099 vendor on Form 1099-MISC that will be included on third party payment processors such as credit card companies PayPal etc.

The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600.

Do food vendors get a 1099. The 2017 1099-MISC threshold is 600 per year with the exception of payments for royalties. If you buy copy paper Xerox supplies paper cups mailing lists etc you will need to send 1099s to all vendors such as Wal-Mart Office Max Home Depot etc - pending future. Form 1099-MISC if they make payments aggregating 600 or more to any one payee for property.

Whether you send the restaurant a 1099-MISC depends on the business structure. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. I would say yes you do need to 1099 since they prepared the food it is considered a service and a product.

5 Form W-9 If Vendor Info is. However if the restaurant is a corporation then you are not required to. An invoice is an electronic or paper request for payment.

Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. Vendors Backup Withhold from Vendor Payments if Necessary Issue Forms 1099 File 945 if Backup Withholding was Required. Similar to how you dont pay sales tax on food from a supermarket because it is not a service but do pay sales tax when buying from a restaurantfood truck since it is prepareda service.

1099 Rules Regulations Who must file. Vendors who operate as C- or S-Corporations do not require a 1099. Do not report the check data if any of the below apply.

Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor. If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll. They are not an employee so they do not receive hourly or salary wages for each payroll period.

You can get official forms at IRS offices or by calling 1-800-TAX FORM How about substitute Forms 1099. A restaurant would be considered a service provider under the IRS rules regarding filing a 1099-MISC. For a consignment craft store do I 1099 vendors with over 600 in sales or over 5000 in sales as discussed as direct sales in instructions on 1099 forms.

Corporations except law firms dont get 1099s so if the restaurant is a corporation you dont send one. Reimbursements to federal or military employees such. A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package.

They must then also send copies of this form to their contractors subcontractors vendors and service suppliers. Small businesses must report purchases of services from unincorporated vendors. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year.

Any business owner company or employer who secures outside services from a vendor contractor or subcontractor is required to file a 1099-MISC form with the IRS. Taxpayer identification number TIN of the vendor - which would be a social security number SSN for individuals and sole-proprietors and an. What is a 1099 Vendor.

The company then sends the resulting 1099 form to the supplier. Instead a 1099 vendor will send you a 1099 invoice after performing work for your business. Merchandise products or goods.

New Member June 4 2019 909 PM. Credit or travel card payments. Effective tax year 2011 - local banks issue IRS forms 1099-K for credit card and travel card payments.

Mark as New. A large proportion of small businesses use the services of unincorporated businesses or are themselves unincorporated. Thus personal payments arent reportable.

If you have paid them 600 or. So over 600 paid to vendors on a 1099 and this would be entered in Box 11 as NEC is this correct. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

Under current law it is the payment for services that triggers the Form. If You Pay A Vendor More Than 600 Or 10 In Royalties A 1099-MISC is the form any business sends anyone they pay to do a service who isnt an employee such as those loyal workers who signed a W-2 at the start of their contract and already get their taxes removed from their paychecks. This means that if any of your vendors fall into the categories above you dont need to issue them a 1099 if you havent paid them 600 or more.

A person is engaged in business if he or she operates for profit. Type of business entity which is used to determine whether or not payments to the vendor could be reportable on a 1099-MISC.

Amazon Com 1099 Div Income Tax Forms 2020 Set And 1096 Kit For 10 Vendors 4 Part Complete Laser Forms With Self Seal Envelopes In Value Pack 1099 Div Income 2020 Office Products

Amazon Com 1099 Div Income Tax Forms 2020 Set And 1096 Kit For 10 Vendors 4 Part Complete Laser Forms With Self Seal Envelopes In Value Pack 1099 Div Income 2020 Office Products

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 2020 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 2020 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

How To Add The New 1099 Nec Tax Form To Sage 100 Kissinger Associates

How To Add The New 1099 Nec Tax Form To Sage 100 Kissinger Associates

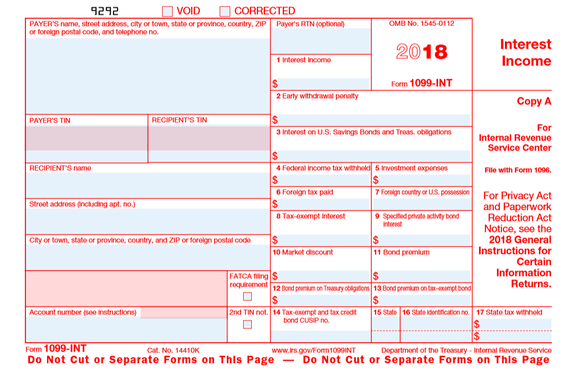

1099 Int A Quick Guide To This Key Tax Form Business Markets And Stocks News Madison Com

1099 Int A Quick Guide To This Key Tax Form Business Markets And Stocks News Madison Com

1099 Misc 5 Part 2020 Tax Forms Kit 100 Count Tax Forms Security Envelopes Small Business Accounting Software

1099 Misc 5 Part 2020 Tax Forms Kit 100 Count Tax Forms Security Envelopes Small Business Accounting Software

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

Amazon Com 1099 Misc Forms 2020 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc 2020 Office Products

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

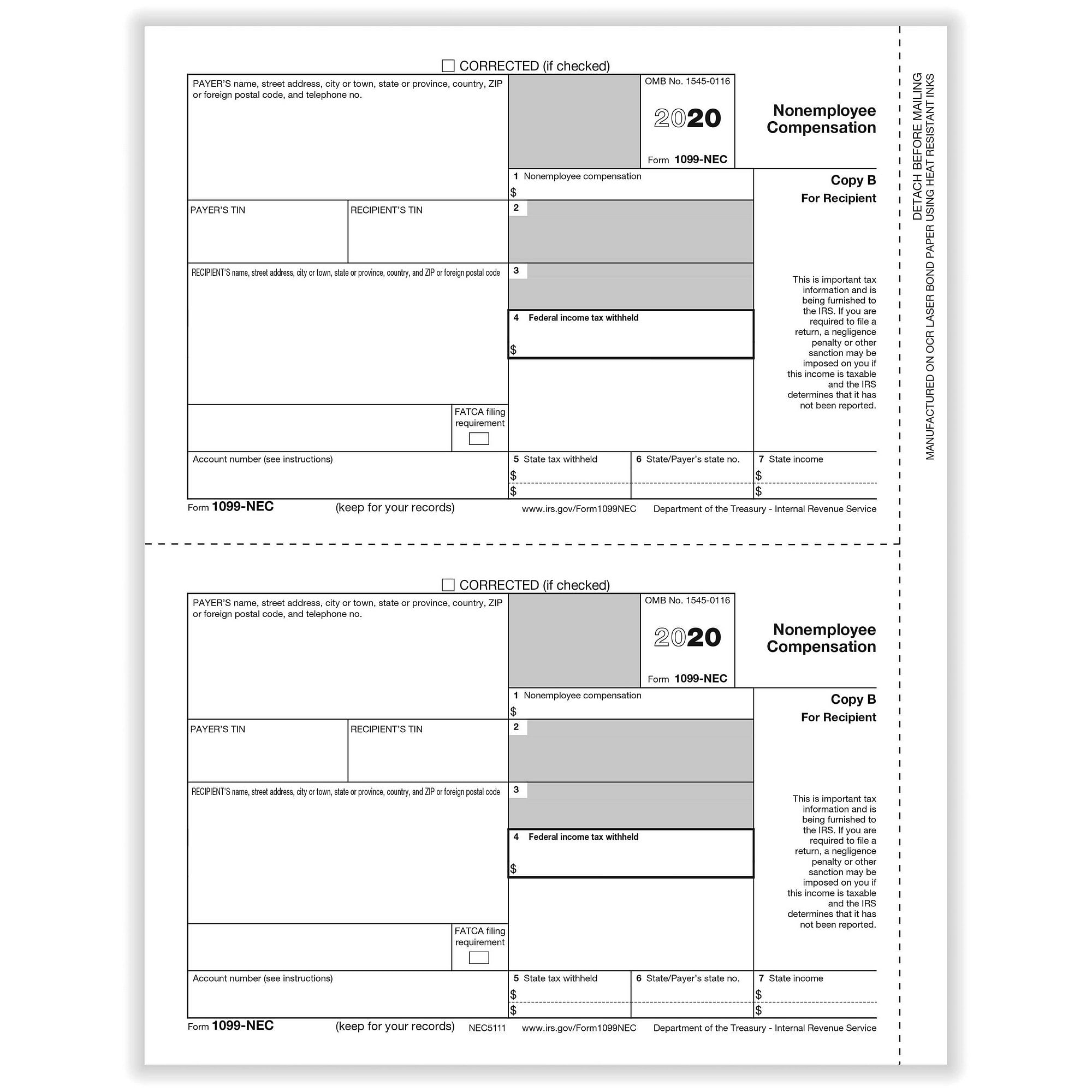

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Amazon Com Adams 1099 Misc Continuous Forms For 2019 20 Carbonless 4 Part Forms Dot Matrix Compatible 3 1096 Summary Transmittals Txa2299 White Office Products

Amazon Com Adams 1099 Misc Continuous Forms For 2019 20 Carbonless 4 Part Forms Dot Matrix Compatible 3 1096 Summary Transmittals Txa2299 White Office Products

Amazon Com 1099 Misc Forms 2020 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc 2020 Office Products

Amazon Com 1099 Misc Forms 2020 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc 2020 Office Products

1099 Nec Non Employee Compensation Rec Copy B Cut Sheet 1 000 Forms Ctn

1099 Nec Non Employee Compensation Rec Copy B Cut Sheet 1 000 Forms Ctn

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose