Can I Claim Medical Expenses Without Receipts

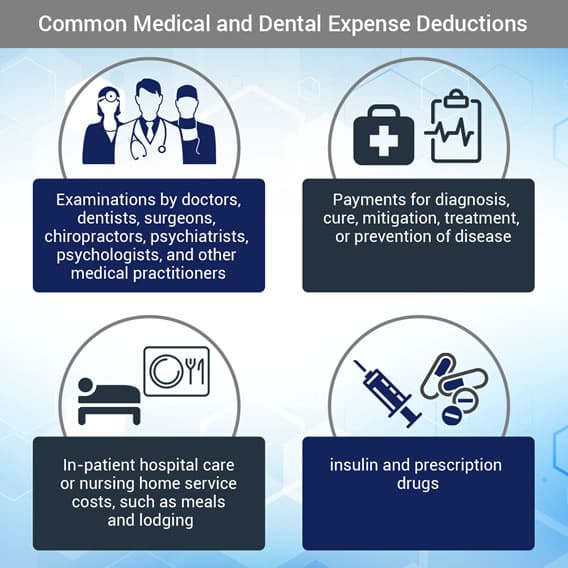

The Internal Revenue Service does allow taxpayers to deduct some expenses without keeping receipts and the agency allows credit card records and paid bills to serve as proof of expenses. Apr 04 2017 An important detail to understand is that when it comes to deducting medical expenses you can only deduct the portion of qualifying expenses that exceed 10 percent of your adjusted gross income.

Free 11 Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

You do not send these records with your return but you should keep them with your tax records.

Can i claim medical expenses without receipts. Sep 17 2020 a claim for health expenses. If youre receiving a settlement as well as reimbursements the settlement can be taxed but the reimbursements cant. However we may request to view them if your claim is selected for checking.

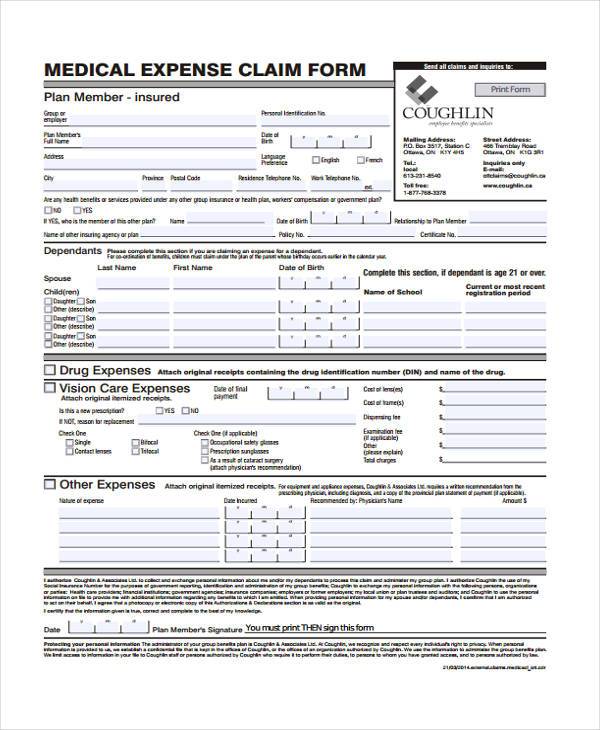

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. Jun 14 2017 The nature and purpose of any medical expenses. Mar 30 2020 You can only claim for medical expenses if you have receipts to prove your claim.

Mar 05 2010 Step 1. If youre getting a reimbursement for physical injury and expenses from a legal action you can deduct that amount from your taxes. Note that you have to have actual receipts for.

See Deducting Medical Expenses. You should always save your receipts when you claim a deduction whether its for business charity medical expenses or otherwise. To deduct your medical expenses youll have to itemize your deductions.

If you choose this option the. All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. Premiums for medical dental long-term care vision Medicare Part B and Medicare Part D.

Firstly the expense must be allowable. The amount of the other medical expenses. May 16 2018 In fact you can claim up to 300 for these expenses.

Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted. Revenues myAccount service includes a receipts tracker service which allows you to store your receipt details online. There are cases where you can claim a tax deduction without a receipt but there are serious restrictions.

This means you should be able to answer yes to these questions. Oct 01 2020 Medical aids including wheelchairs hearing aids and batteries eyeglasses contact lenses crutches braces and guide dogs and their care Receipts are required to claim these costs and should be attached to your tax return if you file a paper copy by mail. Jan 03 2020 Generally you cant make tax claims without receipts.

You might still be able to claim those items even without a receipt. The Revenue Receipts Tracker app RRTA is the quickest and easiest option to save your receipt details or images or both to Revenue storage. You cant deduct medical costs covered by the reimbursement.

You cant make tax claims without receipts. For example if your business is claiming several business expenses and only 5 of them do not have receipts but detailed notes then this should be OK in the eyes of HMRC. If you dont use this service you must keep your medical receipts for six years because Revenue may investigate your claim.

If youre self-employed and use your private vehicle for work-related activities such as traveling between job sites or offices dont worry you wont need to hoard all your fuel receipts. Its directly related to and needed for your occupation. However it should be reasonable to be accepted by a tax inspector.

Find more information about medical expense deductions. You will need to keep the above documents for each medical expense you incur. Apr 06 2011 The IRS never asks for receipts anyway right.

You do not need to submit these receipts this includes Med 2 forms when you make a claim. Qualified deductions include any of the following expenses paid for yourself your spouse your dependents and any children that you could have claimed but didnt because of a divorce or separation agreement. On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or.

In the UK there is no rule on the amount that you can claim without receipts.

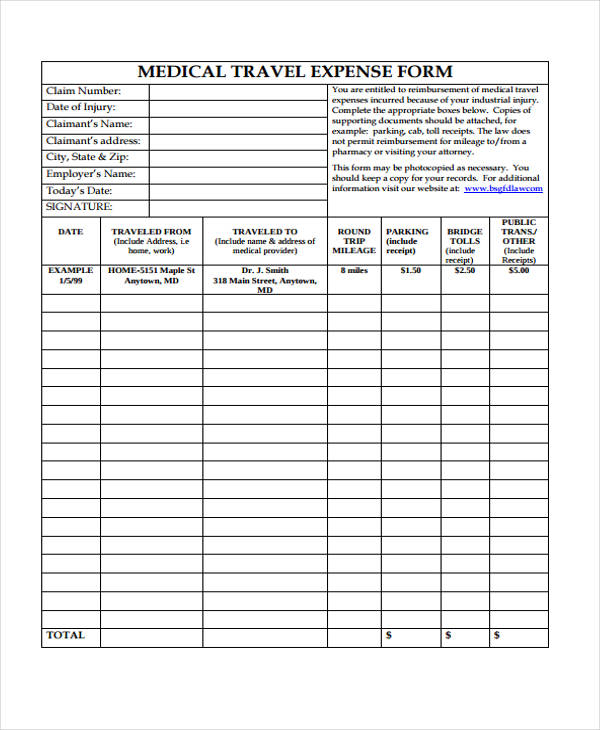

Free 11 Medical Expense Forms In Pdf Ms Word

Free 11 Medical Expense Forms In Pdf Ms Word

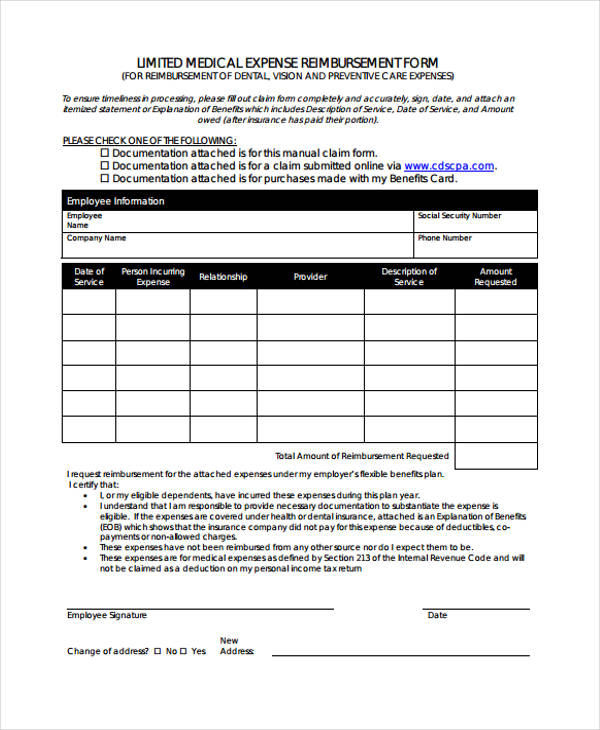

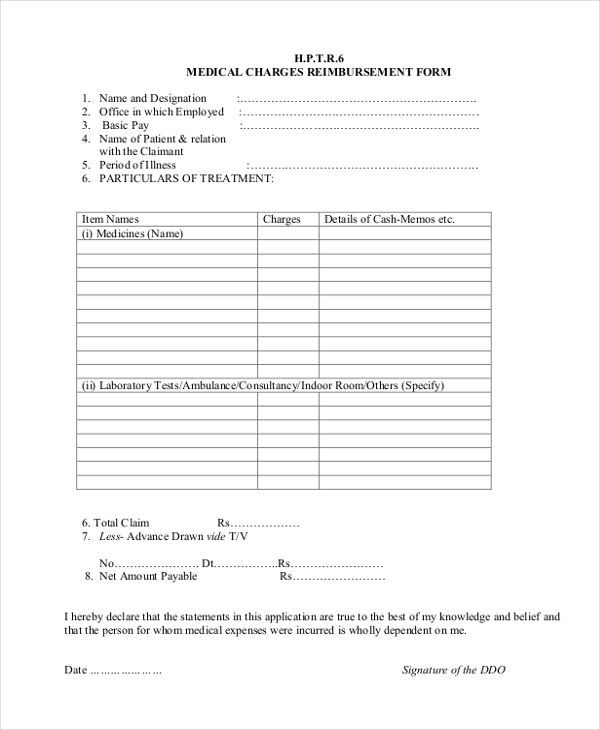

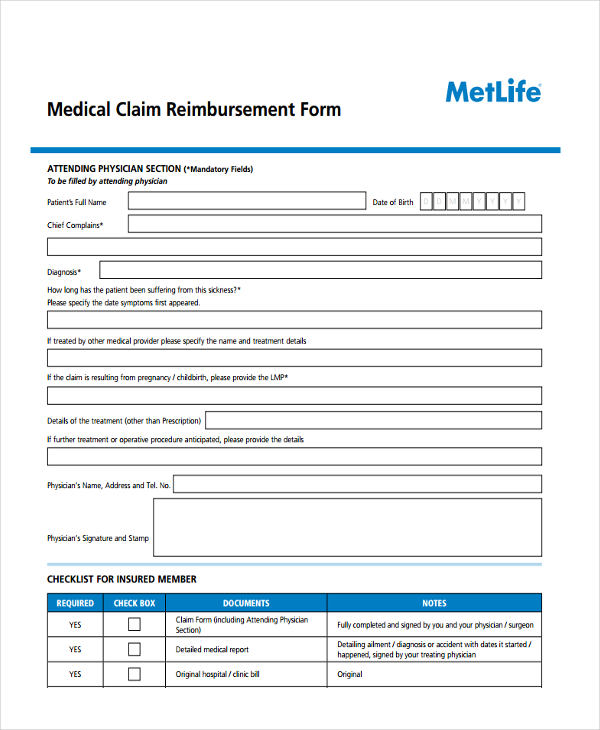

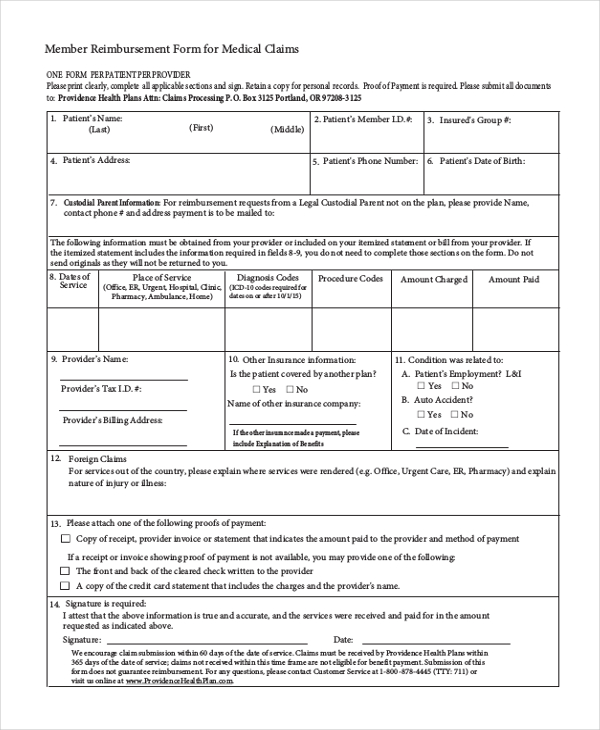

Free 8 Medical Reimbursement Forms In Pdf

Free 8 Medical Reimbursement Forms In Pdf

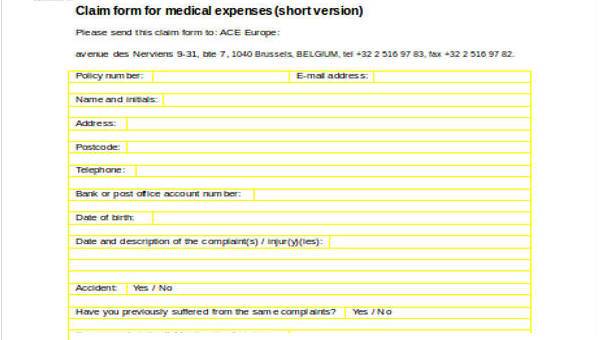

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

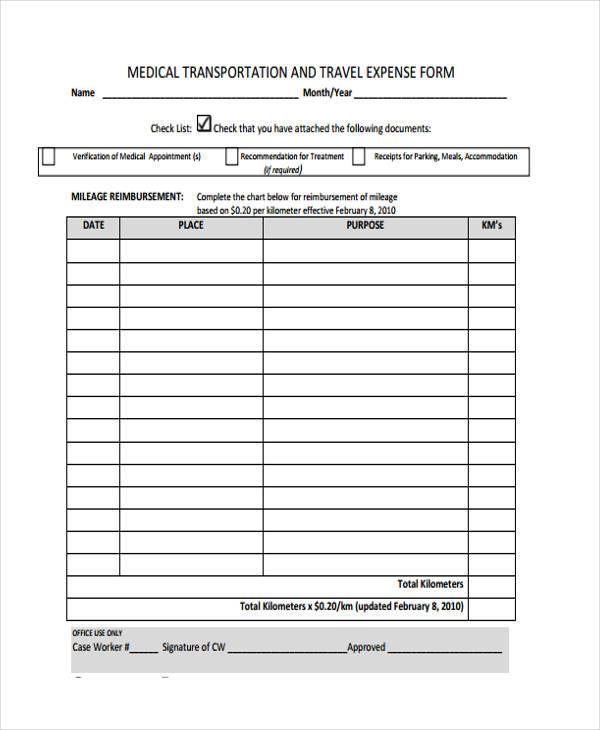

Free 9 Sample Reimbursement Forms In Pdf Ms Word Excel

Free 9 Sample Reimbursement Forms In Pdf Ms Word Excel

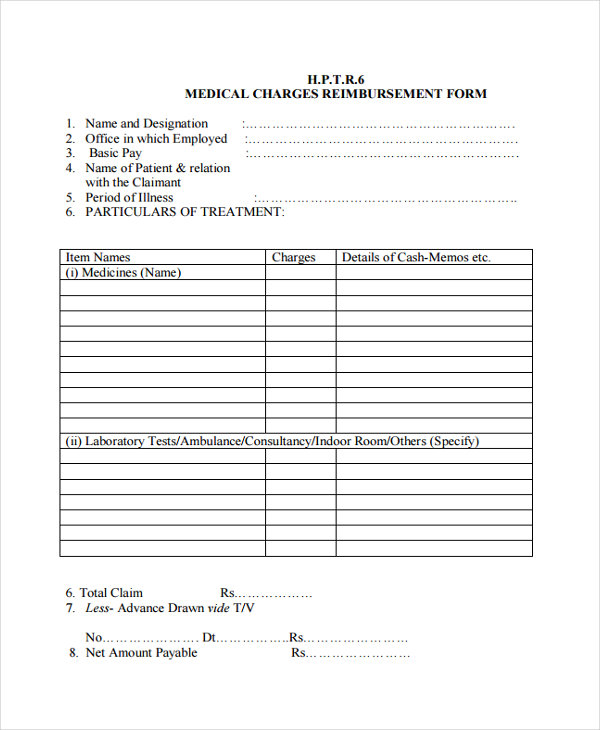

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 8 Medical Reimbursement Forms In Pdf

Free 8 Medical Reimbursement Forms In Pdf

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Track Medical Bills With The Medical Expenses Spreadsheet Squawkfox Medical Expense Tracker Medical Billing Medical

Medical Mileage Expense Form Mileage Expensive Medical

Medical Mileage Expense Form Mileage Expensive Medical

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Are Health Insurance Premiums Tax Deductible

Are Health Insurance Premiums Tax Deductible

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

14 Medical Reimbursement Form Templates In Pdf Doc Free Premium Templates

14 Medical Reimbursement Form Templates In Pdf Doc Free Premium Templates

Simple Expense Report Template New Medical Expenses Claim Form Sample Forms Expense Template In 2021 Business Card Template Word Report Template Templates

Simple Expense Report Template New Medical Expenses Claim Form Sample Forms Expense Template In 2021 Business Card Template Word Report Template Templates

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

What To Know About Deductible Medical Expenses E File Com

What Medical Expenses Are Tax Deductible The Turbotax Blog

What Medical Expenses Are Tax Deductible The Turbotax Blog

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 8 Sample Medical Expense Forms In Pdf Ms Word

Free 9 Medical Receipt Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf Psd Indesign Ai Publisher

Free 9 Medical Receipt Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf Psd Indesign Ai Publisher