New York Business Tax Registration

Assumed name filings are filed and maintained by the Division of Corporations for corporations limited liability companies and limited partnerships. If you need an FEIN you can download an application Form SS4 or apply online at the IRS web site.

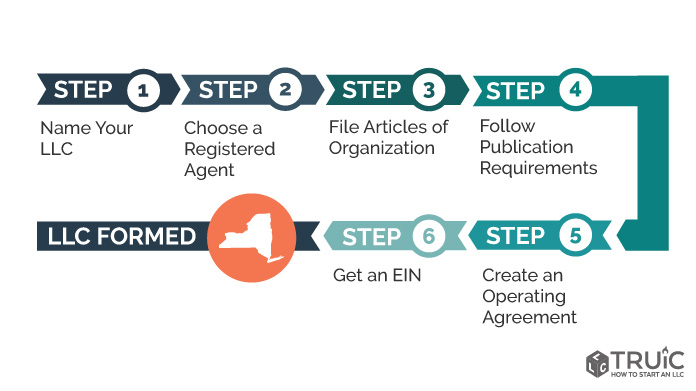

![]() Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

How to Register for New York State Sales Tax.

New york business tax registration. MassTaxConnect is the Department of Revenues web-based application for filing and paying taxes. Your Social Security number if registering as a sole proprietor with no employees - Sole proprietors have the option to register with either their Social Security Number or an Employer. Fillable Foreign Professional Service Application for Authority Form.

To request consent call the New York State Tax Commission at 518 485-2639. This presence can include headquarters a shop or an office. The certificate comes from the New York State Department of Taxation and Finance DTF.

Please enable JavaScript to view the page content. Most of these rules apply to businesses with a physical presence in New York State. You must register or renew your registration with the New York State Tax Department for every calendar year in which you.

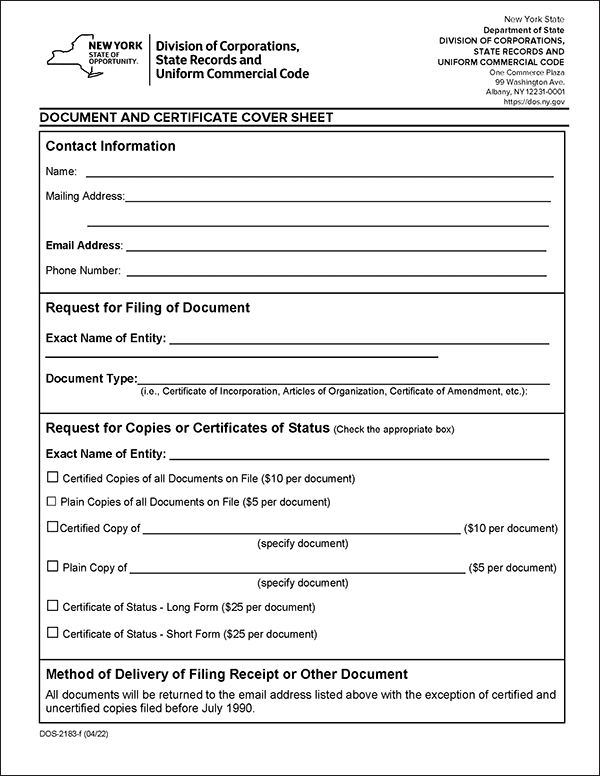

Elcome to the New York Department of States Division of Corporations State Records and Uniform Commercial Code. In most cases if you dont live in New York City you arent required to pay New York City personal income tax. Business Tax Filing Information and the COVID-19 Outbreak Effect of IRS Deadline Extension for 2020 NYC Individual UBT Filers.

FY 2021 State of the State FY 2021-22 New York State Budget 2021 Legislative Advocacy Agenda Legislative Session Calendar Legislative Memos. If you have a 7-digit number enter the number using a dash. Will be paid to prepare one or more New York State tax returns or reports.

Tax Bulletin ST-360 TB-ST-360 Printer-Friendly Version PDF Issue Date. Please enable JavaScript to view the page content. NYC is a trademark and service mark of the City of New York.

Sales Tax Web File. Every person who sells taxable tangible personal property or taxable services even if you make sales from your home are a temporary vendor or only sell once a year must register with the Tax Department through New York Business Express before beginning business. The certificate allows a business to collect sales tax on taxable sales.

Heres a quick list. New York State tax law offers a full exemption from New York State sales and use tax on a motor vehicle purchased in another state by a person in the military service of the United States so long as that other states sales use excise usage or highway use tax. If you were not a resident of New York when you purchased the vehicle use Claim for Sales and Use Tax Exemption TitleRegistration Motor Vehicle Trailer All-Terrain Vehicle ATV Vessel Boat or Snowmobile Sales Tax Form PDF at NY State Department of Tax Finance DTF-803 to receive a non-resident exemption from NY State sales.

Your support ID is. The completed Application for Authority together with the required consent attached and the filing fee of 200 should be forwarded to the New York Department of State at the address indicated above. Beverage container deposit initiator.

Register as a sales tax vendor. Types of Certificates of Authority. Before you register you must obtain a Federal Employer Identification Number FEIN from the Internal Revenue Service IRS.

Or will facilitate a refund anticipation loan RAL or refund anticipation check RAC. You can also obtain an application by calling the IRS at 800 829-3676. News Releases Business Council in the News Member Spotlight The Presidents Report Coolest Thing in New York State CONNECT Podcast Black History Month Womens History Month.

Business Income and Excise Taxes 2019 Business Tax Return Filing Information and the COVID-19 Outbreak. For more information on how to determine if youre a New York City resident see Form IT-21041 New York State City of New York and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. You must register with the Tax Department before carrying on certain activities in New York State.

Applying for a Certificate of Authority. Your support ID is. New York Business Express.

However if youre an employee of New York City you may be. Report tax evasion and fraud. Please note that the database does not include corporate or other business entity assumed names filed pursuant to General Business Law 130.

Your New York State Identification Number used for state income tax withholding will be your Federal Employer Identification Number EIN followed by a location code if applicable to your business. Use Sales Tax Web File to schedule payments in advance save your bank account information for future payments and receive instant confirmation when we receive your return. The Division examines files and maintains numerous documents vital to business and state government including state and local laws oaths of office trademarks certificates of incorporation and Uniform Commercial Code Article 9 financing statements.

Your UI Employer Registration Number will be a 7 or 8-digit account number. To register a business with MassTaxConnect you will need the following documents and information. Doing business with us.

Business tax e-file mandates for partnership sales and corporation tax filers.

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

How To Get A Resale Certificate In New York Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

Apply For Your License Insurance Individual Original Tba License Application Department Of Financial Services

Apply For Your License Insurance Individual Original Tba License Application Department Of Financial Services

Nys Division Of Corporations State Records And Ucc

How To Register For A Sales Tax Permit In New Jerseytaxjar Blog

How To Register For A Sales Tax Permit In New Jerseytaxjar Blog

Llc In Georgia How To Start An Llc In Georgia Nolo

Llc In Georgia How To Start An Llc In Georgia Nolo

Start Your Own Professional Tax Practice Intuit Proconnect

Start Your Own Professional Tax Practice Intuit Proconnect

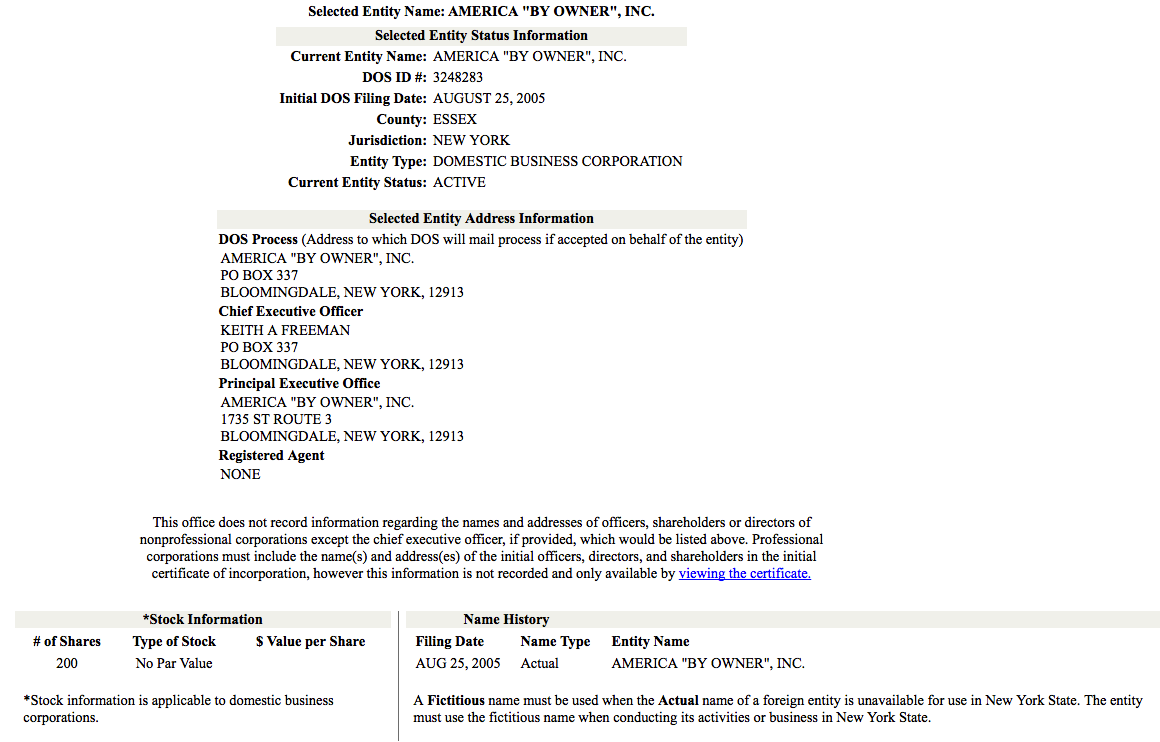

New York Business Entity Search Corporation Llc

New York Business Entity Search Corporation Llc

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

How To Form A Corporation In New York Nolo

How To Form A Corporation In New York Nolo

Sales Tax Guide For Shopify Sellers

Sales Tax Guide For Shopify Sellers

Sales Tax Guide For Shopify Sellers

Sales Tax Guide For Shopify Sellers

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

New York Sales Use Tax Guide Avalara

New York Sales Use Tax Guide Avalara

New York State Tax Information Support

New York State Tax Information Support

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Https Dmv Ny Gov Forms Mv821 Pdf

How To Form A Corporation In New York Nolo

How To Form A Corporation In New York Nolo

New York Department Of State Business Entity Search Corporation Llc Partnerships Start Your Small Business Today

New York Department Of State Business Entity Search Corporation Llc Partnerships Start Your Small Business Today