How To File Form 1099-nec On Turbotax

Use Form 1099-NEC to report nonemployee compensation. Additionally theres no automatic 30-day extension to file Form 1099-NEC and the IRS wont automatically be sharing the information with states.

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

How to file form 1099-nec on turbotax. I hit continue and it takes me to a Rate Turbotax page. Enter all the information exactly as it appeared on the original incorrect form but enter 0 zero for all money amounts. Running a bit behind on taxes this year.

Generally payers must file Form 1099-NEC by January 31. The 1099-NEC only needs to be filed if the business has paid you 600 or more for the year. These are due tomorrow.

Where is the file button. When you finish the 1099s and hit continue you get the print and save options hit contnue adn then you get asked if you want to purchase Turbotax Advantage. If you made less than 600 youll still need to report your income on your taxes unless you made under the minimum income to file taxes.

Starting in tax year 2020 payers must complete this form to report any payment of 600 or more to a payee. Canceled debts reportable under section 6050P must be reported on Form 1099-C. Current Revision Form 1099-NEC PDF Information about Form 1099-NEC Nonemployee Compensation including recent updates related forms and instructions on how to file.

This is the first year I have had to file with a 1099-NEC. Print and file copy A downloaded from this website. Why is there no way to file a 1099 NEC from TurboTax.

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Extension for Sending 1099-Misc Forms to Recipients. To do this fill out a new Form 1099-MISC and enter an X in the CORRECTED box at the top of the form.

A penalty may be imposed for filing with the IRS. It gives me the option of XX. Now the IRS provides a separate 1099-NEC Form for reporting non-employee payments.

Once done mail the form to the IRS. Beginning with tax year 2020 the IRS will require your self-employment income of 600 or more to be reported on Form 1099-NEC non-employee compensation instead of Form 1099-MISC so look out for that form in the mail beginning January 31. Heres how to file the amended form.

IRS Tax Tip 2020-80 July 6 2020. After asking who paid me it asks how the payers federal ID number formatted. Section 6071 requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

On TurboTax I found the section to input a 1099-NEC. Or Have a Question. 1099 NEC Form Filing Available Now.

When you get your Forms 1099-NEC for your nonemployee compensation youll see that youve received Copy B. Similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not.

There is a new Form 1099-NEC Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation. See the Instructions for Forms 1099-A and 1099-C. Fill out the 1099-NEC form and be sure to select the Corrected checkbox.

Next prepare a new 1099-NEC and enter all the necessary information. Online in a PDF format available at IRSgovForm1099MISC and IRSgovForm1099NEC. First void the original Form 1099-MISC.

This means the business owner must send all copies of Form-NEC Copy A to the IRS by that date and send Copy B and Copy 2 to any nonemployees for whom a form was completed. Order 1099-NEC IRS forms online at IRS Online Ordering for Information Returns and Employer Returns or over the phone at 800-829-3676. Also the IRS provides only 30 days extension for filing 1099-NEC for certain reasons.

The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. For reporting non-employee payments theres no automatic 30-day extension to file the Form. No Thanks I dont need anything.

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. Easily Correct Mistakes on your efile 1099 Tax Form e-File 1099 NEC Forms online in Minutes. Business travel allowances paid to employees may be reportable on Form W-2.

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

E File Form 1099 Nec Online How To File 1099 Nec For 2020

E File Form 1099 Nec Online How To File 1099 Nec For 2020

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File Form 1099 Nec With Taxbandits Youtube

How To File Form 1099 Nec With Taxbandits Youtube

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

How To File Form 1099 Nec For Contractors You Employ Vacationlord

How To File Form 1099 Nec For Contractors You Employ Vacationlord

How To Offer Proactive Real Time Solutions For Your Customers Customerservice Customersolutions Business Solutions Solutions What Is A Goal

How To Offer Proactive Real Time Solutions For Your Customers Customerservice Customersolutions Business Solutions Solutions What Is A Goal

What Is Form 1099 Nec Turbotax Tax Tips Videos

What Is Form 1099 Nec Turbotax Tax Tips Videos

How To File Taxes With Irs Form 1099 Nec Turbotax In 2021 Filing Taxes Irs Forms Irs Taxes

How To File Taxes With Irs Form 1099 Nec Turbotax In 2021 Filing Taxes Irs Forms Irs Taxes

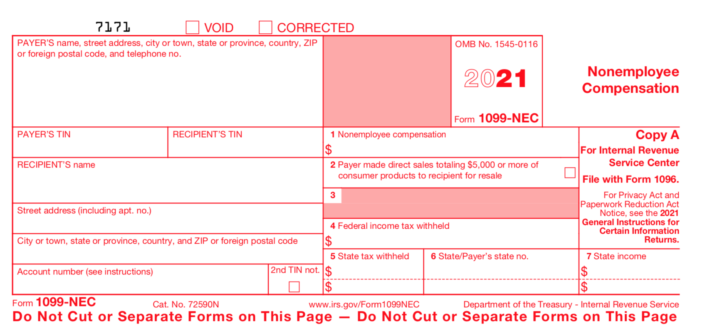

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form