Barclays Business Bounce Back Loan Application Form

Be aware I have literally 1000s of articles to load about Barclays BBLs and from all other banks too. Bounce Back Loan Scheme BBLS Application Form Consultation Accountant in London.

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

Barclays are of course going to check whether the business entity you are applying for has already got a Bounce Back Loan and that is what they should be doing to negate the chances of fraud.

Barclays business bounce back loan application form. These questions are used to define whether the borrower is an Undertaking in Difficulty. Barclays 5th May 2020. Barclays said its first bounce back loans will be.

You must have a Barclays Business current account and have a mobile number to use this feature in the Barclays app. Information that is provided on a consolidated basis in this form needs to be calculated in accordance with Commission Recommendation 2003361EC. Barclays has come under pressure to fix its faulty bounce back loan scheme BBLS application process after customers said they had been left waiting nearly a week to receive cash they had been.

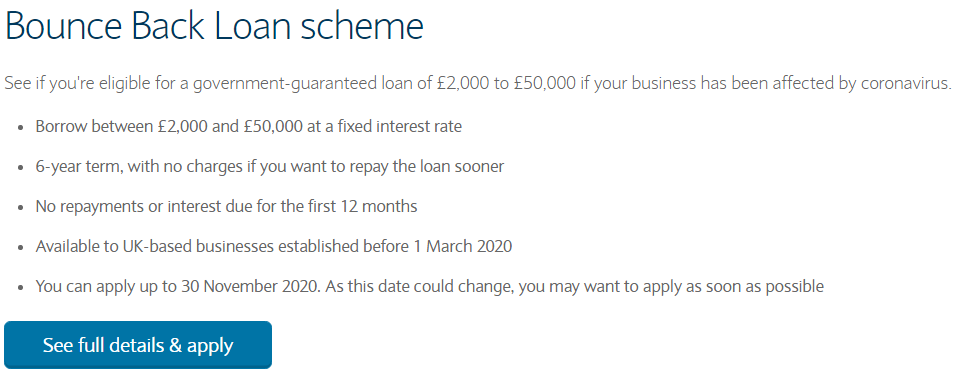

It offers loans up to 50000 and is designed to be simpler and quicker than the existing Coronavirus Business Interruption Loan Scheme CBILS. If you are not already a customer but have a new customer appointment in the diary before the end of the scheme on 31 March 2021 were able to offer a Bounce Back Loan if you meet the eligibility criteria. The UK Government has now responded with a staggeringly popular alternative the Bounce Back Loan Scheme BBL.

Bounce Back Loan scheme Bounce Back Loan scheme This is available to UK businesses that have been negatively affected by coronavirus. The Coronavirus Business Interruption Loan Scheme CBILS closed for new applications on 31 March 2021. Return to reference Terms and conditions apply.

Hannah Bernard Head of Barclays Business Banking said. High street banks are stifling start-up firms at birth by rejecting applications for business bank accounts because they are too busy processing Bounce Back loans for existing companies. GoRings Accountants can help you to fill your application and apply for Bounce Back Loans in UK with various Bounce Back Loan Lenders like Barclays Bank Halifax Bank Santander Bank.

If you already have a Bounce Back Loan with us the quickest way to apply for Pay as you Grow is in Online Banking or the Barclays. To apply for a Bounce Back Loan with us youll need to be a Barclays Business customer or have a personal current account with us that was opened on or before 1 March 2020. You must have a current account with us be aged 16 or over and have a mobile number to use the Barclays app.

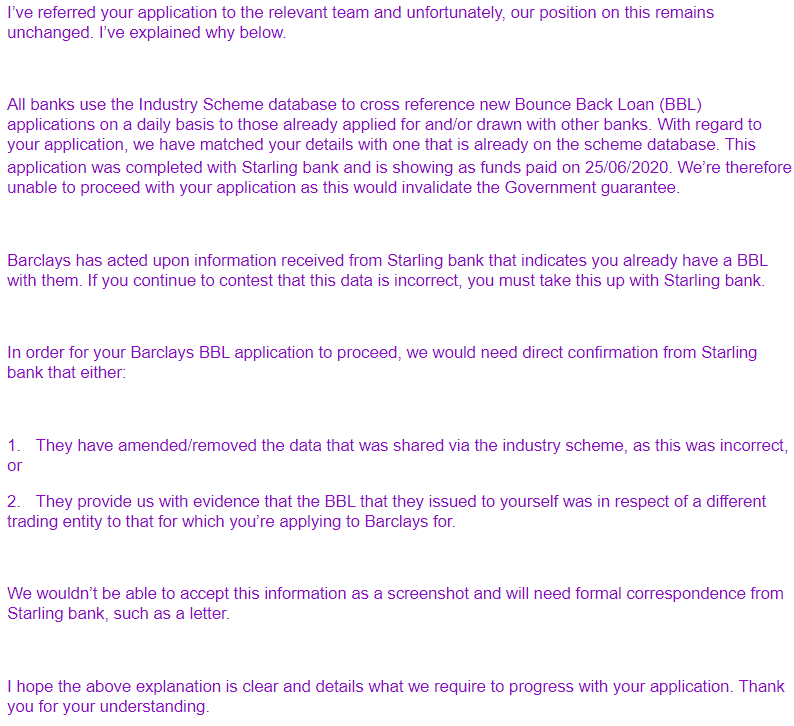

18 December 2020 Application deadline extended to 31 March 2021. Companies of any size can borrow. They do so by scanning the shared industry database and if your business entity is not listed upon it all will be well however that database is riddled with errors.

You can apply for a loan between 2000 and 50000 subject to the eligibility criteria. Winner of Best Use of Mobile at FStech 2019 and Best Mobile Banking. To apply for a Bounce Back Loan with us youll need to be a Barclays Business customer or have a personal current account with us that was opened on or before 1 March 2020.

The BBL scheme offers loans of between 2000 and 50000. The amount youve borrowed under a previous scheme may in certain circumstances limit the amount you may borrow under the Recovery Loan Scheme. Were no longer able to offer you a Bounce Back Loan if youre operating your business through accounts with other banks That sentence does say it all.

If you started your application before then well be in touch shortly theres no need to call us. Barclays Bounce Back Loan complaints along with success stories are listed below. They carry interest of just 25 per cent and applicants fill out only a short online application form.

The loan is supposed to be astoundingly easy to apply for utilising an online application form with only seven questions on it. You can still apply for the Recovery Loan Scheme if youve taken out a Bounce Back Loan or Coronavirus Business Interruption Loan providing you meet the eligibility criteria and lending assessments. Bounce Back Loan scheme closed for new applications and top-ups on 31 March 2021.

Barclays is open for business to accept applications for the Bounce Back Loan Scheme BBLS with 6000 loans at a value of 200m processed by 2pm on the first day. A repayment holiday of up to 6 months is now possible once at any point during the term of a Bounce Back Loan. Supporting guidance can be found here.

Apply for a government-backed loan over 50k if your business has been negatively affected by coronavirus COVID-19. If you started your application before then well be in touch shortly theres no need to call us.

Many Barclays Bank Customers Still Cannot Access Bbl Three Days Later London Business News Londonlovesbusiness Com

Many Barclays Bank Customers Still Cannot Access Bbl Three Days Later London Business News Londonlovesbusiness Com

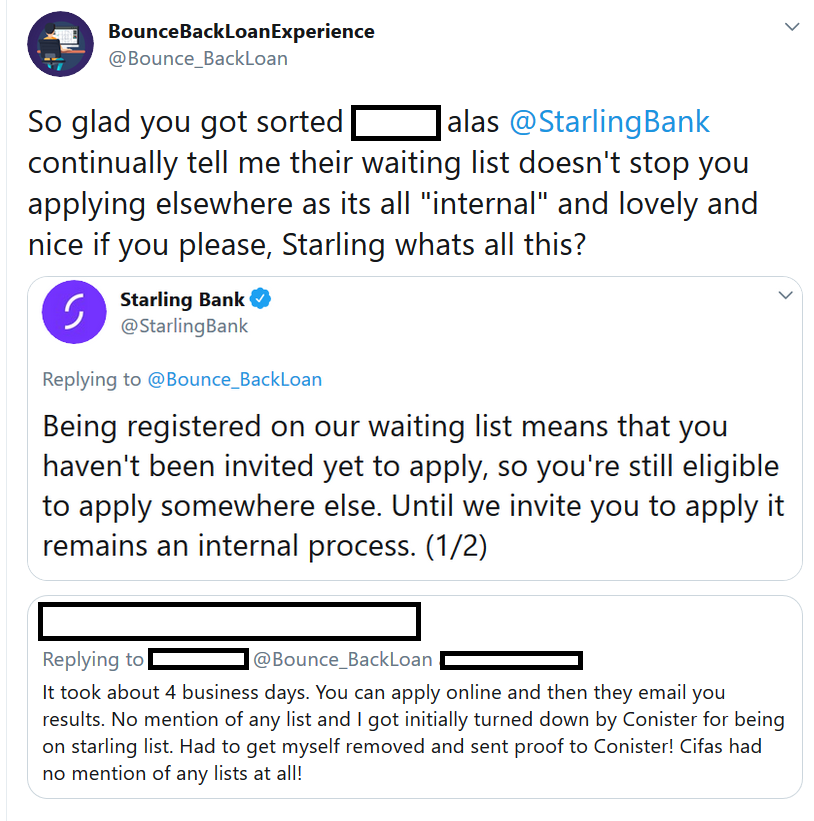

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

How To Apply For A Coronavirus Business Bounce Back Loan Scheme Loan Update Which Banks Process Youtube

How To Apply For A Coronavirus Business Bounce Back Loan Scheme Loan Update Which Banks Process Youtube

Barclays Uk Help On Twitter We Ve Launched The Business Bounce Back Loan Scheme Today We Ll Be Rolling Out To Hundreds Of Thousands More Of Our Customers During The Rest Of Today

Barclays Uk Help On Twitter We Ve Launched The Business Bounce Back Loan Scheme Today We Ll Be Rolling Out To Hundreds Of Thousands More Of Our Customers During The Rest Of Today

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

Many Barclays Bank Customers Still Cannot Access Bbl Three Days Later London Business News Londonlovesbusiness Com

Many Barclays Bank Customers Still Cannot Access Bbl Three Days Later London Business News Londonlovesbusiness Com

Barclays Uk Help On Twitter If You Re Thinking Of Applying For A Bounce Back Loan We Need Your Help Please Make Sure Your Account Information Is Up To Date Before You

Barclays Uk Help On Twitter If You Re Thinking Of Applying For A Bounce Back Loan We Need Your Help Please Make Sure Your Account Information Is Up To Date Before You

Barclays Bounce Back Loans Problems Errors And Update Mr Bounce Back Bounce Back Loan Complaints

Barclays Bounce Back Loans Problems Errors And Update Mr Bounce Back Bounce Back Loan Complaints

Barclays Support Smes With Bounce Back Loan Scheme

Barclays Support Smes With Bounce Back Loan Scheme

Apply For A Business Bounce Back Loan Bbbl Makesworth Accountants

Apply For A Business Bounce Back Loan Bbbl Makesworth Accountants

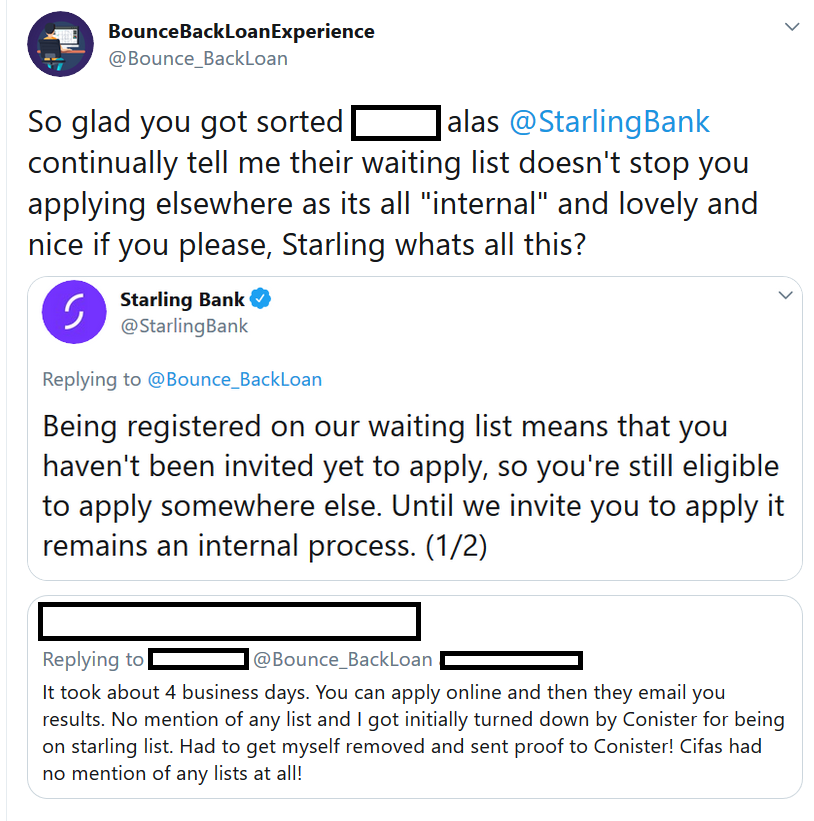

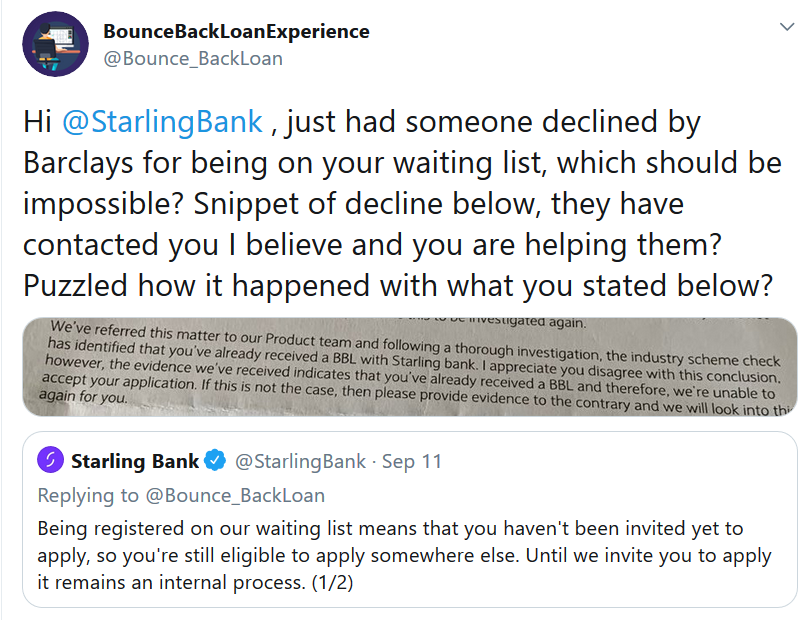

Barclays And Starling Do Battle In Imaginary Bounce Back Loan Row Mr Bounce Back Bounce Back Loan Complaints

Barclays And Starling Do Battle In Imaginary Bounce Back Loan Row Mr Bounce Back Bounce Back Loan Complaints

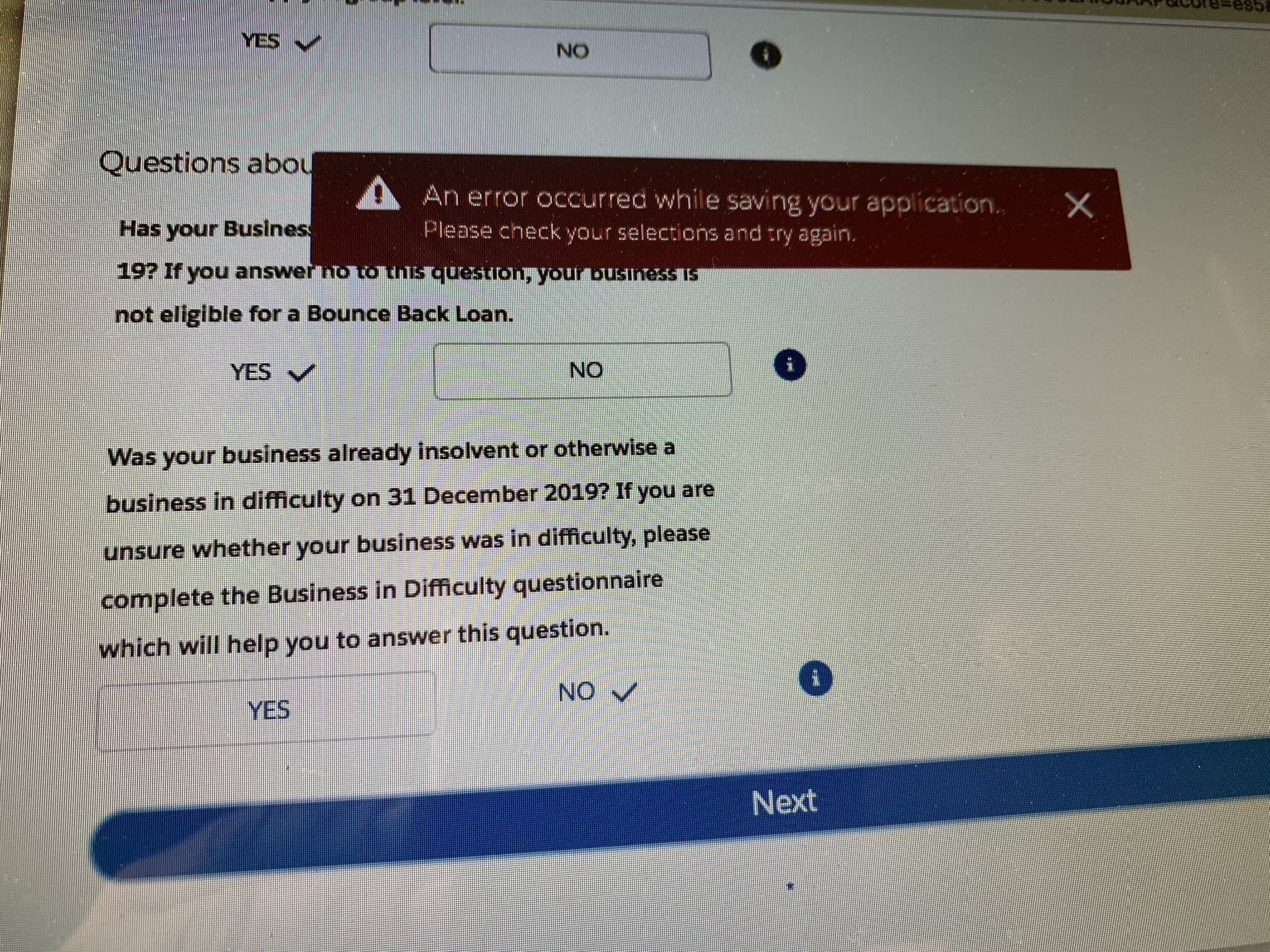

John Bean On Twitter Applying For The Bounce Back Loan From Barclays And Keep Getting This Message Has Anyone Else Got This It Won T Let Me Proceed And All Boxes Are Filled

John Bean On Twitter Applying For The Bounce Back Loan From Barclays And Keep Getting This Message Has Anyone Else Got This It Won T Let Me Proceed And All Boxes Are Filled

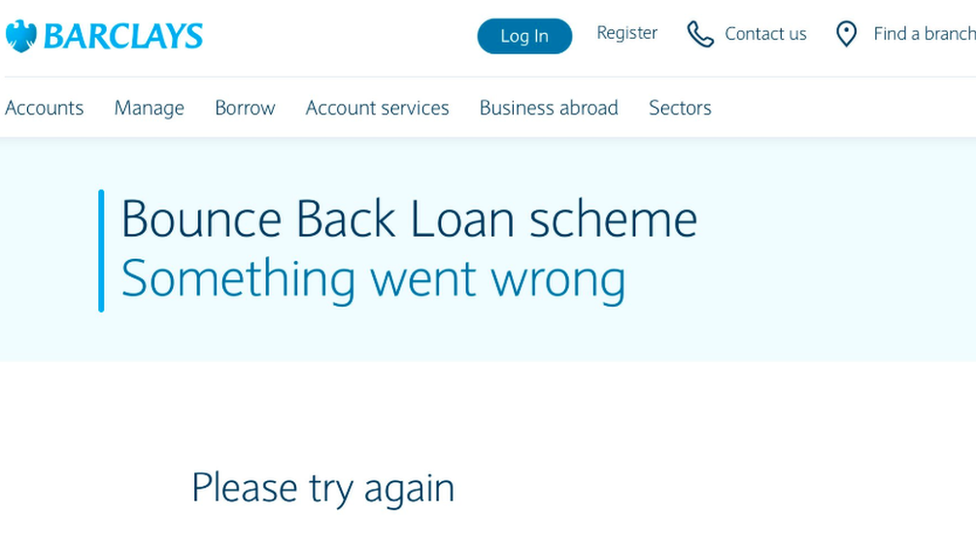

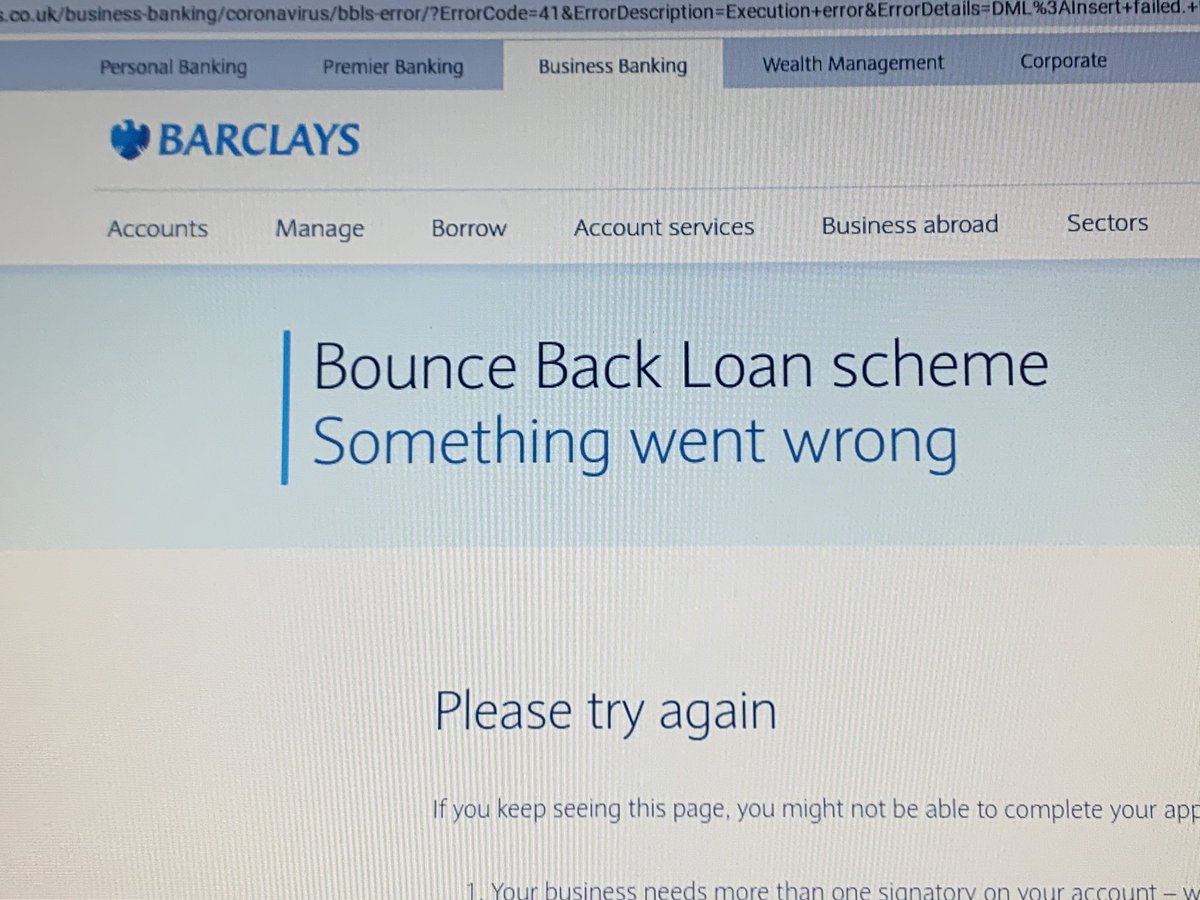

Coronavirus Barclays Customers Struggle To Get Vital Loans Bbc News

Coronavirus Barclays Customers Struggle To Get Vital Loans Bbc News

Santander Uk Help On Twitter Hi There You Can Apply For A Bounce Back Loan We Would Just Ask That You Have A Santander Current Account Be A Uk Based Business Impacted

Santander Uk Help On Twitter Hi There You Can Apply For A Bounce Back Loan We Would Just Ask That You Have A Santander Current Account Be A Uk Based Business Impacted

Apply For A Business Bounce Back Loan Bbbl Optimum

Apply For A Business Bounce Back Loan Bbbl Optimum

Bounce Back Loan Scheme Bbls Credit Passport

Bounce Back Loan Scheme Bbls Credit Passport

Barclays And Starling Do Battle In Imaginary Bounce Back Loan Row Mr Bounce Back Bounce Back Loan Complaints

Barclays And Starling Do Battle In Imaginary Bounce Back Loan Row Mr Bounce Back Bounce Back Loan Complaints

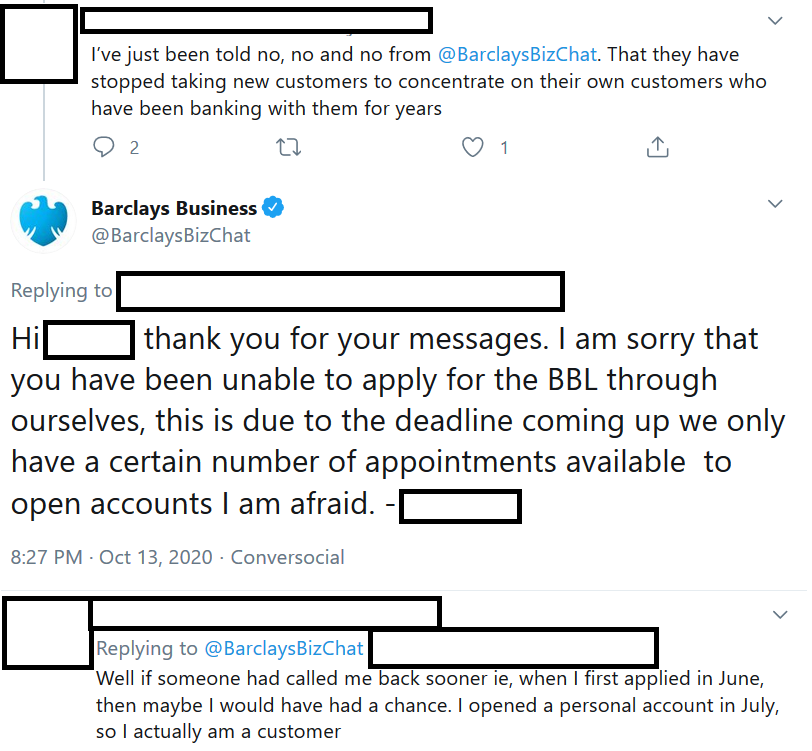

Barclays Slam The Door On New Customers Seeking A Bounce Back Loan Mr Bounce Back Bounce Back Loan Complaints

Barclays Slam The Door On New Customers Seeking A Bounce Back Loan Mr Bounce Back Bounce Back Loan Complaints

Barclays Uk Help On Twitter Hi Richard Let Me Know If You Need A Hand With Anything Amiee

Barclays Uk Help On Twitter Hi Richard Let Me Know If You Need A Hand With Anything Amiee