Sba Disaster Loan Process Covid-19

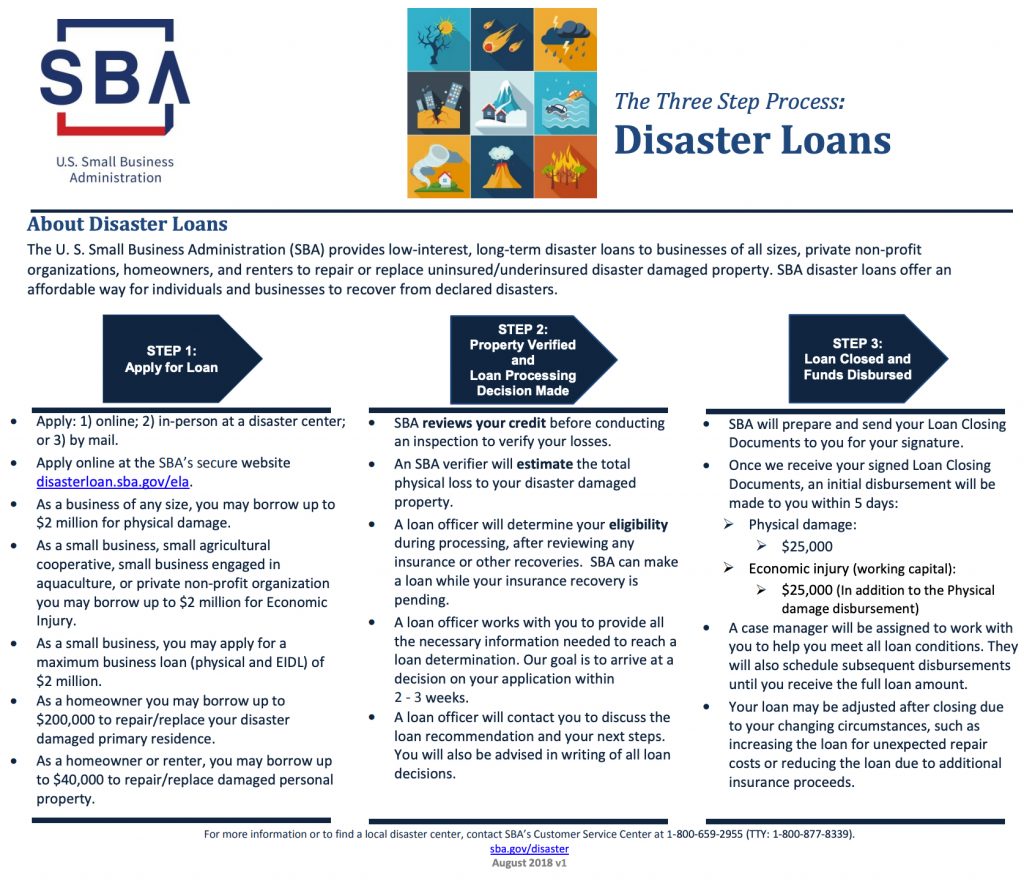

The deadline to apply is December 31 2021. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters.

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

SBA Office of Disaster Assistance 1-800-659-2955 409 3rd St SW.

Sba disaster loan process covid-19. This gave lenders and community partners more time to work with the smallest. At this moment there are no more EIDL funds available as of 552020. For Presidential and SBA Agency declared disasters click on the Incident to view more information about the declaration.

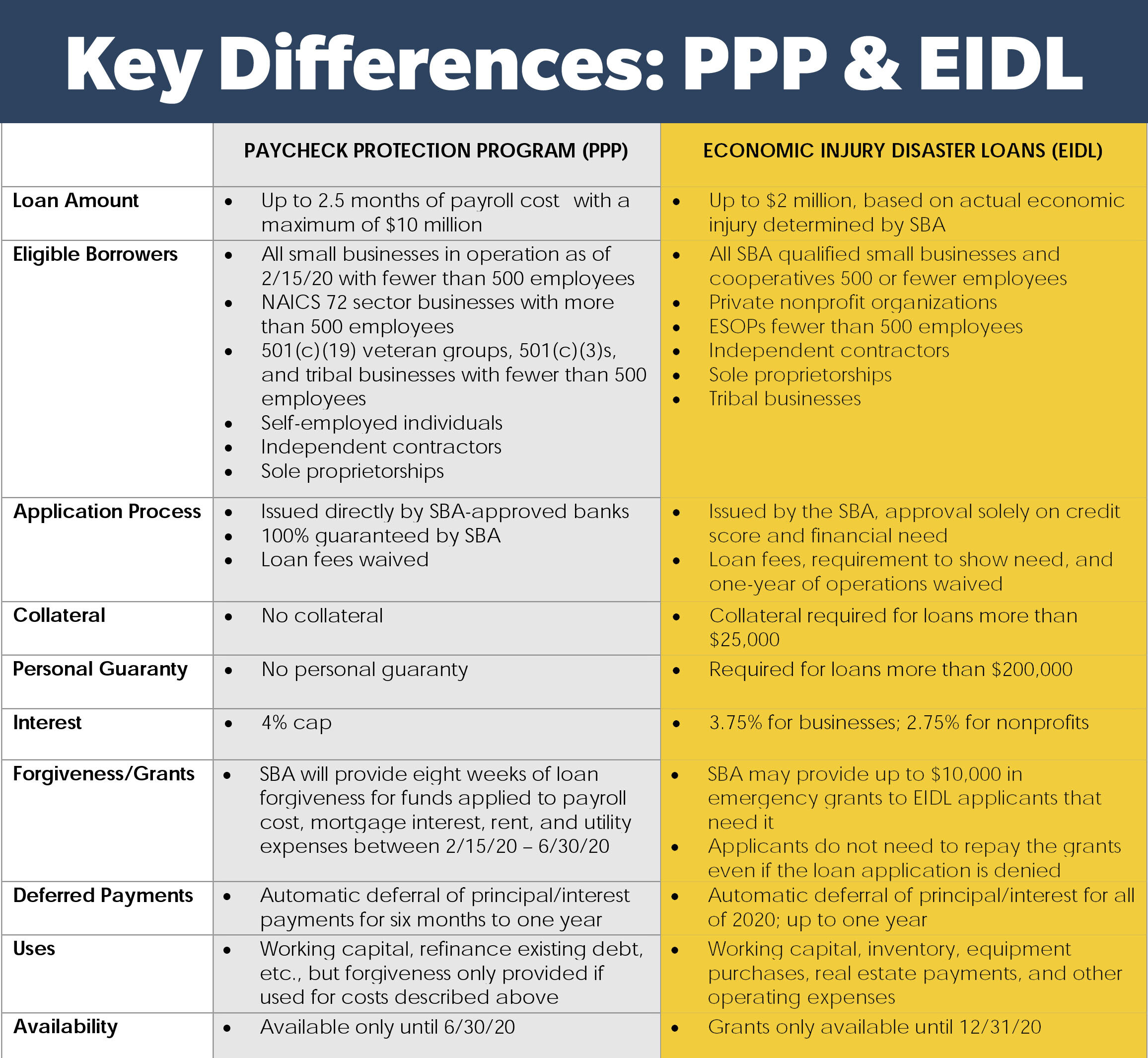

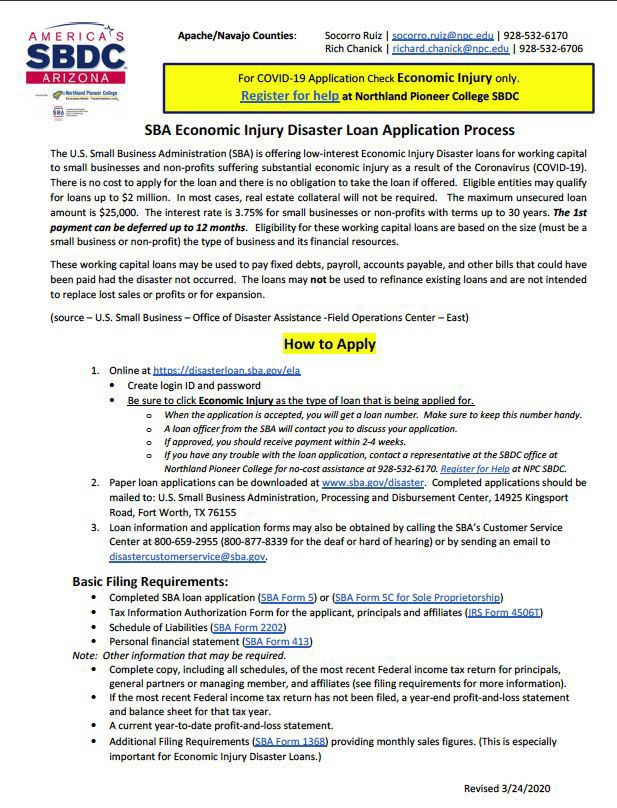

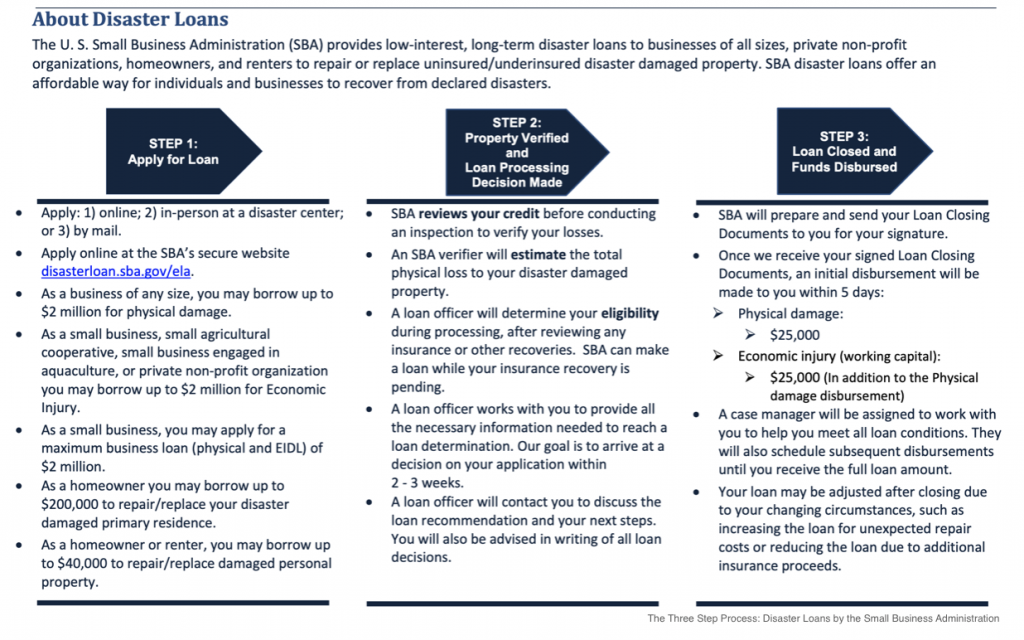

As a business of any size you may borrow up to 2 million for physical damage. Small Business Administration is increasing the maximum amount small businesses and non-profit organizations can borrow through its COVID-19 Economic Injury Disaster Loan EIDL program. SBA loans are based on the borrowers credit worthiness and repayment ability and repayment terms can be up to 30 years.

SBA disaster loans offer an affordable way for individuals and businesses to recover from declared disasters. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity. DisasterLoansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be consolidated.

Who can use an SBA disaster loan. If you are a small business nonprofit organization of any size or a US. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue.

Economic Injury Disaster Loan Also known as EIDL this is another program overseen by the SBA and provides economic relief for small businesses as well as nonprofits that have suffered from a. As a small business small agricultural cooperative small business oengaged in aquaculture or private non-profit. Treasury Apply directly to SBAs Disaster Assistance Program at.

1-800-877-8339 Monday - Sunday 8 am. Call 1-800-659-2955 TTYTDD. Starting the week of Tuesday April 6 the SBA raised the loan limit for the COVID-19 EIDL program from 6.

2 in-person at a disaster center. Or 3 by mail. SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster.

According to the SBA SBA is unable to accept new applications at this time for the Economic Injury Disaster Loan EDIL-COVID-19 related assistance program including EIDL advances based on. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees. Funds come directly from the US.

Federal Disaster Loans for Businesses Private Nonprofits Homeowners and Renters. COVID-19 Small Business Loans and Assistance The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic. Specifically on February 24 2021 at 900 am.

More than 37 million businesses employing more than 20 million people have found financial relief through SBAs Economic Injury Disaster Loans. COVID-19 Economic Injury Disaster Loan. If youre interested in a COVID-19 EIDL loan the SBAs online application process is designed to be easy and quick via their portal.

Disaster Loan Assistance. SBA Economic Injury Disaster Loan EIDL Program for COVID-19. Relief options and Additional Resources CLICK HERE.

13 hours agoSBA to make economic injury disaster loans available to agricultural businesses impacted by COVID-19 Press Release. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. Apply online at the SAs secure website httpsdisasterloansbagovela.

SBA loans are available with a federal major disaster declaration or with a SBA agency disaster declaration. CLA can help you review your EIDL options as well as other funding possibilities. Starting the week of April 6 2021 the SBA is raising the loan limit for the COVID-19 EIDL program from 6-months of economic injury with a maximum loan amount of 150000 to up to 24-months of economic injury with a maximum loan amount of 500000.

Access your SBA Economic Injury Disaster Loan Portal Account to review your application and track your loan status. Agricultural business with 500 or fewer employees that has suffered substantial economic injury as a result of the COVID-19 pandemic you can apply for the COVID-19.

Business Development And Support Division Sba Economic Injury Disaster Loan Program

Business Development And Support Division Sba Economic Injury Disaster Loan Program

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Https Www Sba Gov Sites Default Files Resource Files Covid 19 2 Choices With Ppp April 16 Ver 1 Pdf

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans

Coronavirus Covid 19 Sba Disaster Loan Assistance Infographic Vegas Chamber

Coronavirus Covid 19 Sba Disaster Loan Assistance Infographic Vegas Chamber

Sba Disaster Assistance In Response To The Coronavirus By Hawaii Community Foundation Issuu

Sba Disaster Assistance In Response To The Coronavirus By Hawaii Community Foundation Issuu

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Coronavirus Covid 19 Small Business Guidance Loan Resources Southern Oregon Business Journal

Coronavirus Covid 19 Small Business Guidance Loan Resources Southern Oregon Business Journal

Nglcc Sba Disaster Relief Webinar Nglcc S Takeaways Nglcc Org

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett