Do I Have To Pay Taxes On My 1099-r

Removed money from my 401k 1099r. Reported on Form 1099-R.

If a plan participant gets divorced his or her ex-spouse may become entitled to a portion of the participants retirement account balance.

Do i have to pay taxes on my 1099-r. But the form isnt just for retirees drawing on their nest eggs. Also note that some annuities pay retirement income in a single lump sum. There are two types of rollovers.

This is true even if you dont file a Schedule C. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. These show payment due to death of the account owner.

Reportable disability payments made from a retirement plan must be reported on Form 1099-R. A 1099 R Form is no exception it reports distributions from retirement plans. There are other situations when you might get a 1099-R before you retire.

Also if your income is solely from Social Security you dont need to get a 1099-R tax form. You do not typically have to pay taxes on this money. Reporting conversions on your return.

These distributions are deemed taxable income and may be subject to early distribution penalties. Sign in to your account click on Documents in the menu and then click the 1099-R tile. There is no special reporting for qualified charitable.

By doing so you will have less left in the account to potentially grow tax-free and if you are under 59½ youll also incur the 10 penalty on the amount you dont convert to the Roth IRA. Enter a 1099-R here. Depending on the type of plan and the amount of benefits the ex-spouse may have immediate access to his or her portion of those assets or at some point in the future usually upon the participants retirement or death.

Federal Taxes Wages Income Ill choose what I work on - if that screen comes up Retirement Plans Social Security IRA 401k Pension Plan Withdrawals 1099-R. Summary The given numbers on a 1099-R are insufficient to be able to fill out your tax return correctly. I took out the recommended tax of 10 but it saying I owe a lot in taxes To help ex - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

So the income is taxable to the recipient in the year received. Social Security taxable wages are capped at a maximum each year. IRS Form 1099-R reports all of the distributions youve taken from your IRA or 401k retirement accounts during a calendar year whether or not those amounts are taxable.

How to request your 1099-R tax form by mail. The IRS has a Retirement Topics page called Exceptions to Tax on Early Distributions which should help you determine if you do have an exception to the 10 penalty. Then when I put in my 1099-R I got from Vanguard my refund goes down by 70.

Report such payments on Form W-2 Wage and Tax Statement. If you get a 1099 Form of any kind its usually related to some type of income you received that you may have to pay taxes on. You can verify or change your mailing address by clicking on Profile in the.

Any individual retirement arrangements IRAs. I do a backdoor conversion from a traditional IRA to a roth IRA bc I am over the salary limit. You do not get money back for a 1099-R.

You may be required to make estimated tax payments in the year of the conversion before you do your return. This means you may have only one big taxable income for a year and no longer need a 1099-R. Federal and state income taxes are collected on 1099 retirement income.

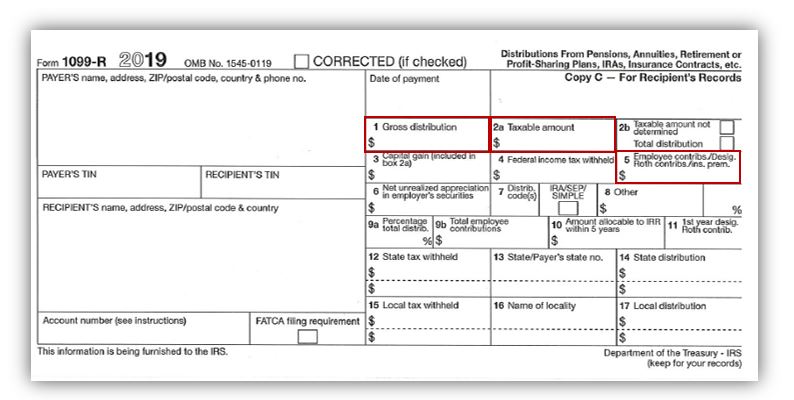

If box 2a is zero you do not pay tax on it. Profit-sharing or retirement plans. Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4 are still taxable based on the amounts in Box 2a.

Form 1099-R is issued when a taxpayer does not make the required loan payments on time. I put 6000 into my traditional IRA and then do a roll over to my roth IRA. Annuities pensions insurance contracts survivor.

An indirect rollover occurs when you take possession of the retirement funds and then deposit them into another retirement account. A direct rollover is reported on Form 1099-R in box 7 with the code G or H. Yes if you have 1099 income you are considered to be self-employed and you will need to pay self-employment taxes Social Security and Medicare taxes on this income.

I use turbo tax and I have typed in all my 1099s. When this occurs the amount not repaid is considered a distribution and is usually reported on Form 1099-R with the distribution code L. Remember this is an information return and not necessarily an income tax return.

A 1099-R tax form reports distributions from a retirement plan income you might have to pay federal income tax on. Well send your tax form to the address we have on file. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is Health Insurance Deductible 1040 Line 29 Personal Finance Money Stack Exchange

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Irs Form 1099 R Box 7 Distribution Codes Ascensus

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Tax Withholding And 1099s Pera

Tax Withholding And 1099s Pera

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Understanding Your 2018 1099 R Kcpsrs

Understanding Your 2018 1099 R Kcpsrs