Business Trust Fund Express Installment Agreement

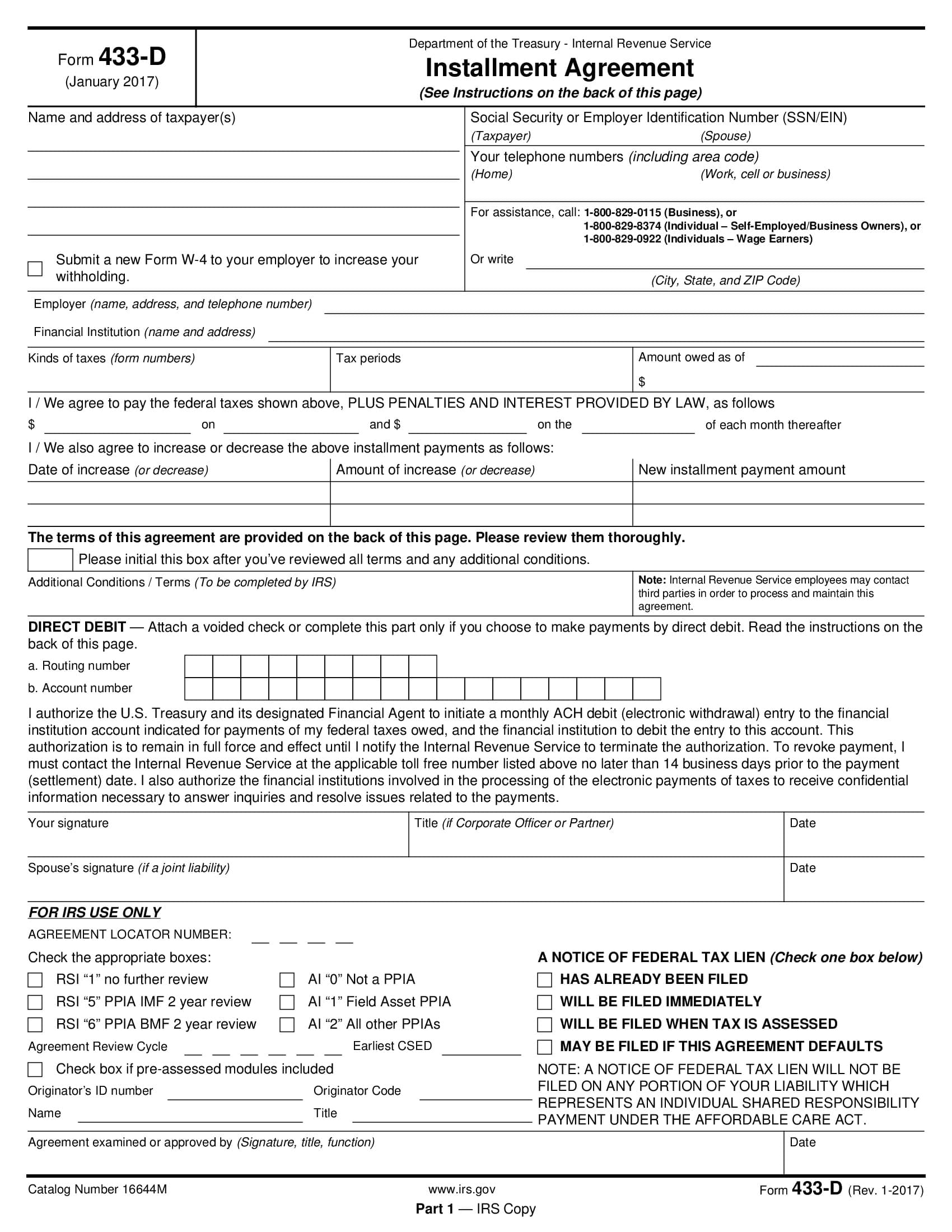

Businesses that do not qualify for an IBTF-Express IA should prepare Form 433-B CIS for Businesses. If your business owes up to 25000 you can qualify for a streamlined installment agreement.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

The IRS will determine how much the business can afford.

Business trust fund express installment agreement. Businesses who currently have employees can qualify for an In-Business Trust Fund Express Installment Agreement IBTF-Express IA. U0010This is for business with payroll back taxes. Owe Less than 25000 In-Business Trust Fund Express Business Installment Agreement.

An In-Business Trust Fund Express agreement may be available for businesses that owe up to 25000. Forward approved agreements to Centralized Case Processing along with the unassessed Trust Fund Recovery Penalty administrative file if one was prepared after taking the actions described above See IRM 514741 and IRM 514945. In-business Trust fund express installment agreement.

Any Amount of Business Back Taxes The payment terms will depend on the business financial condition. When an in-business trust fund IBTF installment agreement is granted and the TFRP is not being assessed the TFRP file must be sent along with the IBTF installment agreement to Centralized Case Processing where the agreement is being monitored. Frazier has the experience that business owners need to obtain an In-Business Trust Fund Express Installment Agreement IBFT.

If the business owes more than 25000 an installment agreement is still possible but a completed collection information statement Form 433-B will be. These installment agreements generally do not require a financial statement or financial verification as part of the application process. If your business is behind on its payroll taxes the In-Business Trust Fund Express agreement can help the business get back on track without having to provide the IRS with an extensive amount of financial information.

Installment agreements are not appropriate for taxpayers who are considered to be repeaters see IRM 578 since they are not in compliance and therefore do not qualify for an in-business installment agreement. These installment agreements generally do not require a financial statement or financial verification as part of the application process. An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

These amounts are then paid to the IRS at the end of every quarter. In-Business Trust Fund Installment Agreements. In-Business Trust Fund Express Installment Agreement Businesses with employees are required to withhold income Social Security and Medicare taxes from their employees paychecks.

If we accept your offer you can pay with either a lump sum. An In-Business Trust Fund Installment Agreement is an installment agreement for unpaid trust fund taxes payroll taxes. If your business owes less than 25000 to the IRS in delinquent payroll taxes you may be eligible for an IBFT.

You owe 25000 or less at the time the agreement is established. You must pay the debt in full in 24 months or before the collection period expires whichever is earlier. Repeater trust fund taxpayers are those that.

The IRS will accept 2 year payment terms. To qualify your business must owe less than 25000 and you must be able. Qualifying taxpayers include individuals Form 1040 liabilities businesses with income tax liability only and out-of-business entities with any type of tax liability.

If your small business currently has employees and is behind on its payroll taxes you might qualify for an In-Business Trust Fund Express Installment Agreement. These agreements allow you to make monthly payments and generally do not require you to provide extensive financial information. -Business Trust Fund Express installment agreement at.

If your business has employees you may qualify for In-Business Trust Fund Express Installment Agreement for back payroll taxes. It does not include accrued penalty and interest. The aggregate unpaid balance of assessments the SUMRY balance is 25000 or less.

In-Business Trust Fund IBTF Express installment agreements may be granted if. In-business trust fund installment agreements IBTF-IA input to IDRS Status 60 must be monitored in Centralized Case Processing. IRS Small businesses who currently have employees can qualify for an In-Business Trust Fund Express Installment Agreement IBTF-Express IA.

You can apply for this agreement online or by mail. You must be compliant with all filing and payment requirements. You can also pay down the liability to 25000 or less and then apply.

To qualify you must be in business have. To be eligible the current liability must be 25000 or less if. Box b the entered into an installment agreement provision.

You must enroll in a Direct Debit installment agreement DDIA if the amount you owe is between 10000 and 25000. In-Business Trust Fund Express Installment Agreements The Law Offices of Charles R. The criteria to qualify for an IBTF-Express IA are.

The criteria to qualify for an IBTF-Express IA are. Are not current with Federal Tax Deposits FTDs. Before the IRS Fresh Start the threshold for business tax debt was only 10000.

10 business days if the amount in the notice is 100000 or more. The unpaid balance of assessments includes tax assessed penalty and interest and all other assessments on the tax modules. Offer in Compromise.

If its your business that owes the taxes you may be eligible for this agreement which doesnt require a financial statement or verification.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

Regional An Idle Venezuelan Tanker With Millions Of Gallons Of Oil Is Creating Panic In Trinidad Barbados Today In 2020 Venezuelan Gallon Trinidad

Regional An Idle Venezuelan Tanker With Millions Of Gallons Of Oil Is Creating Panic In Trinidad Barbados Today In 2020 Venezuelan Gallon Trinidad

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Irs Installment Agreements Information From Irs Tax Attorney

Irs Installment Agreements Information From Irs Tax Attorney

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

/GettyImages-1134339032-1a1857a503694986ab4bb39607d2d4f6.jpg) Using A Credit Card To Pay Monthly Bills

Using A Credit Card To Pay Monthly Bills

Automatic Bill Payment What It Is And How It Works Forbes Advisor

Automatic Bill Payment What It Is And How It Works Forbes Advisor

Tax Dictionary In Business Trust Fund Express Installment Agreement H R Block

Tax Dictionary In Business Trust Fund Express Installment Agreement H R Block

Installment Agreements For Businesses

Installment Agreements For Businesses

Letter Of Interest Sample Job Letter Letter Of Interest Sample Lettering

Letter Of Interest Sample Job Letter Letter Of Interest Sample Lettering

Guide To American Express Purchase Protection Bankrate

Guide To American Express Purchase Protection Bankrate

H R Block Review 2021 Pros And Cons

Business Irs Payment Plan Alg Tax Solutions

I Need Payday Loan Today Where Can I Go Ace Cash Express Ace Cash Express Payday Loans Payday

I Need Payday Loan Today Where Can I Go Ace Cash Express Ace Cash Express Payday Loans Payday