How To Register A Business On E Filing Sars

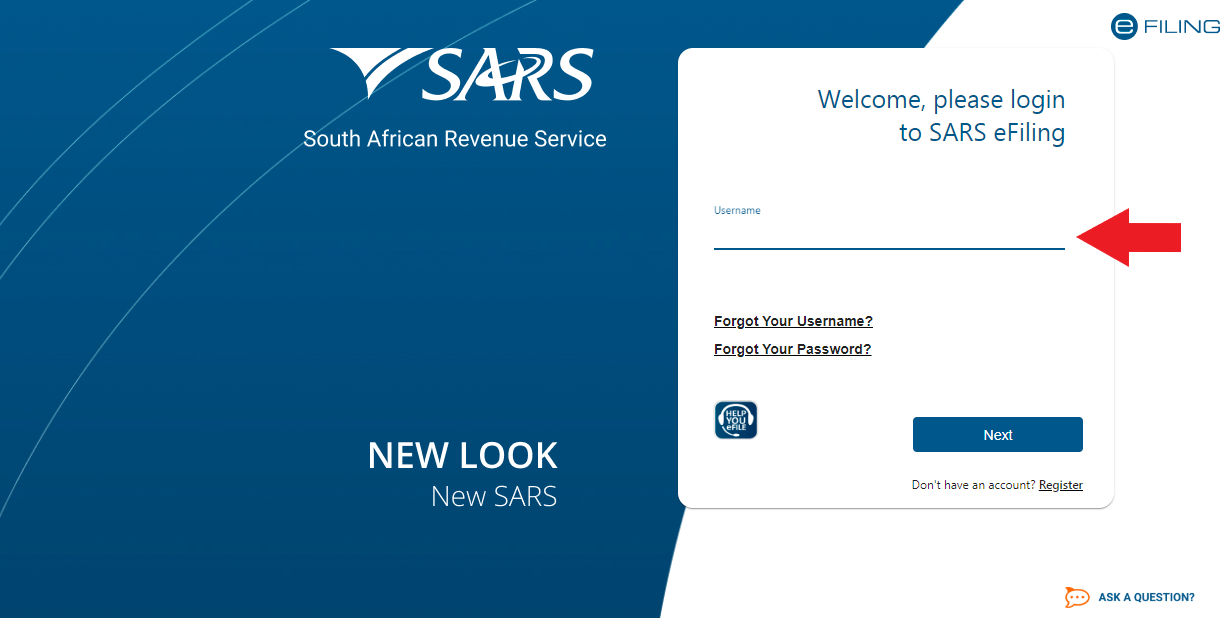

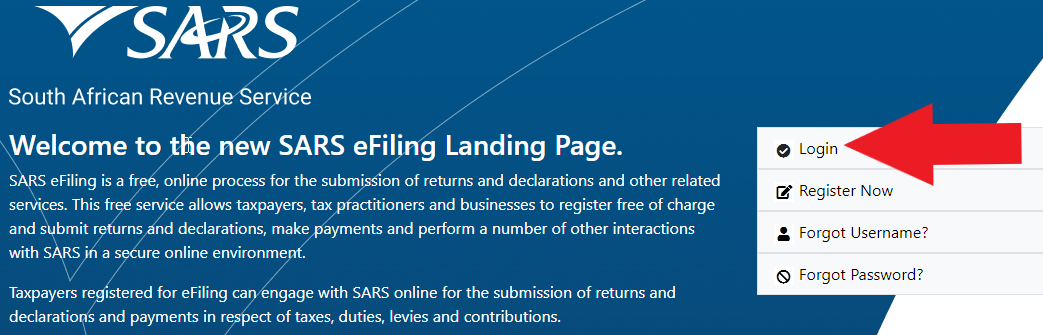

Click the Login button Enter your username and password Click on the Home button followed by User and then Pending Registration This will tell you what else is needed to process your eFiling. To complete the registration process you will need at hand.

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Change of name address or when no longer operating as an employer etc.

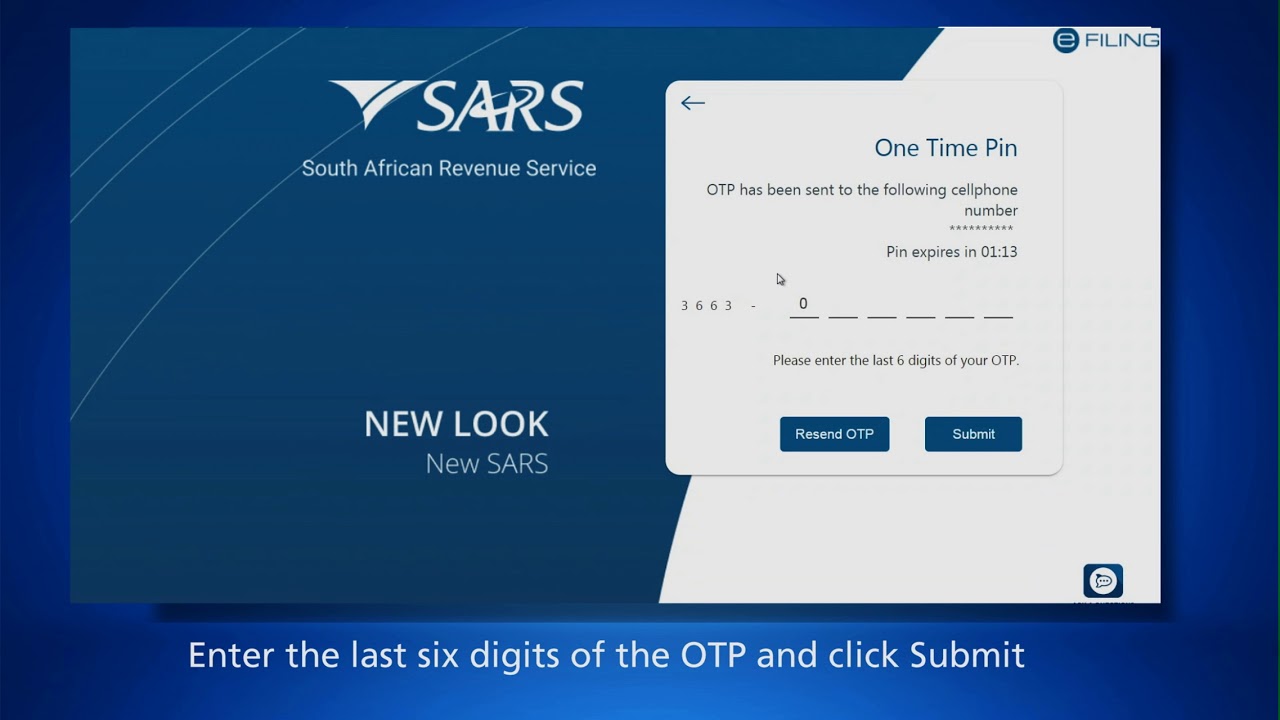

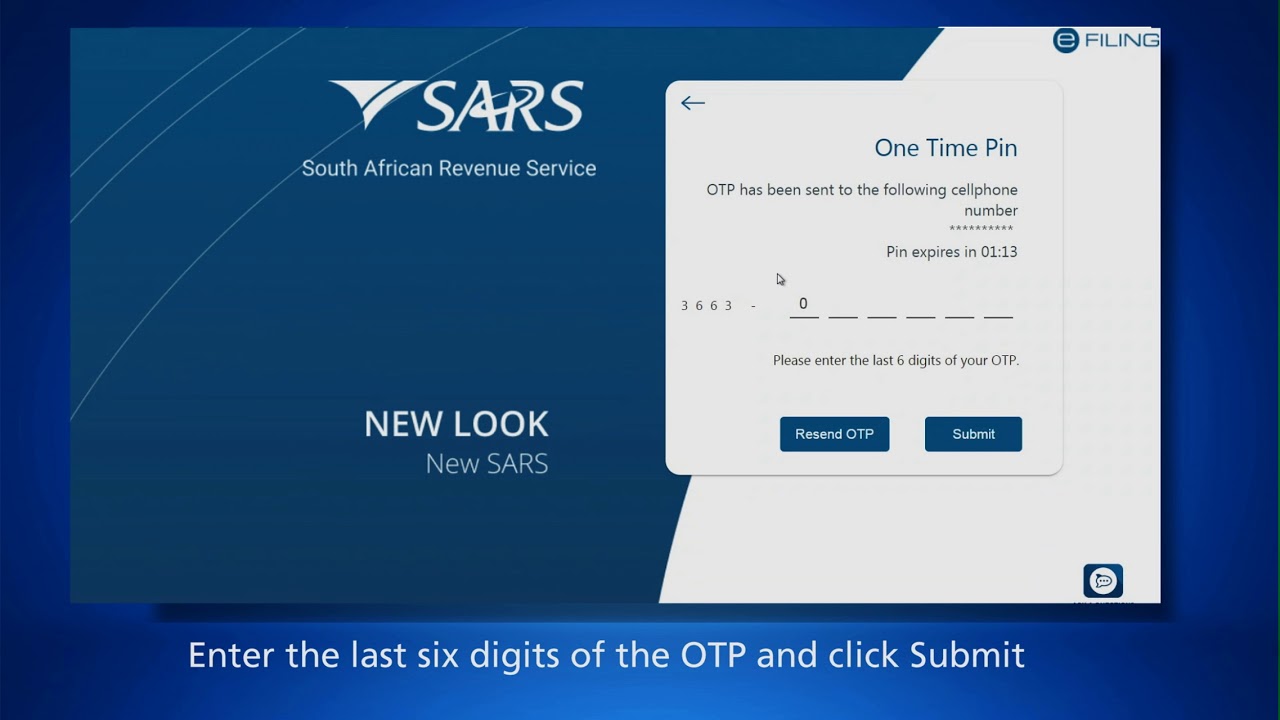

How to register a business on e filing sars. REGISTER FOR SARS EFILINGLONG AWAITED EASY 3 STEP PROCESSAvoid the lines to SARS and do it right the first timeI take you step by step to log into e-filing. The SARS tax number 4. You will also provide your identification number as well as your cell phone number before clicking on Register.

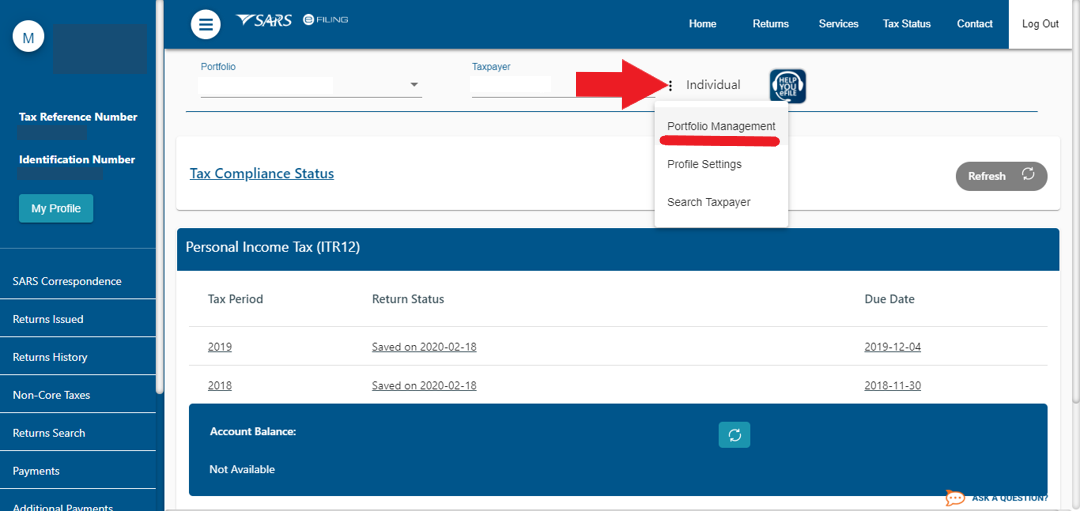

Your tax registration numbers. Identify Your Type of Business. Choose the correct user from Taxpayer List.

Start a Business Step 1. The registration number 5. Profit Articles of Incorporation Non-Profit Articles of Incorporation.

On the Individual portfolio select Home to find the SARS Registered Details functionality. Complete all your additional personal details in order for SARS to register you for a tax number and on efiling. Complete your contact details along with login details that you would like to use then click next.

The Division of Corporations is the State of Floridas official business entity index and commercial activity website. Name of the company 2. Open your browser and type in sarsefilingcoza Click on the REGISTER button on the top right corner Click on the For Individuals tab on the bottom left corner.

Steps to Starting a Handyman Business. Due to the high volume of filing activity in conjunction with the implementation of these upgrades there will be a delay in. The eFiling Register screen will appear where you need to complete your personal details then click next.

ManageChange with E-Filing. Research Starting a Business. Click on the check box for all applicable Tax Types.

Click Organisation Tax Types. Get your business license and register your business name or alternatively form an LLC Corporation. To enjoy the full benefits and convenience of eFiling you need to first register to gain secure access to your own tax information.

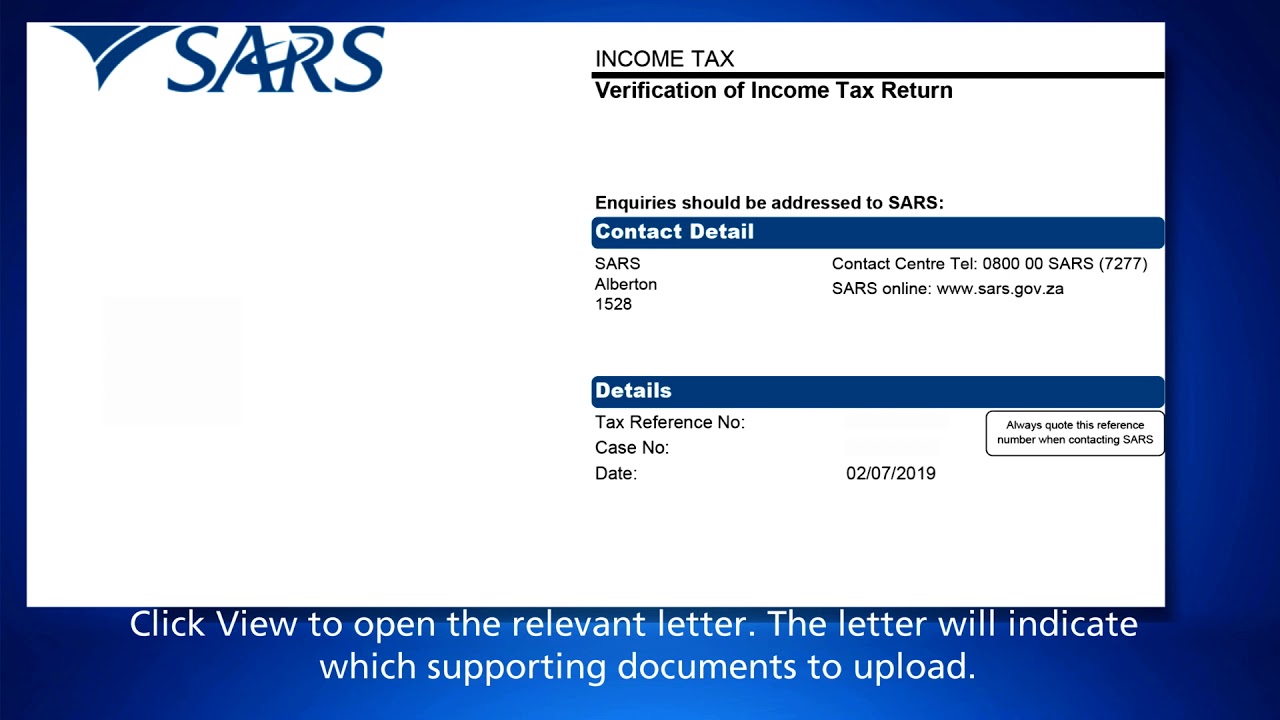

To register as a branch separately from the main branch an EMP102e form Payroll Taxes Application for Branch Registration must be filled in and sent to SARS. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment. Select Maintain SARS Registered Details.

Registration for and the use of eFiling is free. Welcome please login to SARS eFiling. Getting Started with a Florida Business.

All you need is internet access. Get Handyman Business Bond Insurance. Get Transportation such as an F150 Ford Truck with Tool Storage.

The companys banking details 6. You will need the following. SARS eFiling is a free online process for the submission of returns and declarations and other related services.

The efiling profile must be created for an individual. To set up a new eFiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process. Are you a South African Citizen Yes No.

The address and contact number 3. SARS has now created a shared platform. Heres how you can register for SARS eFiling.

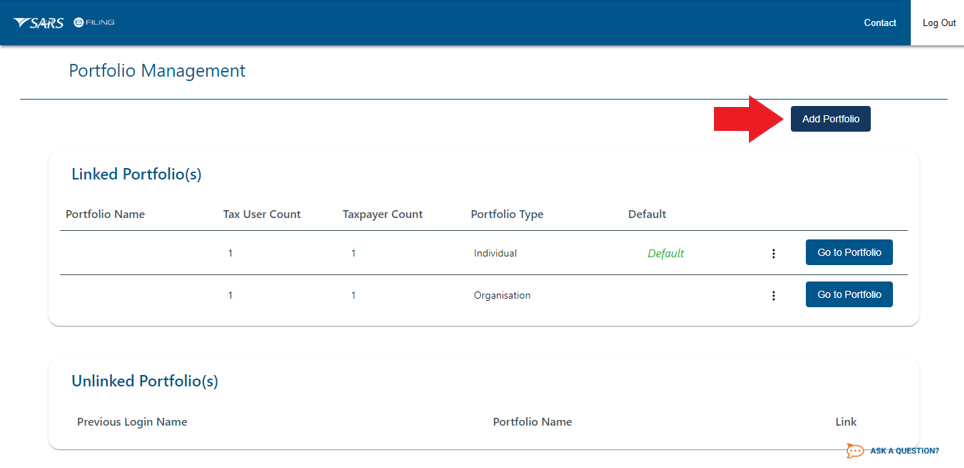

If you need some more help with the registration fill out this form and get in contact with a SARS consultant. Form a Profit or Non-Profit Corporation. You can then add an organisation to your profile.

On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab. Then a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim. Should you need to register for tax manually with SARS you should use Form IT77C.

For the owners of private companies registering a new company through the CIPC website often leads to automatic SARS registration. If you already have an efiling profile it should be easier to just add the company to your. If you register your company in this way you will shortly receive an email from SARS informing you of your new company tax number.

Change of registered details An employer must let SARS know within 21 business days of any changes in registered particulars eg. Decide on a Corporate Structure. General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C.

Tax Practitioners How To Setup Your Primary Username And Link Portfolios On Efiling Youtube

Tax Practitioners How To Setup Your Primary Username And Link Portfolios On Efiling Youtube

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Access My Compliance Profile

How To Access My Compliance Profile

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube

How To Register For Paye On Efiling

How To Register For Paye On Efiling

Register On Sars Efiling Business Tax Types Youtube

Register On Sars Efiling Business Tax Types Youtube

Adding Clients To An Efiling Profile

Adding Clients To An Efiling Profile

How To Register For Sars Efiling Youtube

How To Register For Sars Efiling Youtube

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

E Filing Sars Register Page 1 Line 17qq Com

E Filing Sars Register Page 1 Line 17qq Com

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa