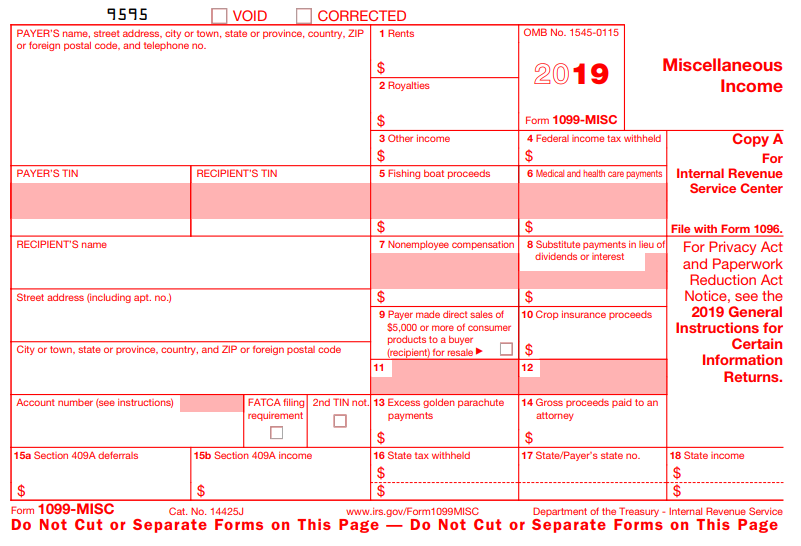

1099 Form 2019 Box 7

For individuals report on Schedule C Form 1040. This is the most common situation and the only box most businesses will need to select for payment types.

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

The following codes identify the distribution received.

1099 form 2019 box 7. For all other reported payments file Form 1099-MISC by February 28 2020 if you file on paper or March 31 2020 if you file. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. If the amount in box 7 of your 1099-DIV is more than the following amount you will need to enter it under Foreign Tax Credits under Deductions and Credits.

We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. If you normally receive a 1099-MISC with information in box 7 you will now receive a 1099-NEC instead. Starting with 2019 we will start to see some changes specifically the addition of Box 7 Qualified Payments.

1 Early distribution no known exception in most. You use the amount entered in box 7 to compute the amount to enter into the Schedule F QBID Smart Worksheet Continued line K 1 Net income allocable to qualified payments from agricultural or horticultural coop. Therefore a Form 1099-MISC is due as follows.

This posed an issue for many users. Form 1099-NEC Replaces the 1099-MISC Box 7. December 06 2019 1028.

Section 6071c requires you to file Form 1099-MISC on or before January 31 2020 if you are reporting NEC payments in box 7 using either paper or electronic filing procedures. In previous years this information was reported on the 1099-MSIC in box 9. If you filed 1099-MISC with only Box 7 in the past you should most likely choose Box 1 - Nonemployee Compensation on the 1099-NEC.

2 Early distribution exception applies under age 59½. There are no changes to the rules which determine if you must report nonemployee. From within your TaxAct return Online or Desktop click Federal.

Loans treated as deemed distributions under section 72p Do not use. Form 1099-PATR has been around for many years without too many significant changes. If you have other payment types youll need to.

Qualified Payments 13457750 There is no 1099-Patr in the ATX program so where do you enter the amounts above. Nothing has changed aside from which box is used to provide this information to the buyer. The 2019 1099-MISC form is the last iteration of the form for now that includes Box 7.

The code s in Box 7 of your 1099-R helps identify the type of distribution you received. This notorious spot on the form is where employers and contractors reported non-employment compensation. Lizmctax you do not actually enter 2019 Form 1099-PATR box 7 into PS19.

Should you be able to come up with the money to do so the deadline for rolling over the offset distribution reported on the Form 1099-R that includes code M in box 7 is the due date of your tax return including extensions for the year of the distribution. This box indicates to the taxpayer the amount of payments that the cooperative used in calculating their Section 199A g deduction. To enter or review the information from Form 1099-MISC Box 7 Nonemployee Compensation.

The Protecting Americans from Tax Hikes PATH Act of 2015 requires Forms 1099-MISC reporting non-employee compensation NEC in box 7 to be filed by January 31. If the amount in this box is SE income report it on Schedule C or F Form 1040 and complete Schedule SE Form. 29 rows 2020 1099-R Box 7 Distribution Codes.

On smaller devices click in the upper left-hand corner then choose Federal. In most cases these are funds generated through contracted work like a temporary hire or freelancing. I know where you enter Box 1 but where do you put Box 6 3 and 7.

Click Add Form 1099-MISC to create a new Form 1099-MISC. Changes in the reporting of income and the forms box numbers are listed below. March 30 2020 914 PM.

If the amount is below the following criteria you dont need to enter it at all. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income. 30 rows 1 2 4 7 8 or G.

Click Form 1099-MISC in the Federal Quick QA Topics menu. 1 Early distribution except Roth no known exception. Looking for your early reply What is interesting here is that the amount in box 3 and box 7 is the same amount as gross farm wheat sales.

Crop insurance proceeds are reported in box 9. For more information on these distributions see the instructions for Form 1099-R. Payments are reported in box 7.

- are not Married Filing Joint and have more than 300 of foreign taxes withheld or. 2019 Form 1099-R Codes Box 7. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

Also see instructions for Forms 5329 and 8606. If you are in the trade or business of catching fish box 7 may show cash you received for the sale of fish. 1 Early distribution no known exception in most cases under age 59 ½.

Payer made direct sales of 5000 or more checkbox in box 7.

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

1099 Misc 2020 Public Documents 1099 Pro Wiki

1099 Misc 2020 Public Documents 1099 Pro Wiki

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Misc 2019 Public Documents 1099 Pro Wiki

1099 Misc 2019 Public Documents 1099 Pro Wiki

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Irs Form 1099 R Box 7 Distribution Codes Ascensus

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group